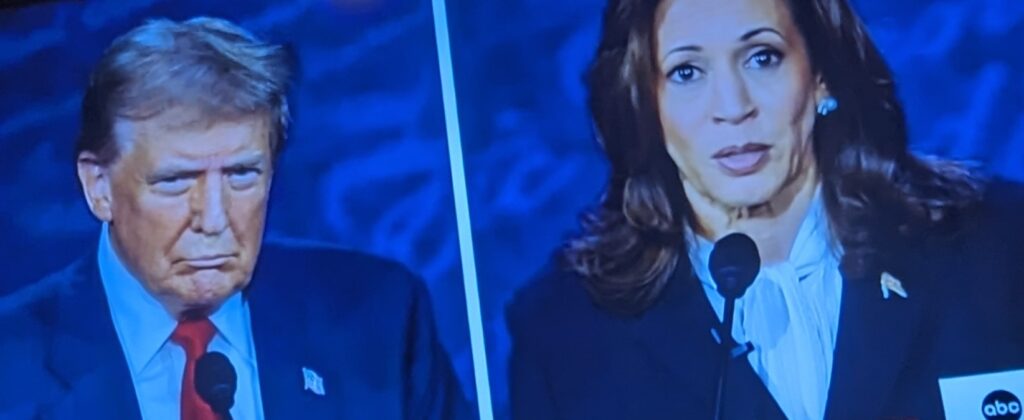

An Aspect of the Harris/Trump Economic Plans That Isn’t Being Discussed, But Should Be

We are not, by and large, policy oriented but we are almost to a person pocketbook oriented. On that score, what Harris and Trump are promising – the “Opportunity Economy” versus the “Best Economy Ever” – resemble white caps on the surface of the ocean. Easy to see but unrevealing of what lies underneath.

And what lies underneath matters. Because most government initiatives rarely outlast a single administration. By contrast, transformative changes to the world’s largest economy tend to be incremental and are most often in response to forces outside any politician’s control. Or, frankly, their imagination.

One exception to the disconnect between short-term politically rooted economic policies and the deep movement of our economy concerns basic plumbing. That is, those structures that comprise the lifeblood of our economy.

For example, the FDIC was created after the Great Depression to buttress banks. It worked. By restoring public confidence that deposits were safe the FDIC solidified the banking sector as a critical financial pipeline for the entire economy. And that piping continues to positively impact our lives some 90 years on. Consider where we would have been without the FDIC in 2008 during the Great Recession, or in 2020 during the pandemic shutdown.

Another fundamental part of our economic plumbing is taxes. No one likes to pay them, but “freedom isn’t free” and neither is Social Security, Medicare, our national defense, our roads, bridges, or railroads, and the countless public goods that we are only vaguely aware of yet routinely rely on virtually every day.

On the federal side that makes the IRS, which collects federal taxes, a key part of the plumbing. We need them because far too many people don’t pay what they owe, leaving the rest of us to cover the shortfall. Besides ultimately reducing the amount of money needed from the rest of us, collecting taxes owed by others also validates our own decision to pay them by demonstrating that we are not idiots for doing so.

Since the IRS collects more money than it spends to collect it, properly resourcing the IRS makes common sense. But common sense too often does not seem to translate into politics or policy.

Until recently, the IRS’ overall budget and collections workforce had been relentlessly cut (by 18% and 31%, respectively) as its responsibilities mushroomed. That changed under Biden when Congress approved a $58 billion increase over 10 years (actually, $80 billion before a claw back by Congress of $21 plus billion).

I am not sure whether the funding that remains is actually an increase. One could argue that most or all of the additional $5.8 billion a year (for 10 years) will do little more than restore the IRS’ capabilities to where they were before the years of cuts.

Regardless, a lot of people don’t file tax returns, including the wealthy. Why? Because the IRS still doesn’t have enough people or bandwidth to adequately police them.

So far this year, the IRS has sent letters to over 125,000 people with incomes (independently reported by employers, brokerage houses, banks, etc. to the IRS) of more than $400,00 that have not filed an income tax return since 2017. To date, about $172 million has been collected from 21,000 of this group, with the likelihood of hundreds of millions of more dollars to come. In 2023, the IRS also targeted people with incomes exceeding $1 million and over $250,000 in tax debts and, to date, has collected another almost $1.1 billion from them.

