NJDOL: Maximum Unemployment Benefit Rates Increase on January 1st

From the NJDOL:

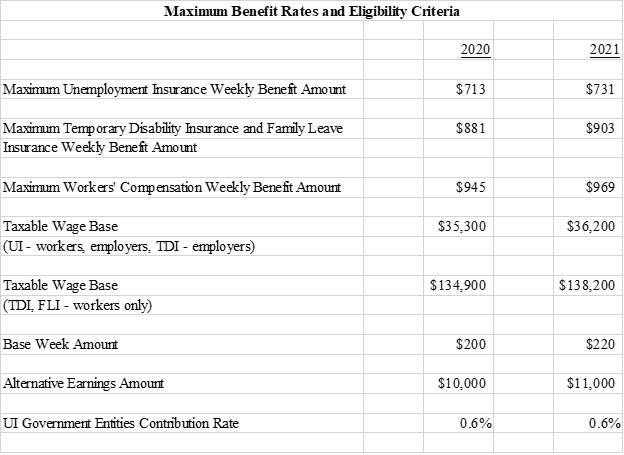

TRENTON – The New Jersey Department of Labor and Workforce Development (NJDOL) announced changes in the maximum benefit rates and taxable wage base that take effect on January 1 for its Unemployment Insurance, Temporary Disability Insurance, Family Leave Insurance, and Workers’ Compensation programs.

As of January 1, the maximum weekly benefit amount for Unemployment Insurance beneficiaries increases to $731, from $713. The maximum weekly benefit for state plan Temporary Disability and Family Leave Insurance claims increases to $903, from $881, while the maximum weekly benefit for Workers’ Compensation rises to $969, from $945.

The maximum benefit rates and the taxable wage base are recalculated each year based on the statewide average weekly wage, in accordance with the laws governing these programs. The benefit rates and taxable wage base for 2021 reflect the $1,291.42 average weekly wage for 2019, which rose by 2.5 percent from $1,259.82 in 2018.

The level of wages subject to wage taxes in 2021 increased to $36,200 for employers covered under the Temporary Disability Insurance program and for workers and employers covered under the Unemployment Insurance program, the Workforce Development Partnership Program, and Supplemental Workforce Fund for Basic Skills.

The taxable wage base for workers covered under the Temporary Disability and Family Leave Insurance programs increased to $138,200 for 2021.

To qualify for Unemployment, Temporary Disability, or Family Leave benefits in 2021, an applicant must have earned at least $220 per week for 20 base weeks, or alternatively, have earned at least $11,000. Benefit eligibility criteria are based on the state minimum wage in effect on October 1, 2020, when the minimum wage in New Jersey was $11/hour for most employees.

The contribution rate for state and local government entities that choose to make contributions rather than reimburse the trust fund for Unemployment Insurance benefits paid to their former employees, remains at 0.6 percent of taxable wages during calendar year 2021.

Below is a chart showing the 2020 rates and the changes taking place January 1, 2021.

###