Murphy Vows to Veto Legislature's Proposed Budget Alternative

TRENTON - A defiant Governor Phil Murphy today pledged to [bubbleAutoLink text="veto the Legislature's budget proposal" id="31616"], arguing that the alternative plan to his budget relies on temporary one-shot and “two-shot” sources of revenue, unverifiable savings, and a projected yawning year-end budget deficit.

It won't have his name on it, he said, denouncing it as a "kick the can down the road" option to his $27.4 billion pro-middle class budget.

“Should the Legislature send me this budget proposal, let me be perfectly clear: I will veto it,” Murphy told reporters, amid sources buzzing about the Legislature landing their version on his desk this coming Thursday.

“When you build a financial house of cards year after year, and see it fall year after year, at some point you have to realize that the same old way of doing business in Trenton isn’t working," he added. "We need a responsible budget based on real, sustainable revenue that makes an historic investment in the middle class.”

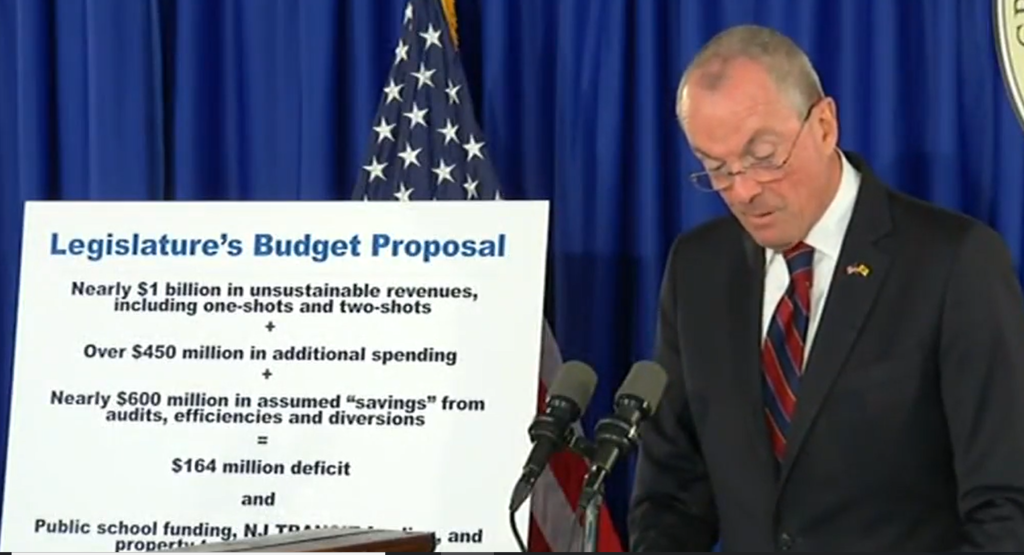

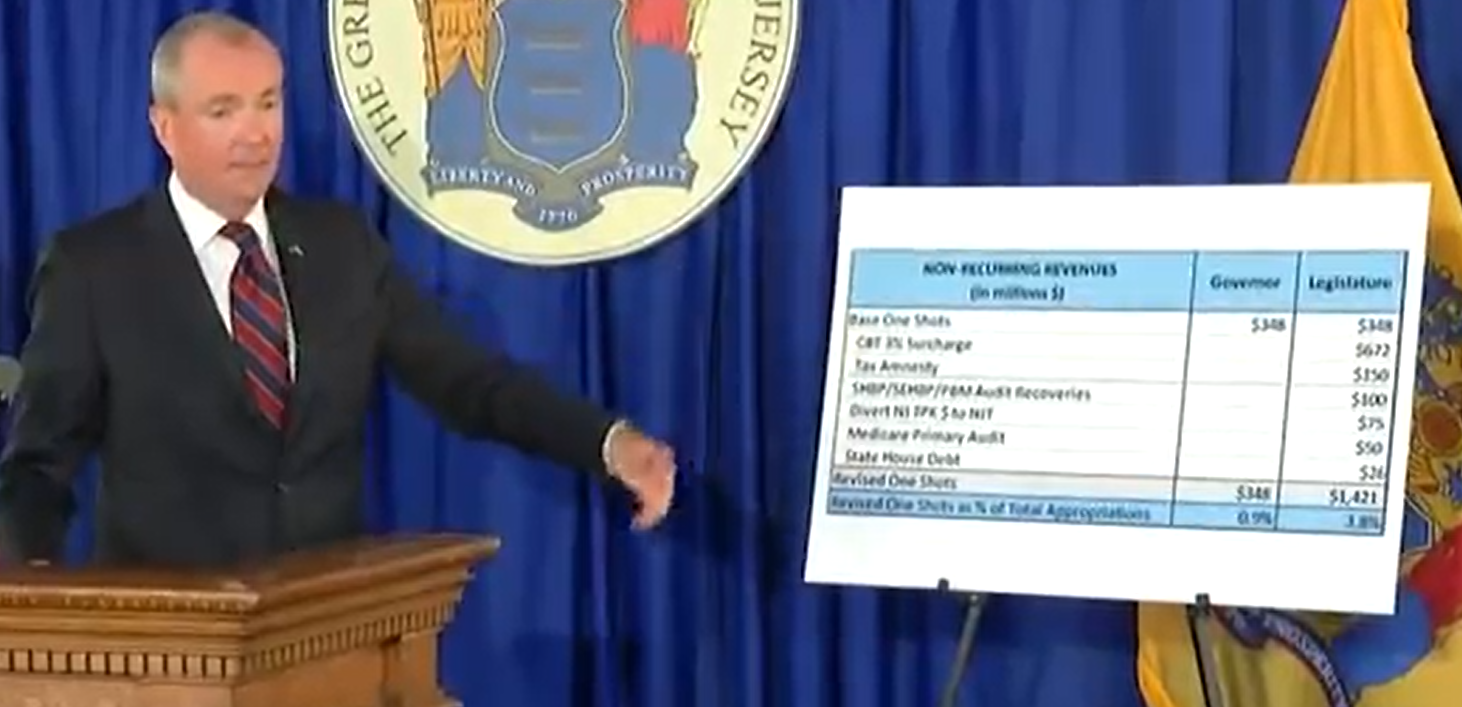

The Governor noted that the Legislature’s proposal would land the state with a $164 million budget deficit. He said the Legislature's proposal requires nearly $1 billion in unsustainable, temporary revenues, through a one-shot tax amnesty program and a “two-shot” increase in the Corporate Business Tax that would expire after the 2020 fiscal year. Murphy noted that corporate taxes have historically shown greater volatility and have been more difficult to accurately project.

He said he got elected with a clear mandate to "stop the games" and said that's what he intends to do with this budget.

In addition, the Legislature is pushing for $450 million in new spending, while also banking on unverifiable savings and efficiencies, Murphy said. Under the state constitution, only the Governor holds the authority to certify state revenues necessary to ensure a balanced budget.

“I’m not going to certify a budget based on gimmicks. We are ending the practice perfected under Chris Christie of making numbers fit a narrative,” said Murphy.

The Governor's proposed budget increases the income tax on residents with taxable incomes of over $1 million, closes corporate tax loopholes that benefit only multi-state companies, and restoring the state sales tax to 7 percent. He said the public backs a millionaire's tax. He also expressed his hope that the tax not drive millionaires out of the state, and said he will make the case that his budget priorities will create a more robust New Jersey economic environment. It includes a 15-year low reliance on nonrecurring revenues, and would close with a projected surplus of more than $740 million.