Governor Murphy Conditionally Vetoes Tax Incentive Programs Re-Extension Bills Without Changes

The recommendations outlined in the conditional veto (see below) largely mirror the tax incentive proposal that Governor Murphy first transmitted to the Legislature in late 2018. The proposal presents sweeping reforms to the current tax incentive programs and shifts the focus to bringing new companies to New Jersey while helping to grow state-based startups.'

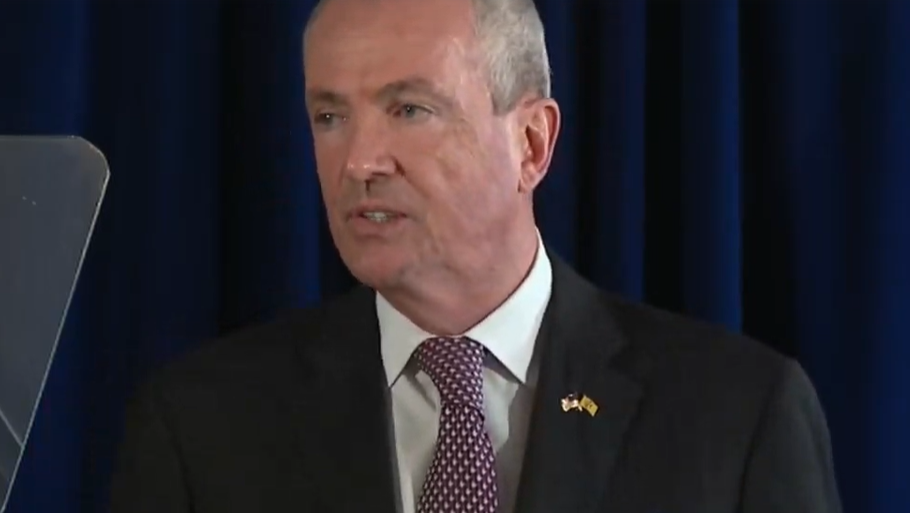

For the past six years, New Jersey has operated under a severely flawed tax incentive program that wasted taxpayer money on handouts to connected companies instead of creating jobs and economic growth', said Murphy. 'The program I’ve outlined in the conditional veto is one that creates good jobs and works for everyone, not just the connected few, and one that will help restore New Jersey’s prominence as the state of innovation'.

Included in the suite of incentive programs are provisions that assure job creation not just at the businesses that receive an award, but also for the working men and women of New Jersey who build and serve these offices.

The five programs included in the conditional veto are:

- NJ Forward – This jobs-based program will provide credits to companies engaged in high-growth industries, U.S. businesses creating a Northeast headquarters, foreign businesses creating a U.S. headquarters, and major job retention projects.

- NJ Aspire – This program will catalyze investments in commercial, residential, and mixed-use projects through a place-based gap financing program.

- Brownfields Redevelopment Program – This program will complement EDA’s Brownfields Loan Program and catalyze more remediation projects and increase job creation.

- Historic Preservation Tax Credit Program – This program, modeled after the National Historic Tax Credit program, will partially reimburse developers who revitalize income-producing historic buildings.

- Innovation Evergreen Fund – This fund is designed to supercharge venture capital investment into Garden State startups.

Each program is capped for a combined total annual value of $400 million. The legislation provides flexibility for the state to award additional tax credits for certain transformative projects, including for projects that deliver food sources to food deserts as designated in consultation with the Departments of Agriculture and Community Affairs.

S3901 would have extended the Economic Opportunity Act in its entirety to January 31, 2020, seven months beyond its sunset date of June 30, 2019.

[pdf-embedder url="https://www.insidernj.com/wp-content/uploads/2019/08/S3901CV.pdf"]