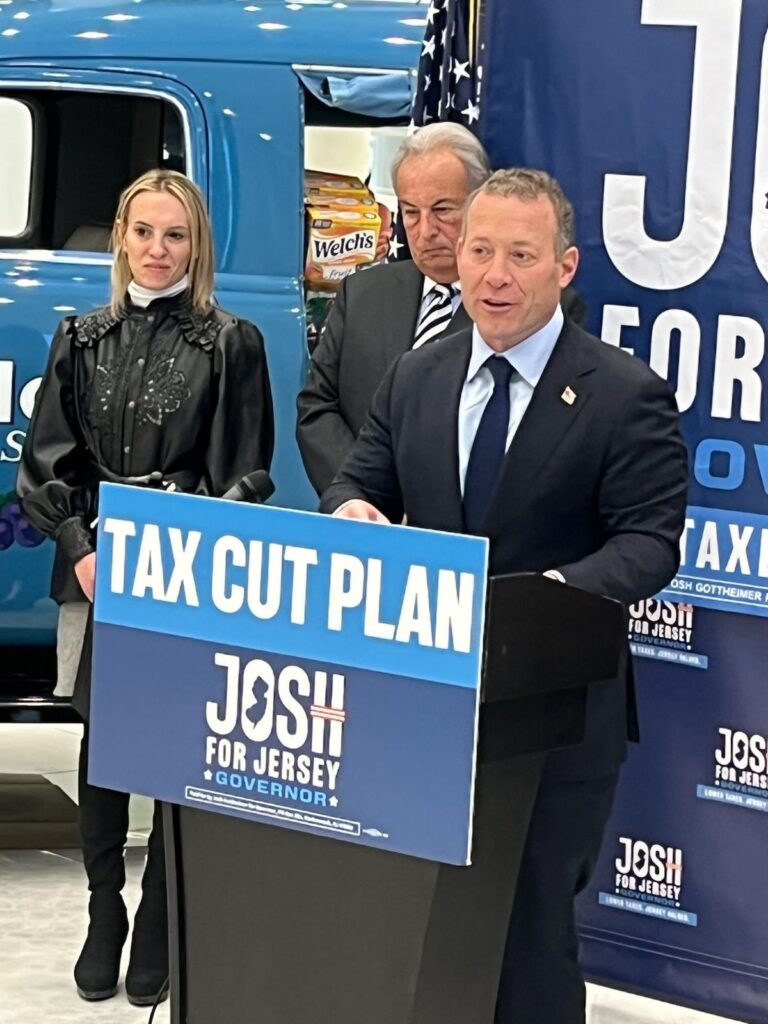

Gottheimer's Plan

PARK RIDGE - Josh Gottheimer says he's been talking to a lot of people in diners - and they agree about New Jersey:

"It's just too damn expensive."

That ain't exactly a revelation, but it is the focus of Gottheimer's campaign for governor.

When the now CD-5 congressman launched his campaign two months ago, he boldly pledged to reduce both the state's income and property taxes.

On Wednesday, he came to PIM Brands, a maker of fruit and chocolate snacks in this Bergen County town near the New York border, to put some, if you excuse the cliche, meat on the bones.

Immediately into a presentation that was watched by about 100 company employees, Gottheimer reiterated plans to cut property taxes by about 15 percent.

That's certainly a worthwhile goal, given the fact New Jersey property taxes are the highest in the nation.

At the same time, reducing them is not easy for any governor, the main reason being that property taxes are not levied by the state. They are controlled by local governments and support the needs of municipalities, school districts and counties.

So, whether he wants to or not, no governor can simply decree that property taxes be reduced.

His plan attacking the problem has many parts.

One is the realization that high housing costs lead to high property taxes. (Keep in mind that property taxes relate to a home's assessment)

"As a result when demand outsrips supply, the costs go up - and that's exactly where we are now," Gottheimer says in a campaign release. He wants to ease the shortage by adding "more than 200,000 housing units."

Then there's encouraging municipalities and school districts to save money themselves, thereby reducing property taxes,

Gottheimer says he's convinced he can cut the state's budget through efficiency measures by at least 5 percent - and he wants local government units to do the same. Some of this can be accomplished by combining services among towns and school districts.

The concept is hardly novel. But the "home rule" nature of New Jersey and the parochial views of many local politicians make this harder than it should be.

He also wants to challenge a current system in which New Jersey residents working at home for New York-based companies pay income taxes across the river. Gottheimer wants that money to be paid to New Jersey.

Some of the savings realized by the above suggestions will be used to reduce income taxes.

As of now, the state's income tax ranges from 1.4 percent to 10.75 percent, making it one of the most progressive in the nation.

Gottheimer says he likes that, but he wants to make it even better.

He proposes a "family tax credit" that would benefit every Jersey family with dependents - children or seniors.

Gottheimer calculates these credits would mean a 50 percent cut for those in the low brackets and a 25 percent cut for those in the middle.

Moreover, he proposes tax incentives to lure both residents and businesses to New Jersey. And he wants to aggressively go after tax cheats.

Businesses would get credits for every job they create and relocating families would be allowed to pay - temporarily at least - the presumably lower property taxes they paid in the state they are leaving.

"Property tax neutral" is the phrase he used.

More generally, Gottheimer began his presentation talking about how residents are fleeing New Jersey.

This, candidly, is what one often hears from Republicans.

In fact, Phil Murphy, who has the job Gottheimer wants, likes to push back on this notion. Just recently, he happily quoted Census data that says the state's population has risen by about 2 percent since the 2020 count and is now at 9.5 million.

