Live Stream: Governor Murphy's FY 2023 Budget Address

Governor Murphy Delivers Fiscal Year 2023 Budget Address

March 8, 2022

Remarks as Prepared for Delivery

"The State of Opportunity: Stronger, Fairer, More Affordable”

Lieutenant Governor Oliver ...

Senate President Scutari ...

Assembly Speaker Coughlin …

Majority Leaders Ruiz and Greenwald …

Minority Leaders Oroho and DiMaio …

Members of the 220th Legislature …

Chief Justice Rabner and Judge Grant …

Members of the Cabinet …

Senior Staff …

Former Governors Florio, DiFrancesco, and McGreevey …

First Lady Tammy Murphy …

Distinguished faith leaders, honored veterans, guests, and friends …

And my fellow New Jerseyans …

It is good to be back in this chamber, and with all of you.

Yet as we sit here this afternoon, 4,000 miles away another anxious evening is darkening across Ukraine -- an anxious evening that will give way to another fitful night.

As New Jerseyans and as Americans we stand unified, with our allies and so many across the world, in calling for an end to the unprovoked and desperate aggression of the Putin regime against the free people of Ukraine. New Jersey stands in support of the international efforts to bolster the Ukrainian resistance and the economic sanctions against Putin and his crony government.

Our administration is assessing what financial or business exposure we may have to the Russian government or Russian-owned business interests or securities -- including in our pension funds. I also thank Senator Paul Sarlo for leading the Legislature’s bipartisan response in support of this effort.

And let me make it perfectly clear -- we will take whatever actions are needed to ensure New Jersey taxpayer dollars are not supporting Putin’s unlawful invasion of Ukraine.

New Jersey is proud to be home to one of our nation’s largest Ukrainian American communities.

We are also the home of the Ukrainian Orthodox Church of the United States of America.

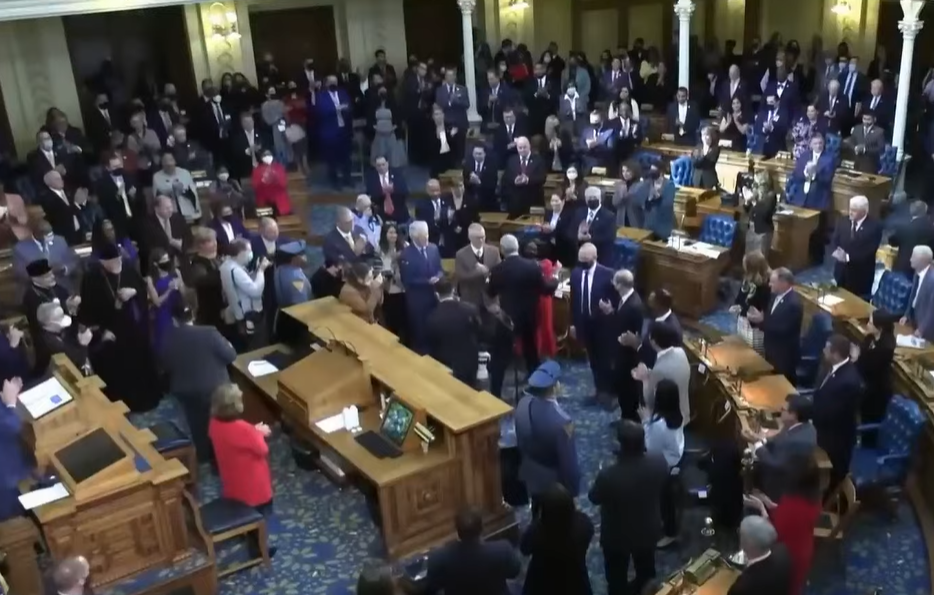

I am incredibly honored that we are joined today by His Eminence Metropolitan Antony and His Eminence Archbishop Daniel. At this time, I invite His Eminence Metropolitan Antony to lead us in prayer and provide today’s invocation.

Thank you, Your Eminence. May God be with you both, and with the People of Ukraine.

Slava Ukraini!

Not that anyone counted, but the last time I stood here was 743 days ago. Seven days later we’d record our first confirmed case of COVID-19 and then, six days after that, our first confirmed death.

