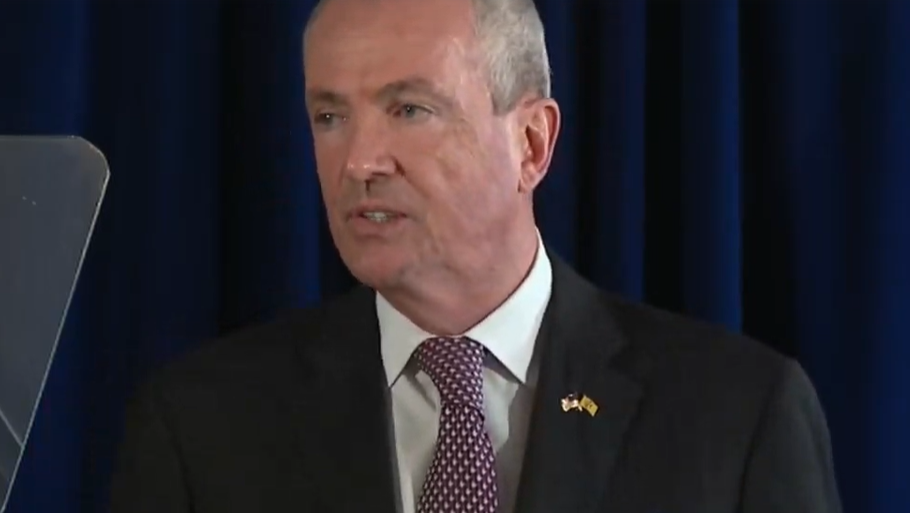

Governor Phil Murphy – Signing of Fiscal Year 2020 NJ Budget Remarks as Prepared for Delivery

You’ve heard me say this before -- as my mother told me, "You’re known by the company you keep."

I am proud to stand with the people in this room.

I am proud to stand with Lieutenant Governor Sheila Oliver, whose commitment to fairness is without qualification.

I am proud to stand with Treasurer Liz Muoio, and her entire team, especially the folks at the Office of Management and Budget and the Office of Revenue and Economic Analysis, who have worked long days over the past months to help us build a better and more honest budget.

I am proud to stand with my staff.

I am proud to stand with organized labor, proud progressives, grassroots and faith leaders, and the many other advocates here who represent a profound change in how New Jersey works -- and, most importantly, for whom it works.

You have been some of the strongest, most passionate, and most dedicated leaders for honest change and real reform. But, most of all, you have given voice to putting the needs of people ahead of greed -- ahead of the wealthy and special interests.

It is in this spirit that I ran for Governor -- to build a stronger and fairer state that works for every family, and to inspire the absolutely necessary shift where power and organization come from the bottom up.

This is the model for how New Jersey moves forward. And, in the last 18 months we have come a long way.

But, I am not naive. Everyone here knows the old ways haven’t been put behind us yet.

While progressive change is taking hold all across our country, Trenton largely remains a holdout. Have no doubt, change is coming to Trenton, and I invite all those willing to join us.

But for those stuck in the failed ways of the past -- we’re moving forward.

So, this budget makes progress and, at the same time, it also falls short.

In a number of consequential ways, this budget is a victory for the values and vision we share.

Spending in this budget is, in fact, very close to that which I first proposed in March. It shares a great deal of the same middle-class priorities. It follows my lead on many important initiatives.

This budget allows New Jersey to do many good and long-overdue things. To make a historic investment in public education. To continue the progress of turning around NJ TRANSIT, and to continue making up for years of neglect. To provide more direct property tax relief. To make health care in New Jersey more available and more affordable, despite the attacks from Washington.

This budget builds on our commitment to a livable wage by supporting those who work with people with intellectual and developmental disabilities, and for hardworking, and underpaid, child care providers.

It builds on our commitment to address our maternal and infant mortality crisis, especially among communities of color -- a righteous cause championed by our superb First Lady, the Lieutenant Governor, and many other leaders in our Cabinet.

