No Soft Landing for the Working Poor

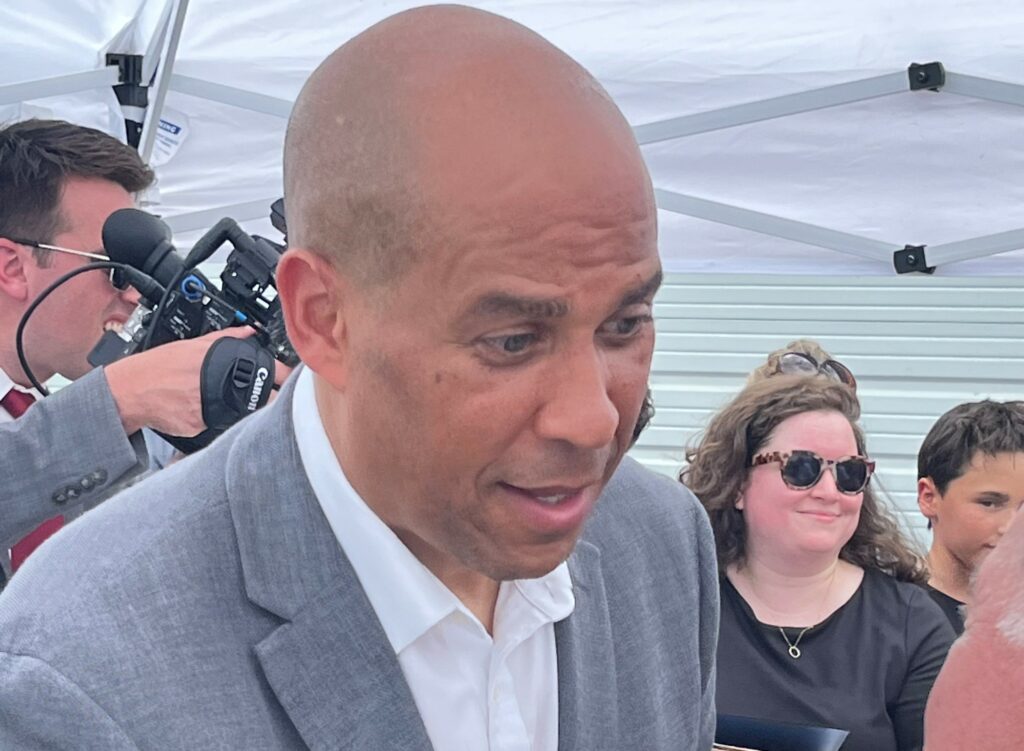

Less than 24 hours after the U.S. Census reported that child poverty has more than doubled, Sen. Cory Booker (D-NJ) and several of his like-minded colleagues will make their case to reporters that Congress restore the Expanded Child Tax Credit that fellow Democrat Sen. Joe Manchin (D-WV) insisted on letting expire and Republicans opposed.

“At one point, Mr. Manchin also privately voiced concerns to his colleagues that the payments could help fuel opioid use, comments that were first reported by The Wall Street Journal and confirmed by a person familiar with the discussion,” the New York Times reported back in December of 2021.

Booker’s quick-next day- response to the sobering disclosure that childhood poverty that had dropped to 5.2 percent, a record low in 2021, had more than doubled last year to 12.4 percent, was because he knew it was going to happen.

On Wednesday, Booker will be joined by Sen. Michael Bennet (D-CO), Sen. Sherrod Brown (D-OH), Rep. Rosa DeLauro (D-CT) and Suzan DelBene (D-WA) “to highlight the skyrocketing child poverty rate and urge Congress to restore the expanded, enhanced Child Tax Credit (CTC)” in light of “an almost 140 percent increase in a single year,” according to a press release.

“Child poverty in 2021 fell to 5.2 percent, the lowest rate on record according to Census Bureau measures,” reported the Senate Joint Economic Committee in November. “The child poverty rate was cut almost in half from the previous year’s rate of 9.7 percent. This drop was the largest single-year decline in child poverty on record and was driven primarily by the expanded Child Tax Credit (CTC) included in the American Rescue Plan.”

In a Sept. 12 statement from the White House, President Biden put the blame entirely on Republicans.

“The rise reported today in child poverty is no accident—it is the result of a deliberate policy choice congressional Republicans made to block help for families with children while advancing massive tax cuts for the wealthiest and largest corporations,” Biden wrote. “No child should grow up in poverty, and I will continue to fight to restore the expanded Child Tax Credit to give tens of millions of families the tax relief and breathing room they deserve.”

