Monmouth University Poll Sees Potential for 'Hurricane Force' GOP Congressional Wipeout in NJ

Powered by New Jersey voters' aversion to President Donald J. Trump - who has a 34% approval rating in NJ - and his policies, Democrats possess a 19-point advantage over Republicans in the generic House ballot among all registered voters here, according to this afternoon's Monmouth University Poll. Galvanized anti-Trump voters in GOP districts are driving the result, a significant gain for Democrats even in a reliably blue state, the poll finds.

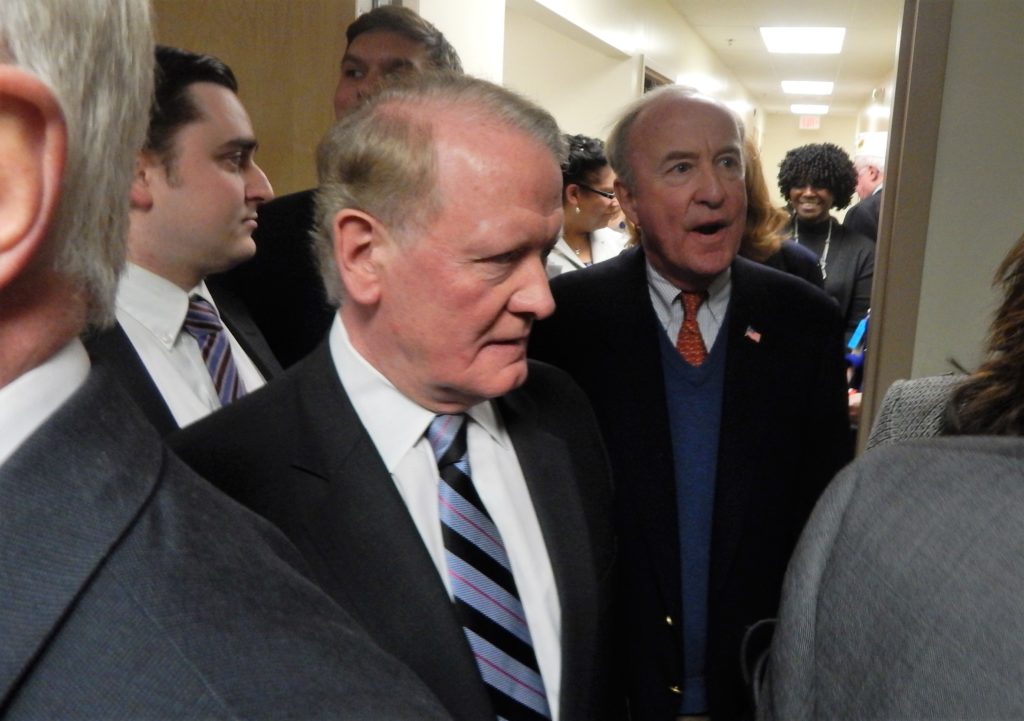

If the polling holds in November it has the potential to switch control of all five congressional seats currently held by Republicans in NJ. Two Republican congressmen (U.S. Rep. Rodney Frelinghuysen [R-11] and U.S. Rep. Frank LoBiondo [R-2] opted not to run again this year. Three others - U.S. Rep. Leonard Lance (R-7), U.S. Rep. Tom MacArthur (R-3) and U.S. Rep. Chris Smith (R-4) - all face a serious threat in this environment.

The poll finds that poor public opinion of Trump leads the list of factors behind the New Jersey GOP’s underlying problems. The recently enacted federal tax reform plan doesn’t help. The Gateway tunnel project has less of an impact, mainly because so few of the commuters who are directly affected by it live in Republican-held districts, the poll finds.

If the election for the House of Representatives was held today, 54% of registered voters in New Jersey say they would vote or lean toward voting for the Democratic candidate in their district compared with 35% who would support the Republican. This gap is significantly wider than the generic House vote edge of 9 points (50% Democrats to 41% for Republicans) measured in a national Monmouth University Poll last month.

If this result holds, it would mark a substantially better result for Congressional Democrats in New Jersey than in recent elections. Democrats won the statewide House vote by eight points (53% to 45%) in 2016 and an even smaller two points (50% to 48%) in the 2014 midterm. Moreover, the poll finds that the overall swing is coming mainly from GOP-held seats.