It maintains the more than $1 billion in real and sustainable savings I outlined in my initial budget, including innovative public-employee health care savings that our administration negotiated in good faith with our union partners.

These remain the only real and sustainable savings in this budget.

It follows my obligation to put our public employee pensions on firmer footing.

I will work with everyone willing to come to the table with ideas for lessening the property tax burden. But, I will not negotiate away the retirement security or the healthcare of hundreds of thousands of middle-class New Jersey families.

Let me restate the words of my Budget Address: "Our public workers are not the enemy; they are our neighbors. They are also taxpayers. They are the heart of our middle class. It is not pandering to stand with them -- it is doing our jobs."

Those who attack them did not get their way this year.

This budget is another down payment on our commitment to the middle class and all those aspiring to get there.

It is, in many ways, a people’s budget, and the values of our communities are writ large throughout its hundreds of pages.

But, it undeniably also falls short in some ways. It falls short because we were all elected to tackle the hard problems -- not to take the easy way out. And, too often, this budget takes the easy way out.

The people of New Jersey are tired of that. And, so am I.

I say this humbly -- I am standing here today because of that desire for change. I was elected because I offered a different vision for New Jersey. And, because I don’t owe the insiders anything.

So, I’m in the fight for the long haul -- it doesn’t end today or next week or next month.

And I know the people of New Jersey, and all of you here today, are just as determined and just as resolved.

The simple question that should drive all of our actions is this: Whose side are you on?

Everyone here knows their answer to that question. And, I know mine.

I am on the side of putting the needs of New Jersey’s families ahead of the wealthy, ahead of privileged insiders, and ahead of powerful special interests.

But, the forces of business-as-usual are stubborn and strong. They are forces that dictate and demand rather than listen and negotiate. And, the people are left out.

The proof of that is found in how this budget falls short on the issue of tax fairness.

This is -- by and large -- the same Legislature that voted five times for a millionaire’s tax. Five times.

They backed up those votes with words like, "This is something we're not going away on," and, "I don't believe in the middle class and the working poor being constantly the ones who have to bear the burden."

And, this year, with Trump’s tax breaks for millionaires, conditions are even more favorable to finally put the millionaire’s tax to work for all of New Jersey.

Let’s start with the obvious. Unlike my predecessor, I will sign a millionaire’s tax.

New Jersey today has more millionaires than ever -- not fewer -- and their numbers are growing. And, we want more of them. In fact, we already have more millionaires per capita than any other state in the nation.

And this modest tax -- barely two-cents on every dollar of income over $1 million -- will not push them out.

In fact, as a result of the Trump tax cuts, those same very wealthy people will, after a millionaire’s tax, and even after the loss of the SALT deduction, still come out way ahead.

Our administration has estimated that the millionaire’s tax would generate more than $500 million dollars -- a half-billion dollars that would be a recurring, reliable source of revenue to invest in property tax relief, public-school funding, and municipal aid.

A half-billion dollars that would strengthen New Jersey against any coming economic downturn.

A half-billion dollars that would not come out of the pockets of the people already squeezed in our state -- the middle class and those striving to get there.

Yet, facts and history were left on the vine, and the voices of the vast majority of New Jerseyans who support a millionaire’s tax were left in the ether. Instead, the budget that I was sent protects 19,000 millionaires and leaves the other almost 9 million residents to pick up the tab.

The legislative leaders refused to give it a fair hearing and refused to put it up for a vote just to deny the people of New Jersey a clear tally of who stands with them and who stands against them.

And so, I ask again: Whose side are you on?

Time and again, the status quo forces in Trenton took the wrong side.

For all its good, the budget the Legislature sent me still protects opioid manufacturers instead of those suffering with addiction, still protects big businesses who push their employees on to Medicaid and push the financial burden for their health care onto our shoulders, and it even still sides with the gun lobby over a commonsense effort to raise handgun fees for the first time since 1966 -- over a half century!

These are the revenues that would have allowed us to do more – to tell our community college students that they matter – or, to free up more funding for pre-K.