It has been, without any doubt, a long and hard two years.

Today we are back in this Chamber. But more importantly, New Jersey is getting back to normal.

Yesterday, for example, marked the first time in nearly two years that our children and educators were together without a statewide requirement to wear masks in our schools.

This was the right step, taken at the right time. We are at this point where pandemic is turning into endemic only because of the hard work put in by so many of our 9.3 million fellow New Jerseyans. The pandemic has been a dark time for our state.

But the darkness has also been pierced by numerous bright lights.

By the light of every healthcare worker … of every grocery store cashier and stockworker … of every first responder … of every NJ TRANSIT worker … of every educator and educational support staffer … among so many others … who stayed on the job so our state could keep moving forward.

By the spirit of countless volunteers who delivered supplies to our frontline workers, cooked and delivered meals to families facing food insecurity, and helped friends and family members and even perfect strangers get vaccinated, among so much more.

And by the ingenuity and resilience of thousands of small business owners who did everything they could to keep their doors open and keep people employed.

One of the things I remain most proud of is that even though each wave of the pandemic tried to knock us down, it never knocked us back.

In true Jersey fashion, we always kept moving forward. And today is a day to look forward.

In both my State of the State Address and my Inaugural Address, I spoke of making New Jersey the place that works and leads the way in building our post-pandemic future.

I spoke of making New Jersey the place where everyone willing to work hard can achieve their American Dream. I spoke of making New Jersey the State of Opportunity.

I also pledged that I would not raise taxes. And I am proud to keep that promise.

Today I present our next budget. This budget is rooted in a renewed commitment to moving our state forward, creating opportunity for every family, and making our state more affordable.

Moreover, this budget directly takes on the most stubborn affordability challenge that has faced our state for decades -- property taxes.

Today, I am putting forward the ANCHOR Property Tax Relief Program to deliver direct property tax relief to nearly 1.8 million middle and working-class and senior households, whether they are homeowners or renters – households in which well more than half of our residents live.

ANCHOR formally stands for "Affordable New Jersey Communities for Homeowners and Renters". But it represents nearly $900 million this upcoming year alone in real help for New Jersey families.

Moreover, ANCHOR is not all we are doing. The ANCHOR program will work alongside our continued investments in our public schools and our communities -- investments which are made to directly attack the root drivers of high property taxes. And it will work alongside the many steps we took together over the past four years.

We increased the minimum wage and put more than a million working New Jerseyans on a path to joining the ranks of the middle class.

We created the state’s first child and dependent-care tax credit, and last year, working together, we allowed even more families to benefit.

We made health insurance more accessible and affordable through the establishment of our own state health care exchange.

We started on a comprehensive effort to lower health care and prescription drug costs.

And we put a higher education at both our community and four-year public colleges back within reach for thousands of students with the Community College Opportunity Grant and the Garden State Guarantee, and by making college costs tax-deductible.

All of this goes to the heart of the meaning of affordability.

To some, affordability means cutting the budget just so they can say they cut the budget -- even if the end result is simply doing nothing at all to actually make life more affordable for our middle class, those working hard to get there, or our seniors.

To the playwright Oscar Wilde, these are the people who, "know the price of everything and the value of nothing".

I am moved far more by the words of the Rev. Dr. Martin Luther King, Jr.: "It is cruel jest to say to a bootless man that he ought to lift himself by his own bootstraps."

We have always understood that opportunity and affordability are linked. Lowering costs and cutting taxes -- the taxes that hit the middle class the hardest -- is but one part of the equation.

I am proud that, across our first four years working together, we cut taxes for our middle-class and working families and seniors 14 times.

When we did raise a tax, it was to make sure large corporations or those at the very top were paying their fair share -- just like everyone should.

Because we did, we have been able to provide more relief and better opportunities for everyone else.

We’ve been able to better support our public schools. We’ve been able to meet our full annual pension obligation. We’ve boosted and created programs that support the dreams of the middle class. And -- because facts matter -- New Jersey has more millionaires today than ever before.

We have also worked to make it easier for New Jerseyans to find more affordable places to call home.