In the five House seats currently held by a Republican, voter preference is split nearly evenly at 46% for the GOP candidate and 44% for the Democrat. The aggregate vote from these five districts in the past two House elections averaged a sizable 22 point advantage for the Republicans (59% - 38% in 2016 and 61% - 38% in 2014). On the other hand, the poll’s vote share in the seven seats currently held by Democrats – 59% Dem to 28% GOP – is in line with the average 30 point advantage Democrats held in these districts in both 2016 (65% - 32%) and 2014 (62% - 36%).

“This is pretty astounding. Not only are New Jersey Democrats doing better on the generic House ballot statewide, but the shift is coming almost entirely from districts currently held by the GOP. If these results hold, we could be down to just one or two – or maybe even zero – Republican members in the state congressional delegation after November,” said Patrick Murray, director of the independent Monmouth University Polling Institute.

“Voters will certainly take a closer look at the quality of the candidates nominated by the Democratic Party in each of these seats this fall. That could certainly change the equation in any individual district," Murray added. "However, these results suggest that New Jersey Republicans are facing hurricane-force headwinds right now.”

The main factor feeding this electoral environment is the decidedly negative view New Jersey residents have of Trump. Just 34% approve of the job he is doing and 61% disapprove. His rating is slightly better, but still in negative territory, among residents in the state’s five GOP-held congressional districts at 43% approve and 53% disapprove. In the seven Democratic districts, the president gets a 29% approve and 66% disapprove rating.

Another potential drag on GOP prospects is the fact that the recently enacted federal tax reform plan is not particularly popular in New Jersey. Just 35% of state residents approve of the plan and 46% disapprove (including 32% who strongly disapprove). This is more negative than national opinion on the new tax code, which garnered a 41% approve and 42% disapprove rating in Monmouth’s national poll last month. Nearly half (49%) of New Jerseyans expect that their own federal taxes will go up because of the new changes and just 19% expect their taxes to go down. Another 25% expect to feel no impact. These state results are more pessimistic than the national mood, with a smaller 37% of the country expecting their federal taxes to go up, 23% expecting them to go down, and 31% expecting no change.

In GOP-held House districts, 42% of residents approve of the tax plan and 46% disapprove. Still, 47% of these residents expect their federal taxes to go up. In Democratic-held districts, just 31% of residents approve of the tax plan and 46% disapprove, with 51% of these residents expecting their taxes to go up.

A majority of state residents (56%) say that New Jersey taxpayers will do worse under the new tax code compared to taxpayers in other parts of the country. Just 6% say New Jersey will be better off and 29% say New Jersey taxpayers will do about the same as other Americans. Residents in GOP-held House districts (64%) are even more likely than those in Democratic-held districts (51%) to feel they will fare worse than taxpayers in other parts of the country.

“Most New Jerseyans feel like they’ve ended up with the short end of the stick from these tax reforms. That’s what makes this plan a particularly tough sell for Republican House candidates here,” said Murray.

Just over 4-in-10 registered voters (43%) say the tax plan will have a major impact on their Congressional vote this year and another 25% say it will have a minor impact. Democrats (54%) are more likely than independents (38%) and Republicans (36%) to say this will have a major impact on their vote choice. Just over one-third of voters (36%) say this issue simply strengthens the party choice they would typically make, 10% say it makes them more likely to switch to a Democratic vote and 7% say it makes them more likely to switch to a Republican vote. Another 6% are unsure of which way it will affect their vote in the end.

"Much of the impact of the tax reforms is already baked into Congressional vote preferences. The key factor now seems to be how it will affect turnout. Democrats are more motivated by this issue than Republicans,” said Murray.

The poll also drilled down to see how many New Jerseyans will be impacted by the new cap on the state and local tax (SALT) deduction that is part of this plan. Nearly 4-in-10 New Jersey residents (38%) say they file a federal tax return with deductions itemized on Schedule A. This conforms with a report by the Tax Policy Center showing that 41.2% of all federal returns from New Jersey in 2015 took the SALT deduction – placing New Jersey third, behind only Maryland (45.7%) and Connecticut (41.3%), in the proportion of filers who use this deduction. Importantly, just over half (51%) of New Jersey’s itemizers report that their SALT deduction is greater than $10,000, another 32% report it is below $10,000 and the remainder are unsure. Taken together, about one-fifth of all New Jerseyans report exceeding the $10,000 SALT deduction on their federal tax returns, including identical percentages of residents in Democratic (20%) and Republican (20%) House districts.