These are the bad old habits that temper a lot of the good progress in this budget. They are the habits that jeopardize the future of the good investments this budget will make in the upcoming year.

But I remain concerned about our ability to maintain them in the following year, let alone the next ten years.

And, the budget I was sent missed its opportunity to save for the rainy day we all know will come, and which many experts are warning us will come.

The Legislature’s plan ignored the statutory obligation to deposit hundreds of millions of dollars into the Rainy Day Fund. To allow that to happen would leave us weaker in the eyes of the bond rating firms, and vulnerable to the next economic downturn.

When he signed the law creating the Rainy Day Fund in 1991, Governor Florio said, "The Rainy Day Fund gets us off the financial roller coaster. A ride that has left us breathless, unable to plan for our future."

Governor Florio went on, "It’s mind-boggling to consider how we became a fiscally precarious state ... We spent money we shouldn’t have; and then we spent money we didn’t have."

Twenty-eight years later, those words ring as true as ever. The need for us to get off the financial roller coaster is more important than ever. The need for us to save for tomorrow is more important than ever.

I will not let this opportunity pass. I am using the full power of my office to protect our fiscal house. We will make a more than $400 million deposit into the Rainy Day Fund.

In addition, I am directing the head of the Division of Budget and Accounting to hold up to $235 million in appropriations in reserve until savings assumed in this budget materialize, current revenues reliably overperform, or the Legislature authorizes new revenues.

These actions -- making the first deposit into the Rainy Day Fund in a decade, plus placing at-risk line items into reserve -- are needed for us to stop the roller coaster and to catch our breath.

In addition, I have prudently used my line-item veto authority to eliminate $48.5 million in spending.

We need to stop spending what we shouldn’t have, and what we don’t have.

That’s true whether it is in the budget, or in our system of tax incentives.

As I have already said, I will veto the incentives extension that sits on my desk. I will not renew a program that drains the funds this budget needs to more deeply invest in the people it will work so hard to support, and which has not moved the needle on economic growth and job creation in our state.

I do not take lightly the prospect of New Jersey going for any period of time without an incentive program, but the expiring programs are so flawed that this actually is the better alternative than continuing a broken and rigged status quo.

I’m ready to work with the Legislature for the long-term success of New Jersey’s economy. And, I sincerely hope they will join me in seizing this moment.

So, here we are at the end of another fiscal year and the story of the good, the bad, and the ugly plays out.

But, as Governor, I am here to lead.

To quote President Harry Truman, a leader who was never deterred by the odds, "In periods where there is no leadership, society stands still. Progress occurs when (people) seize the opportunity to change things for the better."

That means making difficult choices. It means keeping our eyes on the prize even as the forces of business-as-usual seek to needlessly divide us.

So, to be clear, the Legislature and I strongly agree on many essential investments in New Jersey families, and this budget will make those investments. But, we also strongly disagree on who should fund them.

As fundamental as that disagreement is, it is not reason enough to walk away from this budget.

It is not a reason to shut down state government.

It is a reason to continue the fight. It is a reason to continue to ask, "Whose side are you on?"

New Jersey is not a state of quitters. We keep going no matter the odds.

I have signed this budget, but not without deep changes, not without setting funds aside for our future, and not without ensuring it adds up.

So, where some in the Legislature used "magic math," I have used my full legal authority, including the veto pen.

I have met my constitutional obligation of signing a responsibly balanced budget.

Despite all the ways this budget, and the process that created it, fell short, I remain an optimist.

It’s time to move past small thinking and dream big dreams. It’s time to listen to the people of our great state -- the people whose dreams this budget will support.

I am resolved – we are resolved – to make this a stronger and fairer state. A place where every family can succeed. A place where innovators and world-class businesses come to make their future. A place where people can stay to live their dreams and reap the benefits of their hard work.

We have made a great deal of progress and we have more work to do.

The work on the Fiscal Year 2020 budget ends today. But, the fight for the middle class, and all those working to get there continues.

So, this is the question: Whose side are you on?

My answer? Yours.