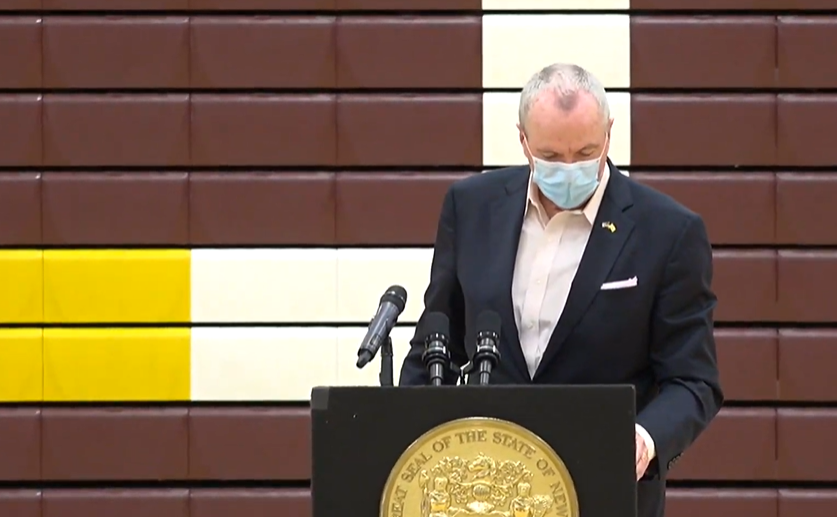

Governor Murphy Signs $9.9 Billion Borrowing Act Into Law

Governor Murphy signed the 'New Jersey COVID-19 Emergency Bond Act' authorizing the state to borrow up to $9.9 billion in light of the fiscal crisis imposed by the pandemic.

“The passage of this legislation is an important step in New Jersey’s recovery from the economic ravages of the COVID-19 pandemic,” he said. “While this is by no means a silver bullet, the ability to responsibly borrow is essential to meeting our fiscal needs in the coming year.”

The Legislature passed the bill earlier today.

From the Senate: Voting along party lines – with two notable execeptions – with (most publicly passionately) Republicans opposed and unthreatened Democrats relying on their comfortable majority, the state senate today affirmed S-2697, a $9.9 billion borrowing bill ostensibly aimed at keeping New Jersey’s budget afloat during the COVID-19 crisis.

The vote was 22-15.

From the Assembly: After GOP lawmakers peppered the Assembly Budget chair over Democrats’ fiscal reasoning, the New Jersey General Assembly this afternoon affirmed its version of the COVID-19 Emergency Bond Act, authorizing the issuance of state bonds totaling $9.9 billion.

Here's the release from the front office:

TRENTON – Today, Governor Phil Murphy signed into law the “New Jersey COVID-19 Emergency Bond Act,” which authorizes the state to borrow up to $9.9 billion to address the unprecedented fiscal crisis that has arisen as a consequence of the COVID-19 pandemic.“The passage of this legislation is an important step in New Jersey’s recovery from the economic ravages of the COVID-19 pandemic,” Governor Murphy said. “While this is by no means a silver bullet, the ability to responsibly borrow is essential to meeting our fiscal needs in the coming year.”

The bill was sponsored by Senate President Steve Sweeney and Sen. Paul Sarlo in the Senate and Assemblywoman Eliana Pintor Marin and Assemblyman John McKeon in the Assembly.

“This will give us the ability to provide the resources needed to respond to crisis economic conditions resulting from the coronavirus,” said Senate President Steve Sweeney. “It also includes a process to ensure responsibility in managing public finances as we work through the fiscal problems that are not fully known. We want to be responsive to financial needs, but we also have to be fiscally responsible and recognize the long-term consequences of actions we take.”

“We must keep New Jersey’s economy moving and we have to continue to provide the government services that are so important during the pandemic,” said Senator Paul Sarlo, chairman of the Senate Budget and Appropriations Committee. “While we understand the need for emergent financing to help with the economic recovery, we still have to be responsible with added debt. This is uncharted territory so we have to monitor fiscal conditions as we make decisions on borrowing.”

“The COVID-19 pandemic has had and continues to have a devastating impact on the State’s economy. Residents, businesses, and government units have seen significant adverse effects,” said Assemblywoman Pintor Marin. “The ‘New Jersey COVID-19 Emergency Bond Act’ authorizes the state to issue state general obligation bonds to help address the fiscal crisis caused by this pandemic. The impact of COVID-19 on our economy, budget and finances is unpredictable and changing rapidly. We must take action to ensure our fiscal viability by empowering the state to apply for and receive federal stimulus loans for the benefit of the state’s ability to respond to the negative impacts of the coronavirus. We do not make this decision lightly. The historic nature of the current pandemic has led to this unprecedented last resort due to the current fiscal crisis.”

“The current public health crisis has thrust us into a new reality that is nothing short of profound and unprecedented,” said Assemblyman McKeon. “Especially when it comes to the toll it is taking on our state revenues and budget. The COVID-19 Emergency Bond Act, approved in the Legislature today, puts us a crucial step closer to crafting a fair and responsible path forward for all New Jersey residents come September. It’s been said before and I’ll say it again: we are in no position to cut or tax our way out the budget deficit we face, we must have the ability to borrow. This Act will enable the State to leverage funds quickly, so we can help everyday New Jerseyans during this once-in-a-lifetime pandemic.”

I just hope is watching and does not give him any money hes been hoarding it for him and his wife he will not even opened a gym because he has never been in one there are at least 5000 jobs that have been lost what about a persons mental health because of his tyrant opinions sooner or later some one is going to snap and they will bilame firearms not the reason.

Stick a fork in the middle-class. We're done! In true Marxist fashion, the Murphys will turn NJ into a state that has only the very wealthy to tax and everyone else who are dependent upon the government.