Those are the raw facts, but Gottheimer says there's no doubt many residents find the state too expensive. He said:

"That has to change, it's time for a reboot."

Seniors with a pension pay income tax, when the pension reaches a certain level. States like Penna and Florida don't have taxes on pensions. I can understand some taxes, but consider a sliding scale. Retirement pensions should not be taxed at the current rate when it crosses the state threshold. The pension taxes are driving seniors out of NJ

Concerning property taxes. He can lower municipal tax but cannot touch school tax which is 67% of my taxes. Lowering municipal tax will not help me a Senior. Other states when you turn 65 you pay no more school taxes. Been paying school tax since 1995 with no kids in school anymore. Give Seniors a break...NO MORE SCHOOL TAXES!

Let us be fair- All 50 states require public school teachers to have a bachelor's degree. It is a bit disingenuous to say, "Murphy signed a law allowing uncertified, non-certified teachers to teach in NJ." The nonpartisan bill which Murphy signed into law, named the Assembly Bill 1669, eliminated the basic skills test for those seeking a teachers certification. Many viewed the test as redundant and an institutional money grab. The idea for the law was introduced as a means to help the chronic teacher shortage in New Jersey. Unfortunately, eliminating a $90.00 test is an insignificant fix to the teacher shortage problem. A potential qualified teacher may view the many obstacles of the profession and decide to take a different and less resistant career path. It is silly to say a mere teachers test is the reason for the poor outcomes many New Jersey schools are facing. Although, it may be true that many times non-certified paraprofessionals are teaching in place of a certified substitute teacher because there is a shortage of substitute teachers allowing for no other option. This probably happens more than the school administrators would like to admit. But it is fair to state that Governor Murphy needs to understand that New Jerseys, "schools are best in the nation" for only certain student populations.

Given that Governor Phil "KNUCKLEHEAD" Murphy signed a law allowing uncertified, non-degreed teachers to teach in NJ, watch NJ education ratings drop like a rock. When this happens, NJ taxpayers should start demanding massive education tax cuts to go along with property tax reduction. Why??? Not too long ago, Murphy said we have the top education system in NJ. After this new law, he can expect that scenario to drop to the bottom of the pack. But, then again, Murphy will be out of office by next year--so he doesn't care about New Jerseyans. I don't think you'll see education tax reduction, even with under-qualified or unqualified teachers coming in. But, what you will see are NJ residents leaving the state in bigger groups than ever before. They're going to raise the kids and school them in states with better school systems and less education taxes/property taxes, less regulations, and more liberties than what NJ has to offer. And, whatever happened to STAYNJ property tax relief of $6,000 per year for seniors???? After calculating what it costs to support ILLEGAL ALIENS in NJ ($5 BILLION/YEAR, while they only pay $150 MILLION in taxes, or ship their money back to their respective countries), that money could be better used to give seniors $10,000/year in property tax relief!!!!! Instead of giving ILLEGAL parasites that don't even belong here free education, free healthcare, free housing, free legal services, free food stamps, etc., stop funding them and take care of New Jersey's residents first.

DC Insider, Congressman Gottheimer, who wants to be the Governor of NJ, declared that he is going to cut both property taxes and income taxes. How nice! In a classic " Washington DC " move he just decided to say he was doing it because that is how things are done in Washington DC. He has no plan, no idea of how to balance a budget. Typical Washington! Gottheimer is a creature of the Beltway,he knows nothing about fiscal responsibility. New Jersey cannot afford to elect as governor an economic apprentice who might be able to learn on the job. The Democratic Primary voters ,especially the senior voters who do come out in these elections are not going to be " joshed" by this DC Insider. What's next Congressman? Eliminate all tolls? Rent free apartments? Free beer? Hey Josh, do us all a favor and keep that BS in DC.

Until cost cutting measures include consolidation of municipalities and school districts, and robust shared services agreements, taxes will not be significantly decreased. NJ simply has too much government and too many attendant regulations.

In a nutshell, it is called "home-rule." This is a hot potato issue that no politician wants to tackle. Families move into towns because of the school district. Plain and simply, they are willing to pay a higher price and get less home for the dollar for that reason and that reason alone. Call it what you want, but everyone wants the same thing, which is a good education for their children and the value of their home to increase. So, good luck to all of the NJ gubernatorial candidates; any plan to cut property taxes will be a game of " hot potato" and this potato is very hot!

Where to begin, show your plan to just hold the current spending to current levels, too many programs are in place which are guaranteed to increase every year- the whole opioid 'crisis' for one-they have the right to overdose -try going to the same address repeatedly to deal with today's overdose . So you want to build 200,000 new homes? Have you checked lumber, electrical, plumbing, finishing touch prices lately? The price to build my home 13 years later would cost me about 3-4 times now and don't forget labor is higher and with the trump criminal enterprise in power your labor force may have to relocate south of the border. These new homes will have kids yes? For every $1 in property taxes collected, $2.53 will have to go out to schools and municipal services. You want to cut income taxes, alaa christie whitman? When she did it, it saved me $83 yet she and her husband saved over $15,000. You might want to sharpen your pencil to figure from where you will 'enhance' savings-62 cents to 70 cents of every dollar collected from property taxes goes to schools. Here is 1 idea that would be a win win for every aspect of municipal, county and state budgets- the first kid in a residence is 'free' the 2nd kid adds 30% to the base property tax bill, the 3rd kid adds 40% to the new base tax bill. Forget the pay one price for school taxes, the more kids you put into the system the more you pay just like most aspects of consumer spending. Start small, just try to hold current spending levels and make the necessary increases to the programs that count while eliminating/decreasing funding to non-worthwhile items.