Mikie Sherrill and the 12 Days of SALT

Listen to audio version of this article

Everybody probably is familiar with the traditional carol, "The Twelve Days of Christmas." Here in New Jersey, many politicos recall "The Twelve Days of Torricelli," that brief period in the summer of 2000 when then-Senator Bob Torricelli was a candidate for governor. And now thanks to Mikie Sherrill, we have the "12 days of SALT." That began Wednesday, and is, of course, to run for 11 more days.

It's hard to know precisely what to make of a photo Sherrill sent out with a press release announcing her campaign. It seems to feature a partridge in a pear tree (of course) and a salt shaker dumping salt on the whole thing.

The message is simple, "Pass the SALT."

Artwork aside, this is a real issue with a real history.

Since federal income taxes began more than 100-years ago, individuals were able to deduct what they paid in state and local taxes from their federal obligation. That changed beginning in the 2018 tax year under a tax reform bill passed by the GOP Congress. The state and local tax, or SALT, deduction was now capped at $10,000. This has real adverse impact in New Jersey where many pay more than that in property taxes alone.

All New Jersey Republicans then serving in Congress except one (Tom MacArthur) opposed the tax bill for exactly that reason. That didn't help much. As we know, only one Republican from New Jersey, Chris Smith, remains in the House. And he agrees that the cap is a bad thing.

Sherrill criticized the cap throughout the 2018 campaign, contending that the average resident in the 11th District paid almost $20,000 in state and local taxes. That means an additional $10,000 is now subject to federal taxes.

It's always hard to know why people vote the way they do, but it seems clear that the SALT cap helped Democrats win all but one congressional seat last year.

But the problem is that as we come to the end of 2019, the cap remains.

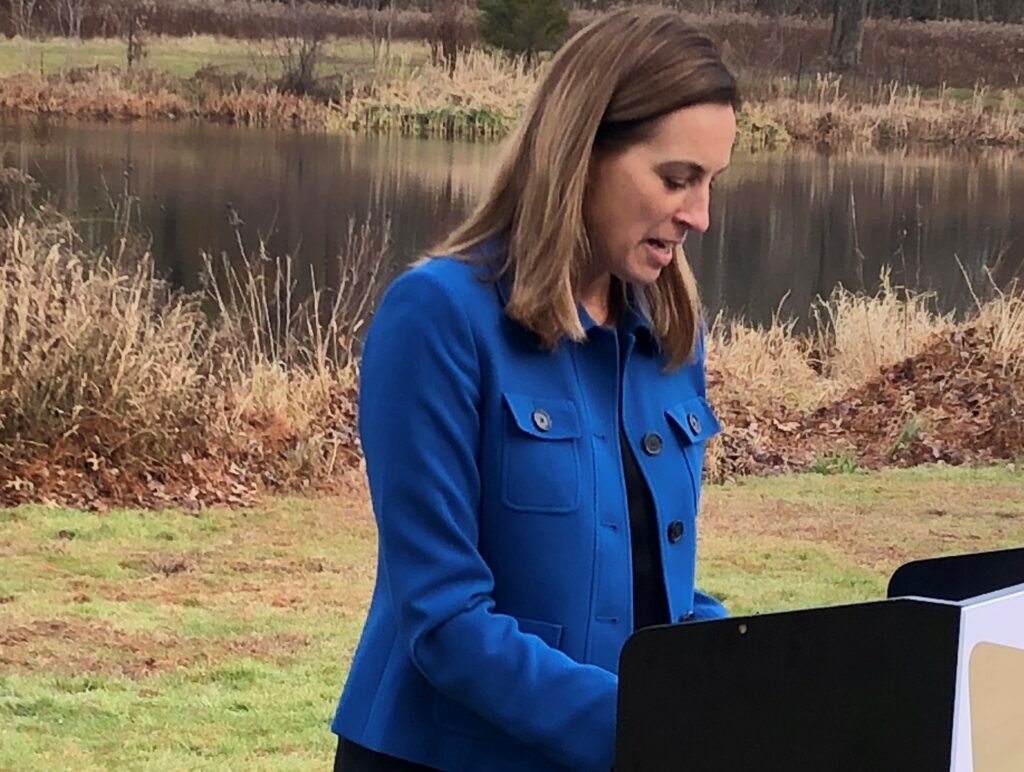

And that is what Sherrill says she's trying to change. She said in her statement that she plans to be on the House floor "every day" until Congress leaves for the holidays "highlighting the impact of SALT on my constituents and on Americans across the country."

Unwittingly perhaps, the congresswoman exemplified the problem. Many Americans across the country couldn't care less about the SALT issue, because their local tax burden is much lower than the one in New Jersey. The current problem emerges because from a national perspective, New Jersey is perceived as a very rich state - just look at average incomes. Residents and representatives from elsewhere don't seem to know, or care, about the state's high cost of living.

So this is a very difficult hill to climb even in the House. It should be taken for granted that the Republican Senate is unlikely to support changes to the Trump tax bill, but that doesn't mean Democrats in the House should not act.

All this is critical for Sherrill and other House Democrats from New Jersey, just about all of whom campaigned on getting rid of the SALT cap.

Sherrill a few months ago introduced a bipartisan bill to exchange the $10,000 cap for the standard deduction, which for the 2019 tax year is $12,200 for individuals.

A week or so ago, Bill Pascrell Jr. talked favorably about legislation that would gradually lift the cap over a number of years.

Still, nothing concrete has happened.

Sherrill says the goal of her "12 Days of Salt" is to lift the cap before the end of the year. That would benefit taxpayers filing returns next April. She said in a floor speech Wednesday that she has met teachers, firefighters, homeowners and small business owners who paid thousands more in taxes this year because of the cap.

Sherrill has to hope her campaign does better than Torricelli's did.