Through the tremendous leadership of Lieutenant Governor Sheila Oliver and her team at the Department of Community Affairs, we established programs to keep families facing foreclosure in their homes -- and to make it easier for already foreclosed properties to be rehabilitated and given a second chance.

We’ve provided down payment help for first-time homebuyers. We put in place one of the nation’s most sweeping moratoriums on evictions to protect renters facing economic hardships during the worst of the pandemic.

And we ended the old practice of raiding the Affordable Housing Trust Fund to fill budget holes elsewhere. This year, we will continue to protect the Affordable Housing Trust Fund so that every dollar goes to ensuring New Jerseyans have access to affordable housing.

But, even more, today I propose a new $300 million Affordable Housing Production Fund. This fund will help us build the entire current backlog of 3,300 already approved, but still yet-to-be-built, 100-percent-affordable housing units by the end of my second term.

The Affordable Housing Production Fund will provide real stability for communities. It will ease the burden on municipalities. And it will short-circuit potential lawsuits by developers. But, most importantly, it will get working families into homes.

Let’s not lose sight of who actually benefits when we build more affordable housing. It’s the educator or first responder who can finally live within the community they serve. It’s also the server at the local diner, the cashier at the grocery store, and the young family just starting out who want to be able to raise their child where the schools are good and the quality of life is high.

This budget attacks two of New Jersey’s most difficult and intractable problems -- property taxes and affordable housing.

We are changing our state for the better over the long-term. We are changing New Jersey to work for every family.

Now, before I go further, I have to take a step back. None of what we aim to do going forward would be possible without the impacts of the past four budgets in firming up our state’s fiscal foundation … meeting our obligations … and prudently investing in our future.

According to Trenton’s conventional wisdom, we’d never be able to get any of these done.

We were told we’d never be able to achieve middle-class tax fairness. And yet, we not only restored middle-class tax fairness, we cut taxes for the middle-class, seniors, and veterans 14 times while also investing directly in their futures.

We were told we’d never be able to properly and fully fund our school funding formula. Standing here today, together we have invested more in our public schools than at any other point in our state’s history -- and we’re on the path to fully funding our obligation to our kids and their parents, our educators, and our property taxpayers.

This is especially critical as we work to undo the learning loss and meet the mental health challenges posed by the past two years.

We were told we’d never be able to both turn NJ TRANSIT around and shield its riders from ever-increasing fares. We’ve not only helped NJ TRANSIT put riders back as priority number one, but this budget will make it five straight years of no fare hikes.

We were told we’d never be able to meaningfully reduce public-employee health care costs without taking a wrecking ball to their health care. But we accomplished this through partnership and compromise, all the while saving taxpayers money.

And we were told we’d certainly never meet our public-employee pension obligations. Not only did we do that last year -- marking the first time in a generation that our full obligation was met -- we’re doing it again in this year’s budget with a $6.8 billion payment.

The naysayers said we’d never be able to implement a strong pro-middle-class agenda and hold the line on property taxes. Yet not only have we been able to put working families first, but we’ve achieved four of the lowest year-over-year increases in property taxes on record.

And then there’s growing our economy. In the nine years before we took office, New Jersey’s economic growth ranked 47th among all American states. Yet, by working together, in the third quarter of 2021, it rose all the way up to fourth. That’s right ... from the fourth slowest-growing state economy in America to the fourth fastest-growing state economy in America. In just four years.

This is what happens when you focus on building an economy that works from the middle out and the bottom up instead of throwing everything at the top in the hopes that something will trickle down to those below.

We were told by some that re-instating the millionaires tax, and leaning into the middle-class, would lead to a great exodus of millionaires. Well, that has been debunked just like that moving van study.

Not only have the "job-creators" stayed, more and more of them are moving in. They’re coming here because our investments are deepening our state’s pool of talented and skilled workers. They’re coming in because our investments are focused on creating the communities in which their own employees want to live.

This is what happens when we use the budget as a tool to grow new industries instead of rewarding the special interests. And none of this happens without a budget that makes crucial investments in people and industries, in communities, and in a true vision.

This is what happens when you use the budget not just to muddle through today, but to build a State of Opportunity for tomorrow.

