Pascrell Says Moore Case Threatens Foundation of American Tax Law

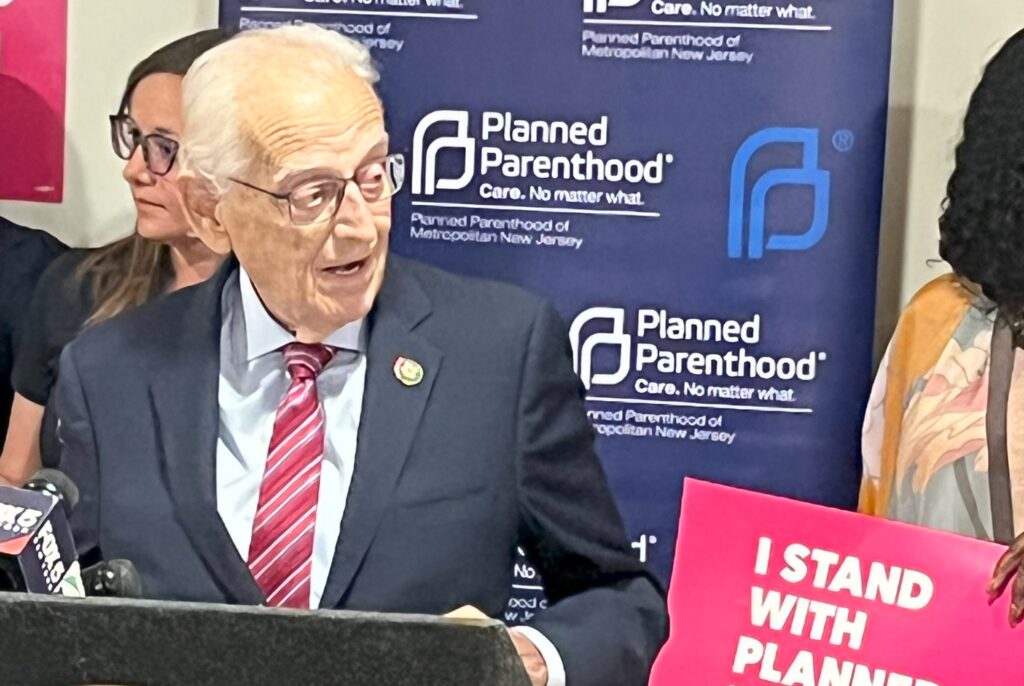

Congressman Bill Pascrell, Jr. (D-9), a member of the tax-writing House Ways and Means Committee and the Ranking Member of its Subcommittee on Oversight, today commented on oral arguments in the U.S. Supreme Court this morning in Moore v. United States.

“While seemingly obscure, this tax case is a Trojan Horse that threatens the very foundation of American tax law,” said Pascrell. “Built on shoddy facts and misrepresentations, this litigation was all but concocted in a Federalist Society laboratory to help the richest Americans avoid a fair tax bill. Furthermore, serious ethical questions remain with one justice participating in this case after his social interaction with parties that helped bring it. The long and short is this: a poorly rendered decision could undo our tax code, help the wealthiest avoid paying their fair share, and exacerbate our deficit. The Supreme Court should do the right thing and dismiss this case without action. To use this as another vehicle to enact sweeping rightwing policy approved by no Americans at the ballot box and pushed by no one except a tiny group of conservative activists is misguided and dangerous.”

I'm sorry Manchurian Candidate Pascrell. But the definition of "income" has already been resolved by the U.S. Supreme Court decades ago. The High Court said "income" DOES NOT include salary and wages, but is the profit you earn on investments. Go read the U.S. Supreme Court caselaw on this, e.g., Eisner v. Macomber, 252 U.S. 189; Lucas v. Earl, 281 U.S. 111; Connor v. United States, et al. It is now time to eliminate the current tax system so the U.S. Government and its politicians cannot use it to destroy and/or control peoples' lives. We need to completely eliminate the IRS and the Internal Revenue (IR) Code completely. It's time to set up a 20% flat tax (with no sunset provision, nor can it ever be modified) on all goods and services, except new cars, new houses and food.

The rich own the politicians.