Gov. Phil Murphy Announces Property Tax Relief Plan for 2 Million Taxpayers

Watch Governor Murphy and Treasurer Muoio’s announcement on property tax relief and tax fairness at 10am:

The Governor’s Office released the following statement:

Governor Murphy Details Plan to Deliver $250 Million in Property Tax Relief Directly to More Than Two Million New Jersey Taxpayers

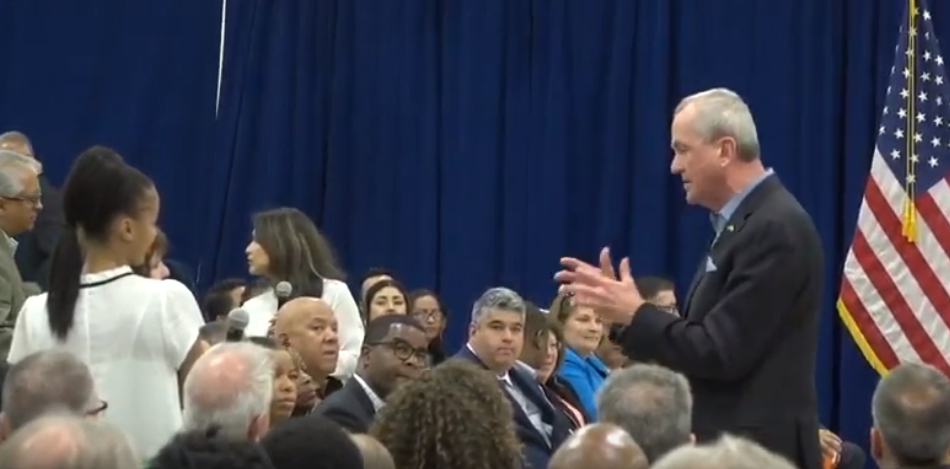

HACKENSACK – Governor Phil Murphy today unveiled details of his proposal to deliver $250 million in much-needed, additional property tax relief directly to more than two million New Jersey tax filers.

As the Governor has noted before, the additional relief is contingent on passage of legislation increasing the tax rate on those earning more than $1 million per year, which would affect approximately 18,000 in-state residents and 19,000 non-state residents.

“The math is pretty simple, as is the logic,” said Governor Murphy. “This is about tax fairness. It’s about answering a simple question: ‘Whose side are you on?’ We stand with New Jersey’s hard-working middle-class, and those striving to join them. The budget we proposed is built on principles of strong fiscal stewardship and investing in core needs and middle-class property tax relief. The millionaire’s tax is how we ensure these principles for the long-term.”

The Governor’s proposal would deliver $250 million in additional tax relief in the form of a one-time, $125 refundable tax credit on 2019 Gross Income Tax (GIT) returns.

In making the announcement, the Governor was joined by State Treasurer Elizabeth Maher Muoio, Hackensack Mayor John Labrosse, Teaneck Mayor Mohammed Hameeduddin, Fort Lee Mayor Mark Sokolich, and Rev. Dr. Gregory Jackson, Senior Pastor of Mount Olive Baptist Church in Hackensack.

“The Governor’s continued push for reliable, recurring revenues is crucial to setting us on the right path, one that will provide much-needed relief to working and middle-class families, while also helping us save for a rainy day and boost our credit rating,” said Treasurer Muoio.

The credit would be in addition to other existing property tax relief programs – Homestead Benefit, Senior Freeze, Veterans’ Deduction, and the increased Property Tax Deduction Cap – while impacting a much broader base. An estimated 2,013,049 New Jersey income tax filers are expected to benefit, which represents roughly 46 percent of all resident returns.

Under the Governor’s proposal, home owners AND renters would be eligible for the additional relief if their gross income is:

- at least $10,000 (single or married-filing separately) or $20,000 (married-filing jointly/head of household/surviving spouse); and

- no more than $250,000.

The proposal will be included as part of the administration’s recommended legislation to expand the millionaire’s tax.

God Bless Governor Murphy!!! THE CHAMPION OF THE WORKING CLASS AND FOR THOSE IN NEED.!!!!!!!

Bob Knapp, Jersey City