Looking forward, Treasury Secretary Yellen has suggested that the $58 billion investment in IRS capabilities should yield collections of somewhere between $200 billion and $500 billion over time in taxes owed. Which is, of course, the mere tip of the $700 billion a year tax evasion iceberg.

You would think that there would be bi-partisan agreement that this IRS funding should be continued and supported. And you would be wrong. To my knowledge the candidates have not spoken directly to this aspect of our economic plumbing. But the two parties have.

MAGA wants to massively defund the IRS. Why? Well, they generally refer to the $5.8 billion a year annual funding over 10 years as a “windfall” Unsurprisingly, without any rational explanation.

Instead, they claim that it will allow tens of thousands of new IRS hires, who will then “harass the middle class.” Leaving you to figure out on your own that, in fact, many of these new hires will simply replace the tens of thousands of current IRS employees who will likely retire during the same 10 year period, about half of the new funding will go to upgrading enforcement capabilities (parts of the IRS still use 1960s software), only 17 out of 1,000 taxpayers making $200 thousand or less are now audited, and the IRS has publicly stated that this audit percentage will not change.

Incredibly – as in “not credible” – one MAGA proposal is to actually reduce the IRS Commissioner’s annual salary to $1. That’s right. One hundred pennies per year. Courtesy of Marjorie Taylor Greene, who has emerged as a centrist MAGA voice in the latest debacle; the Trump/Loomer dumpster fire. As opposed to Trump, who lit the match by inviting, and keeping, Loomer in his inner circle because she says she likes him.

Leaving one to wonder for whom the “Best Economy Ever” will be the best for.

What about the other side? Biden engineered the law that gave the IRS its initial $80 billion and Harris was the tie breaking vote in the Senate that passed it.

This is not about ideology. It is about truth, the lack of it, and basic blocking and tackling. Both sides are proposing short-term giveaways to attract votes. But Harris also wants to do something that matters much more. She wants to maintain and improve the plumbing. And Trump almost certainly doesn’t.

Many of the things you label as “public good” with our tax dollars are things the gov’t should stay out of. Also, we had roads long before we had federal taxes.

The federal income tax was initiated in 1913. Are you suggesting that our road network then (consisting mostly of a hodgepodge of dirt trails) is comparable to what we have now? Or that the interstate highway system built after WWII under the Eisenhower administration is not a public good?

Cheezy, until we – and that includes you – show the discipline of starting with facts and then reaching a conclusion based on those facts, we will continue on the road of conclusory opinions and bad outcomes.

i am sure there is a factual argument to be made against what I have written. And I am sure you have not made it,

Hunter Biden is a great example of a person not paying his taxes. He was one of those 125,000 people who did not file. If the President’s son thinks it is ok not to pay, well you really can’t blame the rest, can you?

The national debt is at 35 trillion and counting. Credit card debt is at an all time high of 1.14 trillion. 66.8 percent of taxpayers live paycheck to paycheck. Many do not have a $1,000 available in case of an emergency.

The Covid slush fund was abused and a gross amount unaccounted for. The proposed give aways are the carrot on the stick to get votes. No talk of a balance budget or term limits. We need honest politicians, not plumbers.

In my opinion, the public good that comes from federal taxes is undeniable; and that federal money can do with better control over spending is also undeniable. But as long as the demonstrable waste/loss is a few points only, it should be OK.

If a more efficient and equitable way of doing something in the private sector that the federal government does today is possible, certainly we should examine that.

@Betsy, while Hunter Biden did not pay his taxes, he did file his tax returns – but some of them were fraudulent. Moreover, he did not pay what he owed, but claimed insufficient funds.

That is precisely what the IRS is supposed to do – detect this and prosecute this. It should not require a special prosecutor.

Properly fund the IRS!

Betsy, this won’t take long.

Hunter Biden is responsible for this own actions. Not his Dad. Not me. Not you. We all make our own decisions. So yes – I can and do blame everyone who owes taxes and does not pay them. Incidentally, the fact that Hunter Biden was prosecuted while his father was President demonstrates that the system works now in a way that would never happen under Trump. .

We do need honest politicians which, I note, you do not accuse Trump of being. We also need to invest in the IRS. You are conflating the thing (in this case, revenue) and how it is used once collected.

