Breaking Down the State Budget Impasse

TRENTON - Governor Phil Murphy met the press Monday morning and delivered a not-all-that-unusual assessment of the state budget impasse.

He said both sides have a "fundamental. breakdown" in philosophy. On the surface, there's nothing surprising about that.

But what is a bit surprising is that this "breakdown" is occurring among Democrats, who control the state Legislature by a pretty healthy margin.

There are warnings about a state government "shutdown" if agreement isn't reached by the start of the fiscal year July 1. We've had shutdowns before in New Jersey and, in truth, they really don't cause all that much pain. But they do produce fascinating optics - like last summer's infamous photo of Chris Christie and friends on a deserted beach.

Putting Christie's beach adventure aside, Democrats need to avoid a shutdown. While a shutdown may not hurt many people - they traditionally do not last very long - it will show residents how incompetent the Democrats running state government are. No party should want that.

The dispute, like many, is about taxes. Or rather which ones to raise.

Murphy has been adamant about increasing income tax rates for those earning $1 million a year or more from 8.97 to 10.75 percent. He also wants to raise the sales tax back to seven cents on a dollar.

The governor noted that "no one celebrated" when the sales tax was decreased two years ago as part of a deal to raise the state's gasoline tax by 23 cents a gallon.

He's probably right about that. In fact, most in New Jersey probably don't even know it's been lowered. That's because it has little practical effect. The current sales tax is set at 6.625 cents on a dollar. Quick, how much is that on a purchase of $68.19?

As for the millionaire's tax, Murphy also would seem to be on rather safe political terrain.

After first saying he doesn't govern according to polls, the governor quickly added that polls show widespread support for a millionaire's tax.

No surprise there. Most people are going to support a tax they don't have to pay.

Senate President Stephen Sweeney is looking at things differently.

Sweeney, who clearly seems aware Democrats are always blasted by Republicans for raising taxes, doesn't want to play that game. One really can't blame him.

Democrats would appear to be in a great position to flip some congressional seats this fall; why give Republicans the issue of Democrats always raising taxes?

To demonstrate that point, we bring you Assemblyman Jay Webber, the Republican candidate for Congress in District 11.

Webber dished out a statement Monday challenging Democratic candidate Mikie Sherrill to take a stand on Murphy's proposed tax increases.

"If she (Sherrill) wants to be a leader in this state, she has to be able to do more than the easy stuff," Webber said.

Sherrill is not necessarily seeking to be a "leader," in New Jersey; she is running to represent one district in the House. That's different.

But there's no denying Webber's point. We know state and federal issues are different, but make no mistake, a tax increase in Trenton will hurt Democrats running to represent the state in Washington.

So, Sweeney is 100 percent right here?

Well, not really.

He has proposed increasing the state's corporate tax from 9 to 12 percent. He reasons this would not be a hardship, given the fact corporations are benefiting from a steep reduction (35 to 21 percent) in the federal corporate tax rate.

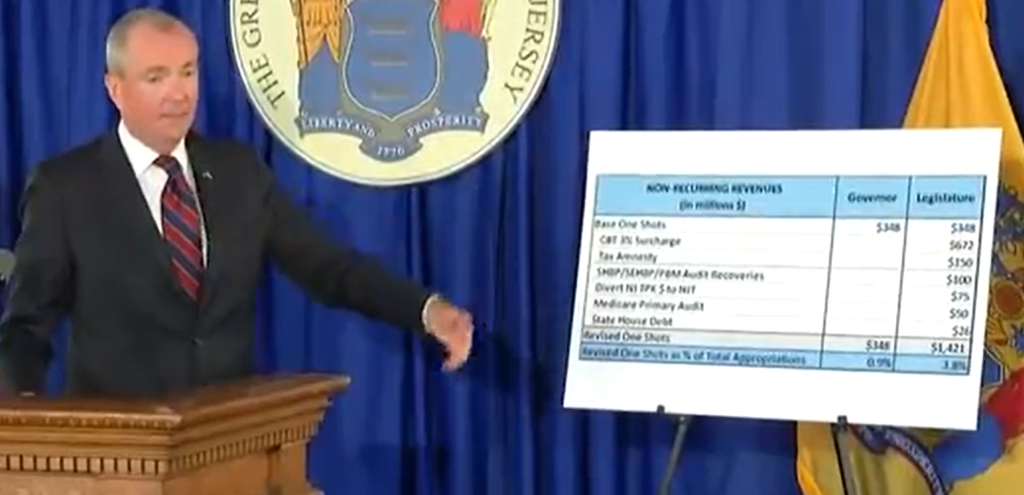

True, but Murphy raised a good point.

Notwithstanding changes in the federal tax code, Murphy said he's concerned about the state's ability to attract businesses if the state corporate tax is too high.

The governor said that if a millionaire gets peeved and moves out of state because income taxes are increasing, that's one person leaving town so to speak.

But if a business owner leaves, or doesn't come to New Jersey in the first place, hundreds of jobs can be impacted.

Positions seem to be hardening. Democratic leaders say they'll vote on a budget on Thursday; Murphy says he'll veto it.

Amid this mess is the somewhat ironic fact that Democrats on both sides are presenting reasons why taxes shouldn't increase.

The smartest approach may be to accept all of them and put some of Murphy's very worthwhile, albeit ambitious, goals on hold for a year. Except for one - legalizing marijuana. Many in this debate probably need a way to relax. As do many residents.

One Republican watching all this from afar is Assemblyman Michael P. Carroll, of Morris Township.

Carroll, who incidentally backs legal pot, seems worried not at all about the Dems' budget predicament.

"I have every confidence that the two sides will eventually come together and compromise on a final product which contains the worst elements of each side's proposals," he said.

Clever fellow, that Carroll.

Millionaires tax misses the point. We need to be invested in the State. We need a new, locally-accountable banking model where folks are fully-invested up to the full value of their homes. Could actually craft a model where we work off the scrip of Interstate Commerce and Banking and have good governance actually pay dividends. Notional values are not nearly as important as dynamic values. The State has a cash flows problem. Stop the bleeding and build up a healthy circulatory infrastructure. Can hit a broad sense of Liberty and Prosperity within three cycles if we get the model right.