Most itemizers (77%) are aware that the SALT deduction will be capped at $10,000 on next year’s returns. Nearly 4-in-10 of the itemizers (38%) say the cap will have a lot of impact on the amount of federal taxes they pay, 37% say it will have a little impact, 15% say it will have no impact, and 10% are unsure of the impact. Among those who currently exceed the $10,000 SALT cap, 49% say it will have a lot of impact on their federal tax burden and 40% say it will have a little impact, with the remainder saying it will have no impact (7%) or are unsure (4%).

Another federal policy that has been touted as a potential campaign issue in New Jersey is the Gateway project, which includes construction of a second rail tunnel under the Hudson River. Three-in-four residents say building this tunnel is either very (39%) or somewhat (36%) important to the state’s economy. However, less than half of the public say the project is either very (19%) or somewhat (24%) important to them personally.

About 1-in-4 New Jerseyans (26%) report that they travel to New York City at least a few times a month and 27% of residents report that they usually travel by train when they do go to New York. Taken together, about 9% of New Jerseyans can be considered to be regular rail commuters to New York City. Two-thirds of this group say that building a new rail tunnel is very (43%) or somewhat (24%) important to them.

The impact of this issue on the 2018 midterms appears to be extremely limited, though, because the vast majority of these commuters (79%) are concentrated in House districts held by Democrats, which happen to be closest to the city. Just under 1-in-10 voters (9%) in the two North Jersey seats currently held by the GOP are regular rail commuters to New York. However, regular NYC rail commuters statewide are much more likely to be Democrats (55%) than Republicans (11%) to begin with – and this pattern holds in CD7 and CD11.

“I’ve seen a lot of reporting on how the Gateway project could be the hot button issue in the 2018 House races in New Jersey. I’ve had my doubts and these numbers back that up. Yes, two-thirds of rail commuters say this project is important to them, but the overwhelming majority of these folks live in districts that are already safely controlled by Democrats. Even in the two North Jersey seats currently held by Republicans, rail commuters are largely Democratic partisans to begin with. There could be an impact if the contests in those two districts are close and this issue spurs some Democrats who do not usually vote in midterms to turn out this time. I am not discounting the importance of that, but it will be marginal in the grand scheme of the 2018 campaign,” said Murray.

Monmouth University Polling Institute conducted the poll by telephone from April 6 to 10, with 703 New Jersey adults, including a subset of 632 registered voters. The results in this release have a margin of error of +/- 3.7 percent for the full sample and +/- 3.9 percent for voters.

QUESTIONS AND RESULTS

(* Some columns may not add to 100% due to rounding.)

[Q1 held for future release.] [Q2-3 previously released.]

4. Do you approve or disapprove of the job Donald Trump is doing as president?

|

TREND: All adults |

April |

July 2017 |

|

Approve |

34% |

35% |

|

Disapprove |

61% |

58% |

|

(VOL) Don’t know |

4% |

6% |

|

(n) |

(703) |

(800) |

[Q5-6, Q8-11 and Q13-19 previously released.] [Q7 and Q12 held for future release.]

[THE FOLLOWING QUESTION WAS ASKED OF REGISTERED VOTERS ONLY: moe=+/-3.9%]

20/20A. If the election for U.S. Congress was held today, would you vote for the Republican or the Democratic candidate in your district? [If OTHER/UNDECIDED: At this time do you lean more toward the Republican or more toward the Democratic candidate?] [ITEMS WERE ROTATED]

|

Registered voters with leaners |

April |

|

Republican |

35% |

|

Democratic |

54% |

|

(VOL) Other candidate |

2% |

|

(VOL) Would not vote |

0% |

|

(VOL) Don’t know |

9% |

|

(n) |

(632) |

21. Do you approve or disapprove of the tax reform plan passed by Congress in December? [Do you approve/disapprove strongly or somewhat?]

|

All adults |

April |

|

Strongly approve |

14% |

|

Somewhat approve |

21% |

|

Somewhat disapprove |

14% |

|

Strongly disapprove |

32% |

|

(VOL) Don’t know |

19% |

|

(n) |

(703) |

[THE FOLLOWING QUESTION WAS ASKED OF REGISTERED VOTERS ONLY: moe=+/-3.9%]