While Biden can take credit for more Americans being back at work, they are losing ground and just jawboning about the glory days of the labor movement isn’t going to fix it when you let the federal minimum wage stay at a pathetic $7.25 an hour, where it’s been since 2009.

“Real median household income fell by 2.3 percent from $76,330 in 2021 to $74,580 in 2022,” the U.S. Census reported. “Between 2021 and 2022, inflation rose 7.8 percent; this is the largest annual increase in the cost-of-living adjustment since 1981.”

The agency’s analysis continues. “The real median earnings of all workers (including part-time and full-time workers) decreased 2.2 percent between 2021 and 2022, while median earnings of those who worked full-time, year-round decreased 1.3 percent. Between 2021 and 2022, the number of full-time, year-round workers increased by 3.4 percent, compared to a 1.7 percent increase in the number of total workers. This suggests a continuing shift from working part-time or part-year to full-time, year-round work in 2022.”

The annual Federal Reserve analysis of what percentage of Americans could cover a $400 emergency expense “with cash or its equivalent” dropped from 68 percent in 2021 to 63 percent last year. For Black Americans, its slid from 48 percent in 2021 to 43 percent. For Latinos, it was an even steeper drop off, going from 54 percent in 2021 to 47 percent.

Stephanie Hoopes is the national director of United for ALICE, a national research organization founded by United Way of Northern New Jersey that’s has 24 additional states tracking struggling households.

“ALICE (Asset Limited, Income Constrained, Employed) may be a relative or friend,” according to the non-profit’s website. “You may be ALICE. As cashiers, waiters, childcare providers, and other members of our essential workforce, ALICE earns just above the Federal Poverty Level but less than what it costs to make ends meet. These struggling households are forced to make impossible choices each day. While such hardship is pervasive, households of color are disproportionately ALICE.”

“It’s always disappointing to see an increase in poverty, especially children in poverty,” Hoopes wrote in response to an InsiderNJ query. “What is even more concerning is that the federal poverty level (FPL) greatly underestimates the number of households struggling financially. From our ALICE – Asset Limited, Income Constrained, Employed - research, we know the number struggling is more than double those in poverty. In 2021, 41 percent of U.S. households (52.5 million) had income below the ALICE Threshold of Financial Survival, meaning they could not afford the basics in the communities where they live in 2021.”

Hoopes said there “were many warning signs that life was getting harder for those with the lowest incomes in the last year” for anyone following the data in Census’s Household Pulse survey.

“58 percent of U.S. households below the ALICE Threshold said it was somewhat or very difficult to pay for usual items such as food, rent or mortgage, car payments, and medical expenses, more than double the rate of those above the Threshold, 25 percent,” Hoopes added. One in five “respondents below the ALICE Threshold in the U.S. reported they sometimes or often did not have enough food in the prior seven days and “17 percent of renters below the Threshold reported they were not caught up on rent payments.”

60 percent of households below the ALICE Threshold “did not have emergency savings or rainy-day funds that would cover their expenses for three months in the event of sickness, job loss, economic downturn, or another emergency.”

Shailly Barnes is the Policy Director for the Kairos Center and the Poor People’s Campaign: A National Call for Moral Revival. She has a background in law, economics and human rights and has spent over 15 years working with and for poor and dispossessed communities.

“According to the latest US census report on poverty in 2022, poverty and low-income rates were back up last year: 41 percent of the population was poor or low-income in 2022. This is approximately 135 million people,” Barnes wrote InsiderNJ. “These numbers had gone down significantly in 2021, mainly due to economic stimulus programs, expanded unemployment insurance and the expanded child tax credit and SNAP programs. All of these programs and expansions had ended by 2022. The 2022 numbers are comparable to pre-pandemic numbers, showing the long-term, ongoing need for policies to address economic insecurity and poverty. These policies were effective in 2021 but were ended too soon. We need them again, immediately, and until we end poverty.”

Struggling families shouldn’t hold their breath.

Washington can’t even agree on who won the last Presidential election, never mind come to the aid of America’s low wage and low wealth households that are in a free fall. Thanks to the federal government’s pulling back multiple supports like the Expanded Child Tax Credit and Medicaid, it was no soft landing for the folks on the bottom of America’s steep wealth pyramid.