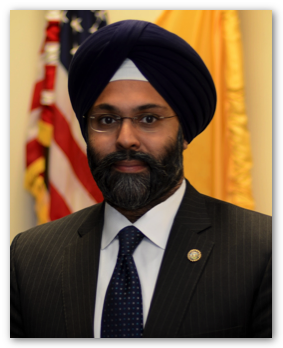

Attorney General Grewal Files Brief to Protect N.J. Workers, State’s Ability to Enforce Misclassification Laws

Attorney General Grewal Files Brief to Protect N.J. Workers,

State’s Ability to Enforce Misclassification Laws

TRENTON – Acting to protect New Jersey workers and preserve the State’s ability to enforce its labor laws, Attorney General Gurbir S. Grewal yesterday filed a brief urging a federal appeals court to rule that New Jersey’s test for classifying workers as employees or independent contractors is not preempted by federal law.

Attorney General Grewal’s amicus brief before the U.S. Court of Appeals for the Third Circuit was filed on behalf of the New Jersey Department of Labor and Workforce Development in a case involving delivery drivers who claim their employer, American Eagle Express (AEX), misclassified them as “independent contractors” and used that misclassification to avoid compliance with New Jersey wage and hour laws.

While Plaintiffs assert that they meet the criteria for “employees” under New Jersey’s established test, AEX has argued that the 1994 Federal Aviation Administration Authorization Act (FAAAA) – a law governing the federally-regulated motor carrier industry – preempts that test. Attorney General Grewal’s amicus brief rejects that argument and asks the court to deny AEX’s attempt to use the FAAAA as a “preemptive sword” that could inflict economic and social harms never intended by Congress.

“Workers are the backbone of New Jersey, and I am proud to defend not only them, but also our state’s labor laws and our economic interests in court,” said Attorney General Grewal. “Misclassification of our workers means those workers lose wages and benefits they rightfully deserve, is unfair to the employers that play by the rules, and ultimately harms the state itself. Our state labor laws were intended to protect workers from these harms, and nothing in federal law prevents us from going after the companies that violate them.”

NJ Labor Commissioner Robert Asaro-Angelo said, “misclassification hurts New Jersey’s economy. It hurts workers, since independent contractors lack unemployment and disability insurance, are less likely to have health care and are more likely to report to unsafe workplaces. It hurts taxpayers through untold millions in lost revenue from unscrupulous employers who fail to pay employee taxes. And, it hurts law-abiding business owners who are assessed higher employee taxes to make up for those who shirk their responsibility. The Labor Department is therefore committed to working with our partners in the Attorney General’s office to end this illegal practice.”

The brief filed today notes that the issues central to the AEX appeal are at the heart of two cases presently being litigated by the New Jersey Department of Labor in U.S. District Court in New Jersey (PDX North, Inc. v. Asaro-Angelo, and Eagle Intermodal Services, Inc. v. Asaro-Angelo.)

The brief asserts that if the Third Circuit finds New Jersey’s scheme preempted by the FAAAA, a significant portion of the State’s unemployment compensation and wage laws will be left “eviscerated.” The brief argues that in passing the 1994 FAAAA, Congress “never intended to create a preemptive bulldozer,” only to limit the ability of states to interfere with uniform federal regulation of the motor carrier industry where “pricing, routes and service” were concerned. In fact, the brief contends, Congress specifically restricted the preemptive reach of the FAAAA, and made plain that its intent was to preserve the authority of states to create and enforce their own laws governing employee classification, wages, and unemployment compensation.

“Ultimately, a finding by this Court that [New Jersey’s] test is preempted or otherwise invalidated would be contrary to Congress’ intent to protect the State’s unemployment compensation scheme,” Attorney General Grewal’s brief states. “It would also have the deleterious impact of preventing the Department [of Labor] from collecting tens of millions of dollars in yearly unemployment taxes” and would strip it of its ability to enforce its wage laws, “expos[ing laborers] to any number of harmful business practices, e.g., illegal deductions, failure to pay adequate wages, and failure to compensate for overtime.”

The filing follows on the heels of other actions by Attorney General Grewal to address the serious threats raised by the misclassification of workers. Last month, Attorney General Grewal joined a brief in the U.S. Supreme Court supporting the right of transportation workers to have their day in court for labor disputes, instead of submitting to mandatory arbitration, even when they have been classified as independent contractors.

And in May of this year, Attorney General Grewal joined the Attorneys General for 11 other states in asking the National Labor Relations Board to uphold a finding that companies engage in unfair labor practices under federal law when they purposefully misclassify employees as independent contractors. As that multi-state brief explained, employers who misclassify workers “do not pay into unemployment systems, maintain adequate worker’s compensation coverage, shoulder their share of employment taxes, observe workplace safety standards, or pay according to the minimum standards set by law.”

The Murphy Administration has also taken steps to address the problem of misclassification. The Governor’s Task Force on Employee Misclassification met for the first time last week, bringing together representatives from the Departments of Agriculture, Economic Development, Human Services, Labor, Transportation, Treasury, and the Attorney General’s office to collaborate on addressing misclassification. The inaugural meeting followed Governor Murphy’s executive order establishing a cross-departmental task force, fostering a new level of cooperation among state agencies on this pervasive issue.

A 2009 U.S. Treasury Department study placed the total federal cost of employee misclassification at $54 billion in unreported taxes – including $15 billion in unpaid Federal Insurance Contributions Act (FICA) and unemployment insurance taxes. Some audits suggest employer avoidance of payroll and other taxes through worker misclassification costs New Jersey more than $500 million in tax revenue annually.