One of the hallmark promises I made to the people of New Jersey when I first sought this office was to restore our reputation for fiscal integrity.

We were once a AAA-bond-rated state. We were looked at as a model for principled fiscal stewardship. We were considered a smart bet and a safe investment.

Over several decades -- across administrations of both parties -- we had gotten away from that.

We have had nothing but a string of downgrades, 11 of which were received under just the previous administration.

Last week, we received direct proof that the financial course we are following is the right one, with the news that Moody’s upgraded our credit rating.

If you can’t remember the last time we got a Moody’s upgrade it might be because you hadn’t been born yet. Moody’s has only upgraded New Jersey once before. In 1977.

Obviously, this is just one upgrade -- but we’re going to keep working to make it the first of more to come.

A bond rating upgrade shows confidence in fiscal mindset and management. And an improved bond rating saves taxpayers money -- potentially a lot of money.

Most of all, this credit upgrade is clear proof that social responsibility and fiscal responsibility are not mutually exclusive. It is clear proof that when you invest in people, invest in growing the middle class and growing the economy, and invest in our future, it all pays off.

Every member of the Cabinet has worked hard to help us restore honesty and transparency in our budget process, but none more so than Treasurer Liz Muoio and her team. And I thank her, and them, for all they do day-in and day-out to keep us focused on protecting our fiscal house.

And so many of you have been partners in this progress, and so I also thank and commend Budget Chairs Senator Paul Sarlo and Assemblywoman Eliana Pintor Marin and the members of their committees for their efforts.

But as I also said in my State of the State Address, simply because the calendar flipped from one year to another or, in my case, one term ended and another began, the old challenges didn’t just go "poof" and disappear.

And so, the budget I propose to you today continues the work of the past four years …

… The work of restoring fiscal responsibility.

… The work of supporting continued economic growth.

… The work of making New Jersey stronger, fairer, and, yes, more affordable for our families and seniors.

And I am excited to be here with partners old and new to continue this work in my new term and your new legislative session.

Senate President Nick Scutari -- this will be our first budget with you in your new role, and I am inspired by all we can do.

Speaker Craig Coughlin -- through your leadership and partnership we have already achieved a great deal and we have more productive work ahead of us.

And to the new Minority Leaders -- Senator Steve Oroho and Assemblyman John DiMaio -- I look forward to finding common ground for the common good.

A budget is not an end in and of itself. It’s a tool to achieving an end. And this budget is built to help us make New Jersey a true State of Opportunity for all willing to roll up their sleeves and work alongside us.

As I noted, we cut taxes for our middle-class families and seniors a total of 14 times in our first term. I made a promise that I would not raise taxes this year. This budget keeps this promise.

Additionally, it cuts numerous state fees by a combined $60 million -- including one-year fee holidays for driver’s license renewals, marriage licenses, state park entry, and for roughly 130,000 professionals across the health care spectrum.

But, even more, it delivers a promise of real and substantive direct property tax relief.

Now, to be sure, every single budget has provided direct relief through any number of standing direct-relief programs. But for far too long that relief was delivered as an afterthought -- it was the scraps left over after everything else was done and the number of taxpayers eligible to even get it was gutted year after year.

Last year, thanks to the leadership of Speaker Craig Coughlin, we took a huge step in finally getting back to that core promise of direct relief for more families. Through our work together, we delivered direct relief of up to $500 to nearly 700,000 middle-class New Jerseyans. This year, I ask you to join me in taking the next logical step.

Our new ANCHOR Property Tax Relief program is a game-changer -- a nearly $900 million investment to secure our taxpayers’ places in their homes and communities.

Through ANCHOR, more than 1.15 million homeowners with incomes up to $250,000 will receive direct relief averaging nearly $700. More than 600,000 renters making up to $100,000 will receive as much as $250 in relief.

And, over the next two years, we intend to continue building up the ANCHOR program until it meets the funding and relief levels promised by the state’s 2007 property tax relief law. When that day comes, we will be providing direct property tax relief for homeowners that will average more than $1,150 per household.

Property tax relief is another in a string of promises made to the people of New Jersey -- along with properly and equitably funding our schools and making our full pension payment -- which had never been fulfilled. Unfulfilled, that is, until this administration.

