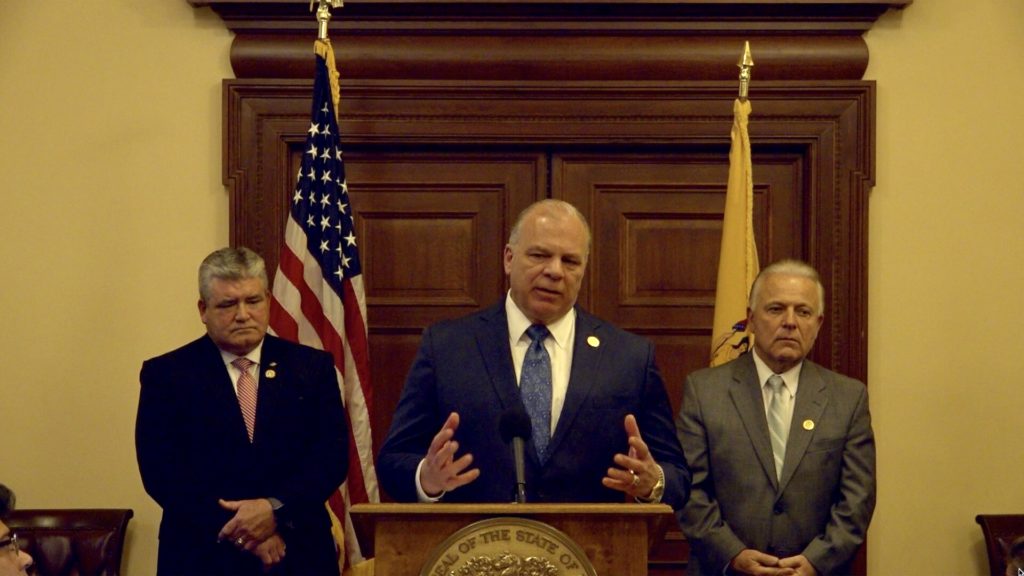

NJ Senate Introduces COVID-19 Response Bills

The New Jersey State Senate introduced a series bills today that will help the state cope with the effects of the current public health emergency brought on by the COVID-19 pandemic. The bills introduced today will be voted on in the Senate’s first-ever remote voting session on Monday, April 13th.

The session will begin at 10 a.m. and can be followed along on the Legislature’s website here.

The following bills were introduced:

- S.2329 (Ruiz/Vitale) would significantly revise requirements for cash assistance benefits under Work First New Jersey program and appropriate $25 million in anticipation of the expanded eligibility.

- S.2330 (Pou/Cryan/Oroho/Vitale) is the COVID -19 Financial Security for Consumers Act which would address financial insecurity issues stemming from the pandemic by requiring insurance carriers to cover COVID-19 treatment expenses without cost sharing and prohibit certain debt collection activities.

- S.2331 (Sweeney/Cunningham) would assist inmates released from incarceration in obtaining necessary reentry benefits.

- S.2332 (Stack/Sweeney/Corrado) would make a $50 million, FY2020, supplemental appropriation to the Department of Community Affairs for a Temporary Emergency Rental Assistance Program.

- S.2333 (Kean/Sweeney/Smith/O’Scanlon) would provide immunity from civil liability for certain medical malpractice claims alleging injury or death incurred during a public health emergency and the state of emergency declared by Governor's Executive Order 103 of 2020.

- S.2338 (Sarlo/Oroho/Bucco) is the “COVID-19 Fiscal Mitigation Act”, would change the tax filing and payment deadline from April 15th to July 15th and lengthen the current fiscal year from July 1st to the end of September.

- S.2339 (Cunningham/Ruiz/Cryan/Singleton) would increase support for laid off workers eligible for unemployment compensation.

- S.2340 (Singleton/Oroho/Greenstein) would authorize a Governor to permit mortgage forbearance and rent payment responsibility reduction for residential property owners and tenants during a state of emergency.

- S.2341 (Vitale/Thompson/Greenstein/Scutari) would authorize a Governor to restrict rent increases on retail businesses as well as permit mortgage forbearance and rent payment responsibility reduction for impacted residential property owners and tenants during a state of emergency.

- S.2342 (Bucco/Greenstein) would permits nonprofit corporations to hold meetings in part or solely by means of remote communication during a state of emergency.

- S.2344 (Pou/Singer/Vitale) would require Medicaid and health insurance coverage for certain refills of prescription drugs during a state of emergency.

- S.2345 (Cryan/Bateman) would require refunds or credit for transient space reservations such as Airbnb and VRBO when a public health emergency or state of emergency is in effect.

- S.2346 (Sarlo/Sweeney/Singleton/Bucco) would extends certain state, regional, county, and municipal agency permit approvals during the COVID-19 emergency.

- S.2347 (Sweeney/Greenstein/Kean) would establish the Employment and Business-Related Tax Deferral Assistance Program within the Economic Development Authority in order to allow small businesses to defer the payment and remittance of employment and business-related taxes.

- S.2348 (Sweeney/Kean/Bucco) would allow for CBT and GIT tax credits to be awarded to certain employers that retain employees during the COVID-19 pandemic.

- S.2349 (Beach) would changes the date of the 2020 primary election from June 2 to July 7, 2020.

- S.2351 (Scutari/Greenstein/Holzapfel) would afford employment protection to certain emergency medical responders.

- S.2352 (Gopal/Lagana/Holzapfel) would increase the penalty for distribution of counterfeit drugs and medical devices during a declared state of emergency.

- S.2353 (Cryan) would exclude from severance requirements for mass layoffs resulting from coronavirus disease 2019 pandemic under the “Millville Dallas Airmotive Plant Job Loss Notification Act”.

- S.2354 (Greenstein/Oroho) would prohibit the cancellation or nonrenewal of insurance during a public health emergency or state of emergency and for 60 days thereafter.

- S.2355 (Gopal/Bateman) would delay mandatory retirement when it would occur during a state of emergency.

- S.2356 (Cunningham) would provide relief to students receiving State financial aid to address special circumstances due to the 2020 public health state of emergency.

- S.2357 (Rice/Gill/Corrado) would require hospitals to report COVID-19 demographic data.

- SR.64 (Cryan/Pou/Bateman) would urge financial institutions to waive and suspend certain fees and payments during the pandemic.

- SR.65 (Sarlo/Greenstein/Testa) would urge the creation of a federal COVID-19 Business and Employee Continuity and Recovery Fund.