Coalition of Activists Wants Murphy to Tackle Progressive Issues in Budget

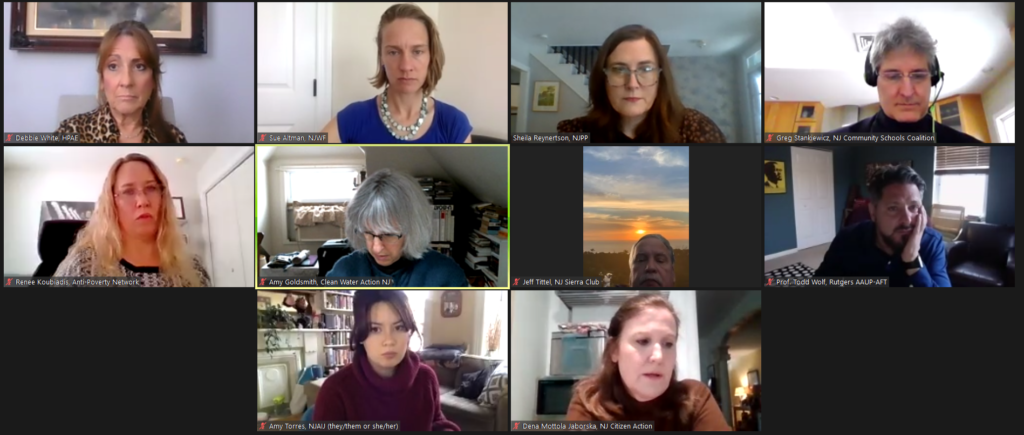

Governor Phil Murphy and the legislature have a lot to deliver on if For The Many NJ will be satisfied with the 2022 state budget. At a time of economic crisis, for both residents as well as for the state coffers, the coalition of organizations ranging from the New Jersey Policy Perspective to New Jersey Citizen Action to the Latino Action Network to NJ Working Families feel that the state needs to deliver on an array of funding projects affected, stalled, reduced, or unimplemented since the pandemic struck.

The coalition called for Governor Murphy to make broad strides in fully funding public education, children’s services, public health, higher education, student debt elimination, closing corporate tax loopholes, addressing racial inequity that has been magnified during the pandemic, as well as environmental issues, and more. To pay for these initiatives, they want the state to ensure that the wealthiest segments of society and industry “pay their fair share.”

Sheila Reynertson of New Jersey Policy Perspective said that the policy decisions made would determine whether the state had a strong or a weak economic recovering, adding that “these destructive events have exposed the ugly rot” of discrimination. “We are here today to call on the governor and legislature to craft a budget that centers on the people, not special interests.”

Dena Mottola Jaborska, Associate Director of New Jersey Citizen Action, said that “Low- and moderate-income families are still suffering from the effects of the pandemic” and their requests for state spending “run the gamut from housing to utility assistance, to an expansion of the Earned Income Tax Credit (EITC) and child tax credits, to health coverage for all children and direct cash assistance for working immigrants excluded from COVID relief.” Jaborska said that it was “a large investment package, but one necessary to ensure a recovery for all, the only kind of recovery that can be effective: a recovery that invests from the bottom up and not the other way around.”

Those on the call were united in the sentiment that the state’s budget represents the moral values of the state itself. The Reverend Sara Lilia, who serves as Director of Lutherans Engaging in Advocacy Ministry, said, “The Bible teaches us where your money is there your heart is also. Where we look at where money is being spent, we can see the values and heart of our state… When we look at revenue, we can see who we prioritize.” To derive the necessary funding, she said, “we also need to raise revenues for those who can afford it the most and suffered the least.”

It was a theme echoed by the many speakers—the wealthy have a moral obligation to contribute towards the benefit of the whole, especially those segments of society which have been hit the hardest by the pandemic and institutional challenges which existed even before that.

Governor Murphy has been the champion of the progressive movement in New Jersey, although many of his likely and presumed allies have charged that he has not done enough. There is also the fact of the unprecedented challenges of the pandemic which put the brakes on many of the normal operations of the state, to the detriment of the residents. Additionally, funding and revenues for the Garden State are critical and have been even before the pandemic, with massive liabilities threatening the state and an unshakable reputation for burdensome taxes. With businesses closed and residents struggling to get by, the state itself was forced to borrow huge sums of money in an emergency move that alarmed Republicans and fiscal conservatives to the point of challenging it in court, although to no effect.

The governor, himself a millionaire, successfully advanced his millionaire’s tax—one of the planks in his platform from the start—although not without great difficulty even in a Democratic-controlled legislature. Wealthy New Jerseyans, the coalition charges, should also be the ones to financially carry through the many programs and initiatives they are calling for to be fulfilled to ensure a healthy state recovery.

