Menendez Urges Advancement of Tax Treaty with Chile

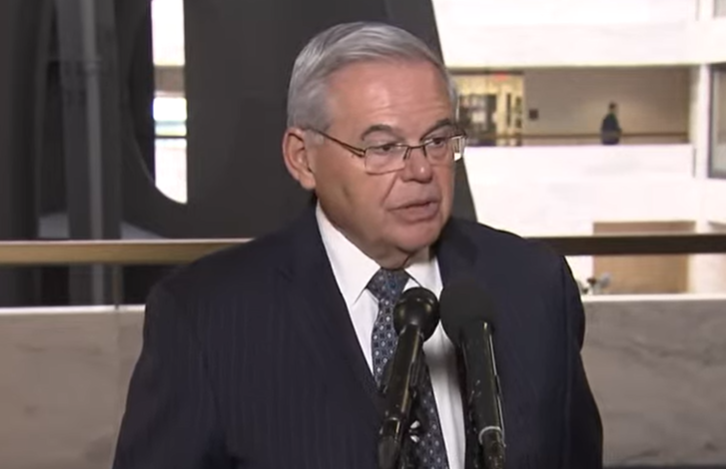

Today, U.S. Senator Bob Menendez (D-N.J.), Chairman of the Senate Foreign Relations Committee, delivered the following remarks on the Senate floor urging his colleagues to approve the U.S.-Chile bilateral tax treaty.

“If the United States wants to level the playing field for American businesses and deepen our ties with Chile, we need to act,” said Menendez. “Chile is one of our strongest democratic partners in the Americas and the Chileans want us to ratify the treaty too. This treaty will advance U.S. interests by building partnerships that will position our country, our economy, and our manufacturing sector for the future.”

Senate approval of the Chile Tax Treaty will facilitate U.S. investment in Chile and Chilean investment in the United States. The Senate Foreign Relations Committee reported out the treaty with an overwhelming bipartisan majority of 20-1. The United States currently has only two tax treaties with Latin American countries, and entering into the treaty with Chile will help rectify that situation and will also help counter China’s increasing activity in the region.

The treaty is largely consistent with the U.S. Model Tax Treaty and other bilateral tax treaties, including in relation to provisions on the avoidance of double taxation and on information sharing related to investigations by relevant authorities.

A copy of the Chairman’s remarks have been provided below.

“Mr. President, this year marks the 200th anniversary of diplomatic ties between the United States and Chile, and 20 years since Congress approved a free trade agreement between our two countries.

In April I led a congressional delegation to Chile.

I had the chance to meet with Chile’s leaders and American businesses operating there.

We were a bipartisan group, and I went with Senator Kaine, Senator Hagerty, and Congressman Cardenas.

And we met with tech companies.

We met with insurance companies.

We met with mining companies — you name it.

You know what every single one of them said to us?

You know what they all wanted from the United States Senate?

To approve the Chile Tax Treaty.

They said if the United States doesn’t ratify the treaty, they will continue to be at a huge disadvantage.

The world is changing. We are undergoing an energy transition.

Without this treaty, we are going to fall behind on critical minerals and manufacturing of the future, and they are right. China already has a tax treaty with Chile.

If the United States wants to level the playing field for American businesses and deepen our ties with Chile, we need to act.

Chile is one of our strongest democratic partners in the Americas, and the Chileans want us to ratify the treaty as well.

We heard that message loud and clear when we spoke to the President and senior members of Chile’s Senate.

We heard it from the Speaker of the Chilean Congress, and we heard it directly from President Gabriel Boric, a strong democratic leader who seeks closer ties with the United States.

We live in a world with increased global competition and a contest between democracy versus authoritarianism.

The United States needs to be strategic about how we deepen [relationships] with key democratic partners like Chile and President Boric.

We must avoid unnecessary delays that undercut our competitiveness.

Remember, we signed this agreement in 2010. That’s 13 years ago, and this would be only our third bilateral tax treaty in all of Latin America.

China is not waiting around.

So, if we want to be competitive, we need to move forward with the same determination, and the Chile Tax Treaty is an incredible opportunity in that regard.

Chile is an important market for U.S. goods and manufacturing, including aircraft, vehicles, and machinery.

Chile is a leading producer of copper, and Chile has the second largest lithium reserves in the world.

This critical mineral is the building block for many modern technologies.

As global demand skyrockets in the coming years — by as much as nearly 4,000 percent — this tax treaty will make it easier for U.S. businesses to be competitive in this emerging sector.

U.S. businesses and their Chilean counterparts want predictability and consistency in tax treatment.

As they continue to scale up operations — and as the United States and Chile forge even stronger economic ties — they want to know they won’t be taxed twice on the same income in two different countries, and that’s why the Chile Tax Treaty has overwhelming support from the U.S. private sector.

The U.S. Chamber of Commerce has expressed its resounding support for the treaty.

It has the support from U.S. companies across a range of industries and sectors, and the treaty enjoys strong bipartisan support – as it’s evidenced by the fact that it passed the Senate Foreign Relations Committee by a nearly unanimous vote, 20-1.

By approving this treaty, we not only give the Senate’s stamp approval right now, we have high hopes for where this treaty will take our two nations in the future.

So, Mr. President—while we’re debating this tax treaty—I do want to take a minute to speak about how we engage on treaties more broadly.

Treaties are a shared constitutional responsibility of the Senate and the Executive Branch.

Nonetheless, as we worked last year to move the Chile Tax Treaty through the Senate, the Biden Administration withdrew from our tax treaty with Hungary without consulting with the Senate or providing advance notice, let alone approval.

It is deeply disappointing that presidents of both parties have advanced these types of unilateral actions and omissions in the past.

Let me be clear: such actions are completely inconsistent with our constitutional structure.

I have asked the President to commit — at minimum — to meaningful consultations with the Senate Foreign Relations Committee prior to terminating any treaty.

Without such a commitment, I will work to address this issue in future resolutions of advice and consent, as well as in legislation.

And I will continue to work to make sure that the Senate protects our constitutional prerogatives on treaties.

Abiding by our constitution — standing up for our democratic values and institutions — this is what binds us with close partners like Chile.

It was in 1823 that this very Senate confirmed our first diplomatic representative to Chile.

This established for the first time official relations between our two young nations.

We took that action then because our countries were determined that the rest of the world take us seriously as independent states.

Our shared values and ambitions have given us two hundred fruitful years of working together.

In science and technological innovation, on immigration visa and academic exchanges, and yes, on the question of critical minerals and renewable energy, which this treaty will take to new heights.

Mr. President, this treaty will advance U.S. interests by building partnerships that will position our country, our economy, and our manufacturing sector for the future.

I appreciate the Ranking Member of the Senate Finance Committee, who had some issues originally, but we worked together and came to a conclusion that is satisfactory to all.

And so I urge my colleagues to vote to advance this treaty, and to ultimately vote to provide advice and consent to ratification. I yield the floor.”

###