22. Will this new tax plan have a major impact, minor impact, or no impact on your vote for Congress this year?

|

Registered voters only |

April |

|

Major impact |

43% |

|

Minor impact |

25% |

|

No impact |

24% |

|

(VOL) Don’t know |

7% |

|

(n) |

(632) |

[THE FOLLOWING QUESTION WAS ASKED OF REGISTERED VOTERS ONLY: moe=+/-3.9%]

22A. Does this issue just strengthen the party choice you would typically make, or will you actually consider voting for a different party than you typically do? [If DIFFERENT PARTY: Does it make you more likely to vote Republican or Democrat this year?]

|

Registered voters only |

April |

|

Strengthen party choice |

36% |

|

Different, more likely Republican |

7% |

|

Different, more likely Democrat |

10% |

|

(VOL) Different party, not sure |

6% |

|

(VOL) Different, more likely indep. |

2% |

|

(VOL) Don’t know |

15% |

|

No impact (from Q22) |

24% |

|

(n) |

(632) |

23. Under this new tax plan, do you think the federal taxes you pay will go up, go down, or stay about the same?

|

All adults |

April |

|

Go up |

49% |

|

Go down |

19% |

|

Stay about the same |

25% |

|

(VOL) Don’t know |

6% |

|

(n) |

(703) |

24. Do you think New Jersey taxpayers will do better than taxpayers in other parts of the country under this new tax plan, will New Jerseyans do worse, or will they do about the same?

|

All adults |

April |

|

Do better |

6% |

|

Do worse |

56% |

|

Do about the same |

29% |

|

(VOL) Don’t know |

9% |

|

(n) |

(703) |

25. Do you fill out a schedule A form on your federal taxes to itemize your deductions or do you take the standard deduction?

|

All adults |

April |

|

Itemize/schedule A |

38% |

|

Standard deduction |

45% |

|

(VOL) Sometimes itemize |

1% |

|

(VOL) Don’t know |

16% |

|

(n) |

(703) |

[Questions 25A-25C were asked of those who answered “SCHEDULE A” to Q25; n=328, moe=+/-5.4%.]

25A. On Schedule A, you can include a deduction for the state and local taxes you pay. This is usually the combined amount of New Jersey income and property taxes you pay. As far as you know was the amount of the state and local tax deduction on your Schedule A form this year more than $10,000 or less than $10,000?

|

Schedule A filers only |

April |

|

More than $10,000 |

51% |

|

Less than $10,000 |

32% |

|

(VOL) Did not itemize/file this year |

2% |

|

(VOL) Don’t know |

15% |

|

(n) |

(328) |

25B. Have you heard that this particular deduction will be capped at $10,000 next year, or have you not heard this?

|

Schedule A filers only |

April |

|

Heard |

77% |

|

Not heard |

23% |

|

(n) |

(328) |

25C. How much do you think this new cap on the amount you can deduct for state and local taxes will affect the federal taxes you pay next year – a lot, a little, or not at all?

|

Schedule A filers only |

April |

|

A lot |

38% |

|

A little |

37% |

|

Not at all |

15% |

|

(VOL) Don’t know |

10% |

|

(n) |

(328) |

[Q26-35 held for future release.]

36. How often do you travel into New York City – more than once week, a few times a month, a few times a year, less often, or never?

|

All adults |

April |

|

More than once a week |

7% |

|

A few times a month |

19% |

|

A few times a year |

35% |

|

Less often |

20% |

|

Never |

18% |

|

(VOL) Don’t know |

1% |

|

(n) |

(703) |

36A. How often do you use the train when you go to New York City – all the time, most of the time, just some of the time, or never?

|

All adults |

April |

|

All the time |

15% |

|

Most of the time |

12% |

|

Just some of the time |

24% |

|

Never |

30% |

|

(VOL) Don’t know |

1% |

|

Do not travel to NYC (from Q36) |

18% |

|

(n) |

(703) |

37. Have you heard of plans to build a second rail tunnel under the Hudson River between New York and New Jersey, or have you not heard about this?

