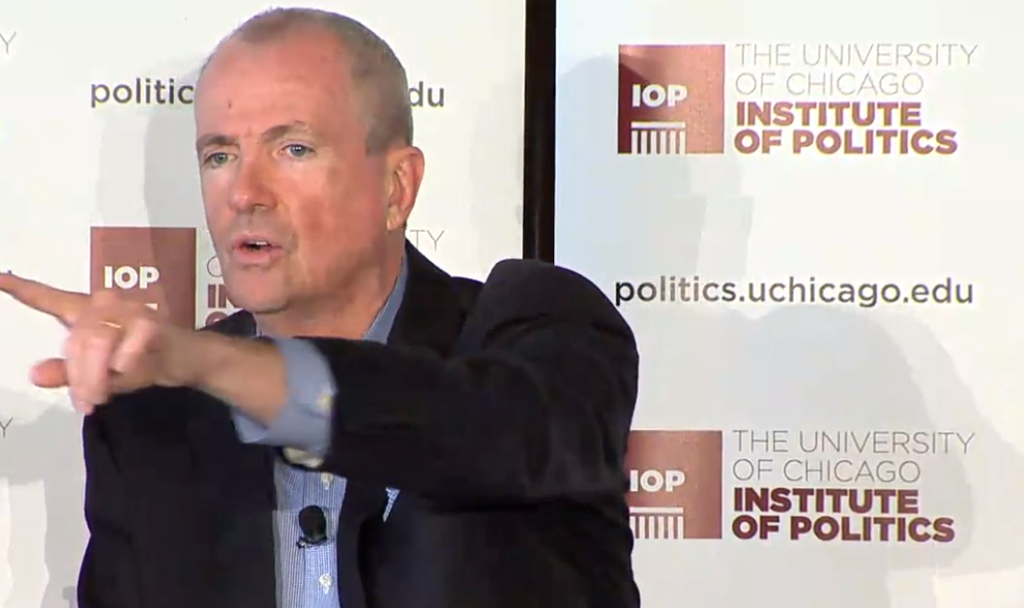

Decision to Air Commercials Pushing for Millionaire's Tax Sets Up Phil Murphy's Administration for Failure

Listen to audio version of this article

Public policy decisions reached in the midst of controversy --- such as the bitter political conflict now engulfing the Murphy Administration --- often reflect rash and personal conclusions rather than sober and contemplative ones.

The determination of the governor, his staff and outside advisers to air television advertisements urging the Legislature to approve his proposal to increase the state income tax on earnings exceeding $1 million is the latest example of agreeing on a course of action in defiance of common sense and prior experience.

When New Directions New Jersey, a political action committee controlled by Murphy’s close confidantes and advisers, launched a similar ad campaign last year, Senate President Steve Sweeney (D-Gloucester) and Assembly Speaker Craig Coughlin (D-Middlesex) denounced it as a brazen and ham-fisted effort by the governor to blackmail the Legislature into support for the tax increase.

Nothing has changed since then --- other than the further and irreparable deterioration of the relationship between Sweeney and Murphy --- and the result will be the same: Rejection of the tax increase.

The Administration decision to unleash New Directions New Jersey is even more mystifying coming on the heels of a gubernatorial veto of legislation which would have required similar groups to reveal the identity of their donors.

When the PAC was created, it pledged to disclose its supporters, only to renege on its promise a year later, lamely explaining that it was concerned that its financial supporters would be subject to political harassment if their involvement became public.

The governor and New Directions were embarrassed further last week when an independent researcher discovered that the New Jersey Education Association had contributed $2.5 million to the PAC.

Sweeney, whose relationship with the Association has all the warmth of the Arctic ice shelf, gleefully pounced on the revelation, caustically referring to the ad campaign as NJEA commercials and hinting that the governor had become the organization’s spokesman.

The decision to move ahead with the ad campaign re-ignited discussion of the outsized influence of so-called “dark money” provided by secret donors and poured into campaigns and policy issues by groups like New Directions.

Murphy’s veto of the proposal to require disclosure --- controversial as it was --- quickly drew additional criticism for its apparently hypocritical effort to hide the source of funding for an ad campaign critical of the Legislature.

If anyone in the governor’s circle of advisers raised these points and warned of placing Murphy in a politically indefensible position, the counsel was ignored.

The decision to air the ads was quickly placed in the context of the increasingly ugly conflict between Murphy, Sweeney and South Jersey political figure George Norcross, an attempt by the governor to respond in kind to the harshly personal assaults on him by Norcross and Camden County and City officials over a task force study of the state’s tax incentive program which it claimed benefited Norcross and his business associates.

It came across as an “I’ll show you who’s boss” statement directed at Sweeney by Murphy but aside from its cathartic effect, it will only produce further bitterness and have no impact on the outcome of the budget deliberations or the millionaire’s tax.

Murphy seems obsessed with the millionaire’s tax, even in the face of certain defeat, and any hope of changing votes in the Senate or Assembly by personally appearing in the ads suggests his Administration has slipped its moorings from reality.

While there’ve been a few scattered expressions of support for the increase, the unbending opposition of Sweeney and Coughlin will hold their respective caucuses together. Believing legislators will defy their leadership and cast their lot with the governor is wishful thinking.

Citing poll data showing broad support for the tax increase, Murphy has criticized the legislative leadership for protecting 19,000 wealthy New Jerseyans while punishing the millions of middle and lower income families struggling to achieve economic security.

“Tax the rich” is historically a popular political battle cry, implying that, first, the wealthy are failing to pay their fair share and second, if the rich are permitted to continue to get away with it, the less wealthy will be forced to pick up the slack.

Murphy’s been unable to persuade the Legislature to accept the argument. The response from Sweeney has been an insistence that the state’s entire tax and spending structure is out of whack and in dire need of reform. Tax increases, he argues, are not necessary to address the fiscal failings.

Sweeney and Coughlin appear confident as well that if the governor forces a government shutdown by refusing to accept a budget that fails to include a millionaire’s tax, the blame will fall almost exclusively on him.

The two leaders will make the case that the Legislature has crafted a spending plan that meets the state’s needs and funds essential services without tax increases while Murphy is prepared to cause massive disruption of government out of personal pique.

The governor is in an untenable position, made even more precarious by taking to television to belabor the Legislature to come around to his point of view.

Like most decisions reached when personal considerations are placed ahead of sober political reality, this one has set the Administration up for failure and embarrassment.

Carl Golden is a senior contributing analyst with the William J. Hughes Center for Public Policy at Stockton University.

Solution to NJs corruption and financial problem Remove Norcross and his entire machine Get rid of the toxic George Norcross Congressman Donald Norcross Stephen Sweeney Judge Jerome Simandle Christopher Christie Stephen Ayscue David Mayer Michael Chertoff