The Agony and the Enmity: Build Back Better and 2022 Battlegrounds

It took months of infighting and then an 8-hour-plus harangue by the Republican leader, but House Democrats were cheering in the end.

It made no difference that the "end" came around 9 a.m. Friday instead of Thursday night as first envisioned.

That didn't change the bottom line - the Build Back Better bill was passed.

New Jersey Democrats responded quickly, firing off upbeat press releases.

The excitement was genuine.

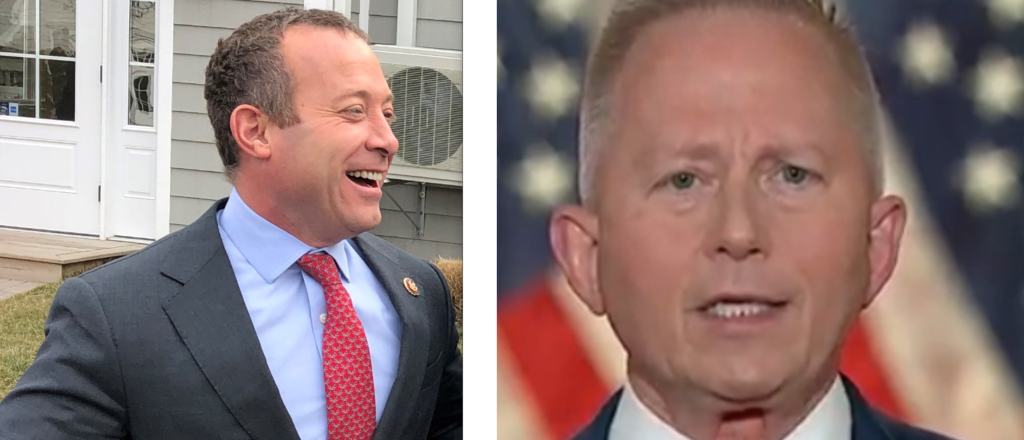

Mikie Sherrill joined Bill Pascrell, Josh Gottheimer and Tom Suozzi of New York to celebrate doing away with the $10,000 deduction cap on state and local taxes.

Other lawmakers offered similar thoughts.

But there's much more.

The bill also expands access to pre-school, provides help for child care, continues (at least temporarily) the child tax credit, expands Medicare, and like the recently-signed infrastructure bill, appropriates money to combat climate change.

Both bills truly are big deals.

But while the infrastructure bill is signed, Build Back Better still has to get through the Senate.

We've all read about the difficulty of getting Joe Manchin and Krysten Sinema on board.

That may still be a problem.

But more and more, the problem in the Senate may come down to SALT - repealing the now, $10,000 cap on state and local tax deductions.

It is unbelievable in some ways how this repeal is being condemned as a giveaway to the rich, and how dare Democrats do that?

Again, those who say that just don't understand New Jersey.

It is, as Phil Murphy infamously said, a high tax state.

And that is why so many average families pay far in excess of $10,000 in property taxes alone. The rich, by definition, benefit from a lot of things, but repealing the $10,000 cap, or at least raising it substantially, would help out many average folk.

Republicans in New Jersey know that.

Some of them at least. More than once on the campaign trail, Jack Ciattarelli ridiculed Murphy and the Democrats for not getting "our SALT deduction back."

Ciattarelli, of course, doesn't have to convince senators from the heartland that people who pay $15,000 in property taxes in New Jersey are not necessarily rich.

But Cory Booker and Bob Menendez need to do that.

As this drama unfolds in the Senate, it will be interesting to see how well they do convincing their Democratic colleagues to fall in line.

So far, a vocal critic of repealing the cap has been Bernie Sanders, the governor's friend from the campaign trail. Apparently they didn't chat about SALT when Sanders campaigned for Murphy last month at Rutgers.

There has been talk of putting an income ceiling on SALT deduction eligibility. That could both appease critics and also ensure middle class families get relief.

Clearly, Booker and Menendez are under some pressure to get this done.

That's one observation.

Two others are simply campaign-related.

Dems are still reeling from the closeness of the governor's race and some losses on Nov. 2. If the full SALT deduction is restored, that's going to be a great campaign selling point for Sherrill, Gottheimer and all other House Democrats from the state.

On the other end of things, what about GOP House members Chris Smith and Jeff Van Drew?

They both voted "no" on Build Back Better, which was the party's position. That meant they opposed doing away with the $10,000 deduction cap.

We'll see in a few months how much that hurts them in the 2022 campaign.