And I thank those of you who have been alongside us over the past four years as we worked to keep our word to New Jersey -- and I invite the rest of you to join this effort.

It is true that we here in Trenton do not set property taxes directly. Property taxes are the result of decisions made at the county, local, and school board levels.

But the thing we here in Trenton can do is take some of the sting out of those tax bills.

Through the ANCHOR program, we will immediately knock the effective cost of what our homeowners are paying in property taxes back to levels not seen since 2016, if not even longer ago. And when the ANCHOR program is fully funded two years from now, and providing a total of $1.5 billion in direct property tax relief, we’ll be knocking it back even further.

This is one of the few times when going back is how we move forward.

Nine hundred million dollars in direct property tax relief this year -- on the way to $1.5 billion in direct property tax relief --for nearly 1.8 million middle-class and senior homeowners and renters. This is exactly the kind of progress we were all sent here to achieve.

And don’t think for a moment that we’re going to take our eye off costs that drive property taxes up in the first place -- and most notably in providing direct aid to our nation-leading system of public education.

In 70 percent of our municipalities, local schools alone account for more than half of the average property tax bill -- more than are collected by all county and municipal governments, local libraries, and fire districts, added together.

And the reality is that every state dollar we provide to a school district is a dollar they, in turn, don’t have to ask from property taxpayers.

This budget dedicates roughly 24 percent of its total expenditures to direct aid to education. It is a signal to every property taxpayer that we are partners in their community’s success.

Great schools protect a homeowner’s investment. They make communities more attractive to prospective new residents. They prepare our workforce for the future. No one wants to see our schools backslide.

Across this administration’s first four years, we invested $3 billion more in K-12 education for our public schools than the prior administration did across its last four. This continues our progress.

Our budget will increase this aid by an additional $650 million dollars -- for a total of $9.9 billion.

This budget provides nearly $2 billion more for K-through-12 classrooms than when I took office in 2018. And we are directing additional new investments this year to mitigate the academic challenges that hit far too many students and their families over the past two years.

This figure does not include our commitment to making sure our students have modern schools in which to learn -- and this year we will make a total $430 million investment in school construction and renovation to deliver upon this promise. Every single dollar of it is a dollar invested in our future and in property tax relief.

We will also continue our work to expand access to pre-K programs for more of our kids.

Since 2018, and in partnership with you and our school districts, we’ve increased pre-K investments to date by almost $250 million -- and expanded pre-K by nearly 9,000 seats in the process.

We’re going to add another nearly $70 million to this total in this upcoming year -- $40 million of which will support the creation of another nearly 3,000 new pre-K seats. Last year I put forward a vision of providing universal access to pre-k for every young learner ages 3 and 4, and this budget will keep us moving toward this goal.

Access to pre-K not only starts our youngest learners down the right path, but it also helps make life more affordable for working parents. And specifically, it helps the working mothers who have shouldered an increasingly unbalanced burden -- particularly during the pandemic -- in trying to achieve work-life balance. Today, as it happens, is International Women’s Day, which makes this commitment even more important.

For those moving on from high school to college, we will keep that next step within reach, as well.

We will continue expanding the reach of our successful Community College Opportunity Grant Program for a fifth year, and we will make the second year of support for the Garden State Guarantee, which can provide two years of study at one of our four-year public colleges and universities, tuition-free to thousands of eligible students. We will also continue our landmark investments in Tuition Aid Grants and the Educational Opportunity Fund.

And, in particular, I must applaud Rutgers University President Jonathan Holloway and Rutgers-New Brunswick Chancellor-Provost Francine Conway for putting forward the Scarlet Guarantee to put a Rutgers undergraduate education within reach for more students. The Scarlet Guarantee follows the lead we set with the Garden State Guarantee.

And we cannot be the State of Opportunity -- the place where the American Dream lives -- unless we go all-in on ensuring our workers have the skills to get the jobs of their dreams.

We will continue our commitment to critical job training programs and building the diverse workforce necessary for tomorrow -- especially in the clean energy economy through programs like the New Jersey Wind Institute for Innovation and Training.