National Parks are a thing. How they are used is determined by the Federal Government, which at times mismanages them. Does that mean we don’t need National Parks anymore?

We don’t know each other but we both live here, and the time for vagueness in this political season is long past. So I will also say this; I appreciate your participation, but encourage you to vent less and focus more.

Andrew, thank you for taking your time to respond and for your well received advice.

I made no mention of Trump. That was clear.

We both agree on the need for honest politicians and that no one likes to pay taxes.

Mr. Leven, we Democrats need more thoughtful writers like you to help get the message out as effectively as you just did. While Walter Mondale was absolutely for a progressive income tax structure in 1984, he stumbled badly in a major speech that year, when he cavalierly assumed Reagan would raise taxes (“but was lying about it”), then Mondale said, in so many words that (Mondale) would raise taxes. It is because of this infamous Mondale word salad that more recent Democratic Presidents, having learned the lesson of not saying precisely what you mean, have finally and meaningfully targeted those earning over $400,000 per year with graduated, higher taxes.

Knowing that Andrew Leven graduated from Syracuse

University College of Law, ranking first in a class of 213, I HAD to read this fact-filled column.

……….GOOD NEWS

“a lot of people don’t file tax returns.”

Evidently they would rather not do it.

I became so excited, I actually tripped over my walker as I raced to my landline phone to cancel my future accountant appointments.

Carefully getting up, I thought you have been paying your taxes for what seems like centuries. It is an ingrained habit.

And so, Andrew Leven and I will pay our taxes, hopefully in a cheerful manner.

Ooops…. almost forgot the purpose of this comment.

THANK YOU, ANDREW LEVEN.

As I always say these columns do not write themselves.

PS….Do not be concerned about my dented walker.

I will use it as a tax deduction.

That’s the Spirit, Kathleen Demarest!

Andrew Leven makes a spurious argument that our taxes went to the public good. He says the following: “The federal income tax was initiated in 1913. Are you suggesting that our road network then (consisting mostly of a hodgepodge of dirt trails) is comparable to what we have now? Or that the interstate highway system built after WWII under the Eisenhower administration is not a public good?” Let’s look at the facts:

1. Eisenhower was the only President to balance the budget in the modern era.

2. The interstate highway system was already underway during and right after WWII. It was a strategic national security imperative. Rt. 208 in Bergen County was just a railroad line and dirt road that led from the Dupont Munitions plant in Pompton Lakes, NJ straight down to the docks at Ft. Lee and surrounding cities. Hence, that’s why it became a “state” highway–for Military purposes.

3. Taxes were significantly lower during Eisenhower than today. Not the rates, but the dollar amounts. The rates remained high to pay the military-industrial complex. We had been at war in Korea, and Vietnam was just starting.

4. Today’s taxes do not go for the “good of the country”. They are spent wastefully and frivolously. $400 BILLION DOLLARS are paid to ILLEGALS, who have no right to Americans’ tax monies. $300 BILLION to Ukraine so far. $200 BILLION to Iran. $500 BILLION to Red China. $3 TRILLION for the Green Raw Deal that has produced no significant energy alternative or carbon control (because China and India are polluting the U.S. with their pollution). Another $2 TRILLION for infrastructure (where only 10% went to fixing highways and bridges; where did the rest of it go?????). $9 BILLION for 7 EV power stations–ACROSS THE ENTIRE U.S. $200 BILLION wasted on solar and wind with no discernible impact on energy production (like Germany and other European nations; bring back nuclear and work on fusion power [that the government has been diddling about for 50 years]).

How about BILLIONS wasted on Transgender, Gay, DEI, ESG programs that are a total and unconstitutional waste of taxpayers’ monies as they cater to small minority segments of society, and don’t help the overall society???? And, hundreds of millions sent to Pakistan and other Muslim countries for transgender education???? These are the same countries that murder gays and transgenders because they are considered religious defectives.

I could go on, but it’s a waste of time trying to discuss with single-minded Democrat-Communists like most lawyers (which I can prove empirically), educators, and the rest of the similar apparatchik.

For goodness sake, TJ. Give it a rest and get some help.

CONFUSED AND BEFUDDLED, MORE THAN USUAL

Determined not to engage, peace and harmony was my goal……..UNTIL…..I read the last sentence of commenter no.11. I had never seen him use the word educators before. Light bulb went off, several actually. He does not respect hard working school teachers.