Sue Altman, Executive Director of New Jersey Working Families, vehemently rejected the idea that increased taxation could lead to an exodus of businesses or residents for other states. “As NJPP and national partners have proven time and time and time again, there is no such thing as millionaire flight. They don’t leave our state. Millionaires and billionaires and all these rich people have lots of anchors which keep them in our state. They stay for a lot of other reasons.” She described the proposal as “a marginal increase” in their taxes which should be something they can and should absorb without difficulty. “They’re not so price sensitive that that’s when they leave, that’s just simply not the case. New Jersey has more millionaires and billionaires than most states; we so far haven’t scared them off. Additionally, during the pandemic we actually saw a lot of people moving to New Jersey from places like New York and really densely populated places looking for housing, property, it’s a seller’s market if you’re in New Jersey. We are the cool kids in town so we should act like it.”

Altman also took aim at the political establishment itself as one of the reasons for the state’s woes. “It’s not a budget issue but think it’s important because it’s about accountability. Here in New Jersey we need to be careful that we’re not subjecting our residents to a corruption tax of not having an accountable state legislature. It’s not unrelated [to the budget] because it’s exactly the reason why we can’t have common sense fiscal policies. Things like marijuana, a lot of other things done in a timely manner in New Jersey, is because our elected representatives are not directly accountable to voters in the same ways they are in other states. The final piece I’ll say, this idea that we need to cater to corporations and act like they’re the belle of the ball is ridiculous. Corporations are not communities, corporations are entities that will shop around and do what they are going to do, but corporations will also want to live in New Jersey and be in New Jersey, we know that already. We also know that giving tax breaks to corporations and providing them with their wish-list of whatever they want does not directly result in community development.” She threw a right-hook at the Gipper, concluding, “We need to stop the crutch of thinking that trickle-down economics works.”

Jeff Tittel, Director of the New Jersey Sierra Club, said that companies like Hertz solar and others had left New Jersey during the Christie years after the former governor was opposed to climate-friendly policies. “Many of the larger corporations, especially in the high tech and bio-tech field, want a state that has good schools, good transportation, good quality of life, and we need to invest in those things to keep them here and bring them in. It’s not corporate welfare that brings corporations to states, it’s those things.” Tittle added that, “Green equals green: if we invest in green, we get green. But more importantly, New Jersey’s priorities are wrong. We have to invest in the education and the housing to keep companies here and bring them here. But a pay to play system that we see year after year sends corporations out of state more than anything else.”

“There’s a lot of confusion about New Jersey being an expensive state,” Jaborska said. “It’s poor people who pay the higher costs for everything. They pay the surcharges, when they fall into debt, not favorable interest rates when they need to borrow. The well-off are the ones who can afford every policy we’ve advocated for as a coalition and continue to advocate for. But ask wealthy people and corporations to pay their fair share, to pay what they can afford to pay so that we can invest and so poor people can progress economically—and really it just shows how much confusion there is about who needs the investment and who is comfortable enough to actually support higher taxes for us to make that investment.”

For Amy Torres, Executive Director at the New Jersey Alliance for Immigrant Justice, she felt that results of the policies currently in place were overlooking the problems’ origins. “We are ignoring how the state has become unaffordable, who has been pushed out through displacement, gentrification, higher shares of iniquity that we’ve been talking about, when we center it on ‘what will the rich do?’ We lose track of what have the rich done to working families already. It’s not a question of where will they go or what will they do, but how the state has created this haven for some at the expense of the money.”

Koubiadis, Executive Director of the Anti-Poverty Network of NJ, said “We also have to realize that it is not the Newarks and Camdens that are struggling. We did a report in 2016 with John Watson Public Policy Institute at Thomas Edison State University called the Cost of Poverty. We have segregation and concentrated poverty in all 21 counties. We are one of the most segregated states in the nation. Our policies around housing, wage stagnation and suppression since the early 1970s if you look at the US Department of Labor data, that has created this situation where there are so many people struggling prior to this pandemic. Those corporations have to be responsible and our state and federal governments to really fund the recovery and provide just relief that can recognize the dignity and worth of every person.”

Governor Murphy and the legislature will need to strike a balance, therefore, between the demands of the state which have not changed—but have, in fact, worsened due to the pandemic—and the economic and political realities he needs to face when it comes to actually funding the state’s priorities responsibly.

Typical Marxists looking for more and more of other peoples money to spend. Same story every time..."pay your fair share." Yep, eat the rich and soak the corporations...see where that gets us.