Our budget will also continue our support for rebuilding our state’s advanced manufacturing, life sciences, and logistics industries.

And we will continue to invest directly in our small businesses with $50 million for the Main Street Recovery Fund, as well as launch new initiatives to support Black and Latino entrepreneurs and promote diversity in economic development.

This year, the New Jersey Economic Development Authority will formally launch the Innovation Evergreen Fund, a groundbreaking $300 million public-private investment partnership to continue New Jersey’s leadership in attracting entrepreneurs and venture capital.

The year before our administration took office, New Jersey attracted just $818 million in venture capital investment. In 2021, through the non-stop efforts of our administration, New Jersey-based entrepreneurs secured $5.5 billion in venture capital.

That’s a nearly seven-fold increase in just four years. The Innovation Evergreen Fund is how we push this number even higher.

Make no doubt about it … we are reclaiming our title as the world’s home for innovation.

Of course, the ability to receive a world-class education, on the one hand, and land a rewarding career, on the other, depend upon every child getting a healthy start in life.

Through this budget, we will continue to support our Cover All Kids initiative that is ensuring that every child in New Jersey has access to health care.

And we are making the investments necessary to implement our new and groundbreaking universal home visitation program for newborn babies and newly minted parents. I am extremely grateful to the First Lady for her continued efforts to make New Jersey the best and safest state in America to deliver and raise a baby, and to the leading legislative sponsors of this law -- Senate Majority Leader Teresa Ruiz ... Senate Health Committee Chairman Joe Vitale ...and Assemblywoman Shanique Speight -- whose advocacy has been so critical.

And we will continue our focused and data-driven fight against the epidemic of opioid abuse – a nearly $100 million investment that supports, importantly, the critical work of harm reduction centers, among so much more.

We will also continue to confront head-on the senseless gun violence that plagues far too many communities across our state. Last year’s budget included a historic $10 million investment in community-based violence intervention funding, and I am proud to maintain this commitment for the upcoming fiscal year.

From Day One, my mission -- and I hope our shared mission -- has been clear.

To build a stronger and fairer New Jersey that works for every family. To build our state from the bottom up and the middle out. To grow and strengthen the middle class. To make New Jersey more affordable for everyone. To create opportunity where none existed, to grow opportunity for those who had too little of it, and to ensure equal access to opportunity for all willing to work hard.

And this budget -- the first of my second term -- driven by our Jersey values and building upon all we have accomplished so far, keeps us focused on this mission.

This budget continues to address problems that others thought were too hard or required too much political sacrifice.

With the ANCHOR program’s $900 million in direct middle-class property tax relief, this budget builds upon the 14 tax cuts we’ve already delivered for our working families, our veterans, and our seniors.

With thousands of new units of affordable housing, this budget makes our state stronger and fairer for those looking to plant their flag in a great community.

With more aid for our public schools and a full pension payment, this budget will continue to apply downward pressure against property taxes.

With solid investments in infrastructure and fixing longstanding problems -- from getting rid of the lead pipes that contaminate drinking water to getting NJ TRANSIT back on track -- this budget focuses on strengthening our state from the inside out.

And with a focus on fostering an innovation-driven economy that grows new industries, restores our environment, and drives investment into our historic communities, this budget will support the careers of tomorrow.

When we talk about affordability and opportunity, what we are really talking about is empowering people. We’re talking about giving people more choices and more options -- and, ultimately, more control over their lives and futures.

That is the fundamental question in the discussion over affordability.

For whom are we making New Jersey more affordable? Who needs more opportunity? Who needs obstacles knocked down?

To me, and in this budget, the answer is clear. It’s everyone looking for their opportunity to live their American Dream, whatever that dream is.

It’s the hardworking families who simply want to catch a break …

It’s the young people starting out who want to not just find a good job, but start a solid and rewarding career ...

It’s the seniors hoping to retire in dignity and security …

And it’s the small business owners and new entrepreneurs looking to make their ideas take flight.

These are the New Jerseyans whose back I have. And they are the New Jerseyans for whom this budget will help turn New Jersey into the State of Opportunity.

Thank you. May God bless you and your families. And may God continue to bless the great State of New Jersey and the United States of America.