I would pair paralegals with lawyers, not educators.

Our trusted, ever alert censor should have censored that sentence and not allowed any unkindness to school teachers/educators. Some, I am sure are sensitive, and their feelings are easily hurt.

PS… I will now turn off my landline phone and get some work done. It is difficult to maintain a home while using a dented walker.

Before your informative column goes to happily reside with some of the retired columns:

On behalf of attorneys, paralegals, educators, DADS, etc, I sincerely thank you.

A reminder: please do not shake your finger at anyone; it is considered simple assault, if threatening.

PA: A TOM KEAN SR. ENDORSEMENT OF HARRIS COULD MAKE THE DIFFERENCE..Alan Steinberg September 6, 2024

Being appreciative, I might remember you in my will with parting words of wisdom. Please do not tell our trusted, ever vigil censor I don’t want to hurt his feelings. If you don’t read this I can send you a copy.

Hey AL, I did give it a rest. I could have gone on. The problem with InsiderNJ.com is that you have a bunch of Left-Wing Democrat cheerleaders cheering you and other Leftist writers on. Yet, when Conservatives and Republicans challenge the alleged facts you spew, we’re censored. InsiderNJ.com is another First Amendment violator.

I must apologize .. Comment No. 14

If you look for my suggested column; it has wondered off. You can find it if you research

TOM KEAN SR.

If it wonders off again, I have numerous copies, black and white and color. ..Your choice.

I agree with comment No.11. Tax money spent wastefully and frivolously!!!

EXAMPLE:

Kerfuffle on my front yard. After the kerfuffle there is a delivery truck on the street with no driver available and a few local and county officers. I was a child of the depression and know the value of money. I would have put traffic cones around the truck and a Do Not Disturb sign on the door and waited patiently for a qualified driver. NO…….an EXPENSIVE flatbed truck arrives to transport the delivery truck with a police escort to its hub……frivolous and wasteful.

Andrew Leven, do not beat your head against a brick wall; you will only get a headache.

An aspect of Harris/Trump Economic Plan that isn’t being discussed is both are ignoring the exploding budget deficit as senior economists plead with both to ‘get real.’

As stated in my previous comment, “No talk of balancing the budget,” from either candidate. I believe that is a very focused statement. Void of sarcasm.

Betsy, you are willing to have a genuine conversation. That is becoming increasingly rare, and precious. Let me respond in kind.

You are, of course, obviously correct. i don’t think anyone discussed a balanced federal budget in over 20 consecutive years.

There is, however, an image having nothing to do with economics that I can’t get out of my head. That is, the chanting Trump led last week at a campaign rally.

Having lied about the Haitians in Springfield (i) being there illegally and (ii) eating household pets, Trump then led the crowd’s call to “get them out.” I believe strongly in borders and in legal immigration only. These Haitians are here legally. they are working. They are not eating pets.

I spent most of my professional life representing this country as a federal prosecutor, and my father shed his blood defending it in combat in WWII, where he sustained a near fatal chest wound.

Harris is an imperfect candidate who at times frustrates many Americans – including me. Trump, and MAGA, make me ashamed of America.

This comment is off topic and, in that sense, unfocused. But it is another largely unspoken aspect – and for me, now, the most important aspect – of this very gray time in our nation’s life.

Sorry Andrew, but Trump was reducing the budget deficit with opening up the oil and gas spigots during his term, making America energy independent/dominant and selling oil and gas all over the world. He brought back businesses from overseas with reduced tax rates, and even had foreign businesses opening here (more tax base). He used the tariffs to great effect, which was helping reduce the budget deficit, until the pandemic hit and shut everything down [based on extremely flawed and fraudulent advice from Deep State operatives like Anthony Fauci and others that seems to have been exposed as a failure]. Yet, Trump’s economy was set up that it kept the economy strong during the Harris-Biden regime, until Harris-Biden decided to keep the massive spending going instead of opening up the economy, opening up oil and gas, which no other country can match. Trump brought back a lot of manufacturing and other businesses.

So, if you follow the conservative Milton Friedman economic theories of cutting taxes instead of the failed Keynsian economic theories which believes you can tax your way out of debt and deficits, you’ll understand that Friedman’s theories are the only solution to reduce taxes, reduce governmental spending, reduce the deficit and reduce the debt.