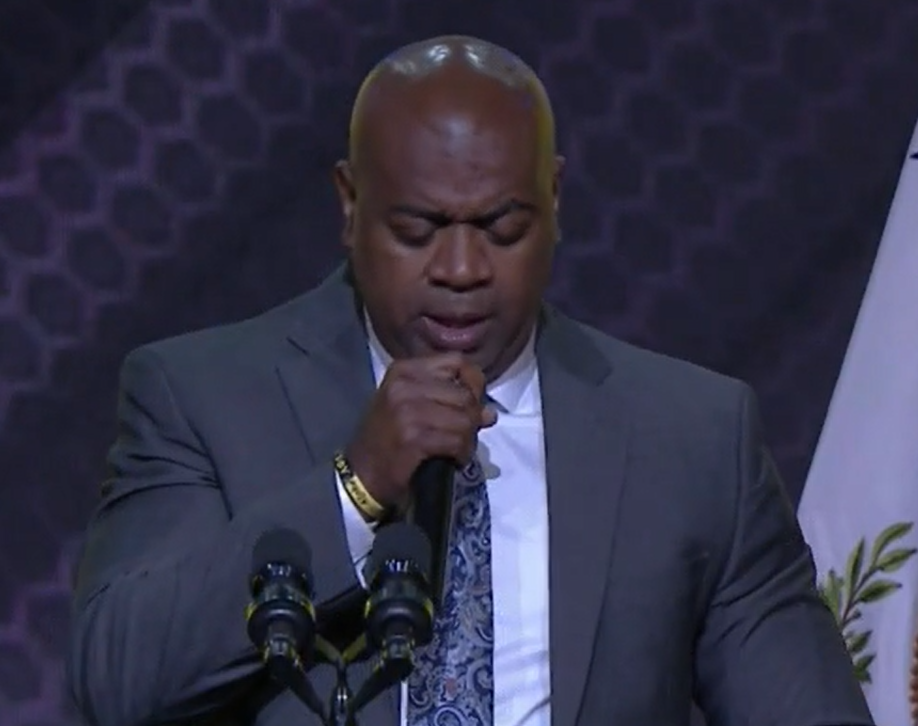

Baraka Goes off on Healthcare Premium Increases for Public Sector Workers

Mayor Ras J. Baraka today criticized health insurance rate increases for employees and early retirees, saying it would hurt Newark’s dedicated municipal workers, taxpayers, deserving retirees, and their families. The City had neither control nor say in this process.

Based on a vote by the State Health Benefits Commission on Wednesday, September 14, some local governments will see an estimated 23 percent health insurance rate increase, while state employees will see about a 21 percent hike. The increased rates will affect the health care plans for more than 800,000 state and local government workers.

“At a time when health insurance companies are making record profits, plans to increase health care costs for New Jersey public employees are a betrayal of thousands of hard-working members of Newark’s municipal family, who are already being harshly impacted by rising costs of living,” said Mayor Baraka. “The City could be forced to bear these expenses, which would squeeze our taxpayers. Adding these costs will only create additional financial hardships for these dedicated workers, retirees, taxpayers and their loved ones. While we are disappointed in this decision, my administration is working non-stop, around the clock, to find viable solutions that will protect our workers from this massive increase.”

With open enrollment quickly approaching, and the State Health Benefits Plan (SHBP), of which Newark is a member, increasing its rates significantly, the City of Newark is faced with trying to mitigate these astronomical increases for the benefits of its employees, retirees, and their dependents. Based on the vote last week, for Plan Year 2023, the state approved the following overall premium rate changes:

· Active Employees: Medical +24% premium increase and Rx +3.8% premium increase. Overall +21.6% premium increase.

· Early Retirees: Medical +16.6% premium increase and Rx – (5.7%) premium decrease. Overall +13% premium increase.

· Medicare Retirees: +0.7% overall premium increase.

To combat these moves, the City is going to market to solicit both fully and self-funded medical plans from Blue Cross/Blue Shield (BCBS) of New Jersey and Aetna; seek to create a new pharmacy benefits plan; and work with HealthCare2U, a national company, to provide part-time workers who lack medical benefits with access to non-emergency care.

With the current rates and payment structure, in order for the City to leave the SHBP, it would have to front approximately $32 million to the state, which represents our portion of outstanding medical and prescription claims, as well as administrative costs.

That is because Newark is not up to date on their premiums!