|

All adults |

April |

|

Heard |

64% |

|

Not heard |

36% |

|

(n) |

(703) |

[QUESTIONS 38 & 39 WERE ROTATED]

38. How important is it to the New Jersey economy that this new rail tunnel gets built – very important, somewhat important, not too important, or not at all important?

|

All adults |

April |

|

Very important |

39% |

|

Somewhat important |

36% |

|

Not too important |

12% |

|

Not at all important |

8% |

|

(VOL) Don’t know |

6% |

|

(n) |

(703) |

39. How important is it to you personally that this new rail tunnel gets built – very important, somewhat important, not too important, or not at all important?

|

All adults |

April |

|

Very important |

19% |

|

Somewhat important |

24% |

|

Not too important |

20% |

|

Not at all important |

36% |

|

(VOL) Don’t know |

2% |

|

(n) |

(703) |

METHODOLOGY

The Monmouth University Poll was sponsored and conducted by the Monmouth University Polling Institute from April 6 to 10, 2018 with a random sample of 703 New Jersey adults age 18 and older, in English. This includes 421 contacted by a live interviewer on a landline telephone and 282 contacted by a live interviewer on a cell phone. Telephone numbers were selected through random digit dialing and landline respondents were selected with a modified Troldahl-Carter youngest adult household screen. Monmouth is responsible for all aspects of the survey design, data weighting and analysis. Final sample is weighted for region, age, education, gender and race based on US Census information. Data collection support provided by Braun Research (field) and SSI (RDD sample). For results based on this sample, one can say with 95% confidence that the error attributable to sampling has a maximum margin of plus or minus 3.7 percentage points (unadjusted for sample design). Sampling error can be larger for sub-groups (see table below). In addition to sampling error, one should bear in mind that question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of opinion polls.

|

DEMOGRAPHICS (weighted) |

|

|

ALL ADULTS |

REGISTERED VOTERS |

|

Self-Reported |

Self-Reported |

|

21% Republican |

22% Republican |

|

41% Independent |

39% Independent |

|

38% Democrat |

39% Democrat |

|

|

|

|

48% Male |

49% Male |

|

52% Female |

51% Female |

|

|

|

|

28% 18-34 |

25% 18-34 |

|

36% 35-54 |

37% 35-54 |

|

36% 55+ |

38% 55+ |

|

|

|

|

60% White |

61% White |

|

13% Black |

12% Black |

|

17% Hispanic |

16% Hispanic |

|

10% Asian/Other |

11% Asian/Other |

|

|

|

|

MARGIN OF ERROR |

ALL ADULTS |

REGISTERED VOTERS |

|||

|

unweighted sample |

moe (+/-) |

unweighted sample |

moe (+/-) |

||

|

TOTAL |

|

703 |

3.7% |

|

|

|

REGISTERED VOTER |

Yes |

632 |

3.9% |

632 |

3.9% |

|

|

No |

71 |

11.6% |

|

|

|

SELF-REPORTED PARTY ID |

Republican |

152 |

8.0% |

144 |

8.2% |

|

Independent |

276 |

5.9% |

237 |

6.4% |

|

|

Democrat |

262 |

6.1% |

241 |

6.3% |

|

|

GENDER |

Male |

342 |

5.3% |

309 |

5.6% |

|

Female |

361 |

5.2% |

323 |

5.5% |

|

|

AGE |

18-34 |

142 |

8.2% |

116 |

9.1% |

|

35-54 |

231 |

6.5% |

210 |

6.8% |

|

|

55+ |

320 |

5.5% |

298 |

5.7% |

|

|

RACE |

White non-Hispanic |

473 |

4.5% |

431 |

4.7% |

|

Other |

201 |

6.9% |

175 |

7.4% |

|

|

COLLEGE GRADUATE |

No degree |

310 |

5.6% |

263 |

6.1% |

|

|

4 year degree |

389 |

5.0% |

365 |

5.1% |

|

INCOME |

<$50K |

163 |

7.7% |

134 |

8.5% |

|

$50 to <100K |

202 |

6.9% |

182 |

7.3% |

|

|

$100K+ |

285 |

5.8% |

269 |

6.0% |

|

|

NJ HOUSE DISTRICT CONTROL |

Democrat |

416 |

4.8% |

373 |

5.1% |

|

Republican |

277 |

5.9% |

249 |

6.2% |

|