ATTORNEY GENERAL’S OFFICE CHARGES FOUR MORE INDIVIDUALS WITH FILING FALSE APPLICATIONS FOR SUPERSTORM SANDY RELIEF FUNDS

ATTORNEY GENERAL’S OFFICE CHARGES FOUR MORE INDIVIDUALS WITH

FILING FALSE APPLICATIONS FOR SUPERSTORM SANDY RELIEF FUNDS

AG’s Office has charged 120 defendants in historic anti-fraud program with state & federal partners

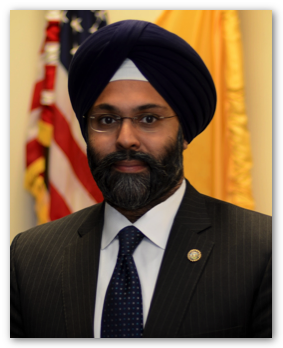

TRENTON – Attorney General Gurbir S. Grewal today announced that the Attorney General’s Office and its state and federal partners have charged four new defendants with filing fraudulent applications for federal relief funds related to Superstorm Sandy, bringing the total number of defendants charged by the office in these cases to 120 since March 2014.

“Any fraud against public assistance programs is deplorable, but these thefts were especially egregious because they diverted funds intended for victims left homeless by one of the most devastating storms in New Jersey history,” said Attorney General Grewal. “We have recovered over $2.2 million through these prosecutions and we also have sent a strong message that should deter this type of fraud during future disaster relief efforts.”

The 120 people charged by the Attorney General’s Office were allegedly responsible for diverting more than $8 million in relief funds. The office is continuing its aggressive efforts to investigate fraud in Sandy relief programs, working jointly with the New Jersey Department of Community Affairs (DCA), and the Offices of Inspector General of the U.S. Department of Homeland Security, the U.S. Department of Housing and Urban Development (HUD), the U.S. Small Business Administration (SBA), and the U.S. Department of Health and Human Services (HHS). Also assisting the taskforce is the New Jersey Division of Consumer Affairs, the New Jersey Motor Vehicle Commission, New Jersey Office of the State Comptroller, New Jersey Department of the Treasury Office of Criminal Investigation, U.S. Postal Inspection Service, and the non-profit National Insurance Crime Bureau (NICB).

The defendants are alleged, in most cases, to have filed fraudulent applications for relief funds offered by the Federal Emergency Management Agency (FEMA). In many cases, they also applied for funds from a Sandy relief program funded by HUD, low-interest disaster loans from the SBA, or funds from HHS. The HUD funds are administered in New Jersey by the New Jersey Department of Community Affairs and the HHS funds are administered by the New Jersey Department of Human Services.

The following four defendants were charged yesterday by complaint-summons:

· Rhea Jolly, 61, of Toms River, N.J., allegedly filed fraudulent applications following Superstorm Sandy for FEMA assistance and state grants under the Homeowner Resettlement Program (RSP) and the Reconstruction, Rehabilitation, Elevation and Mitigation (RREM) Program. As a result, she allegedly received a total of approximately $156,636 in relief funds to which she was not entitled. It is alleged that Jolly falsely claimed in her applications that a home she owns on Beachwood Avenue in Toms River, N.J., which was damaged by Superstorm Sandy, was her primary residence at the time Sandy struck. It is alleged that, in fact, her primary residence at the time of the storm was in Ocean Gate, N.J. As a result of the alleged fraudulent applications, Jolly received approximately $23,285 from FEMA, approximately $123,351 in RREM grant funds, and a $10,000 RSP grant. Jolly is charged with second-degree theft by deception.

· Ralph Lubosco, 66, and Eileen Lubosco, 67, of Cream Ridge, N.J., allegedly filed fraudulent applications following Superstorm Sandy for FEMA assistance and state grants under the Homeowner Resettlement Program (RSP) and the Reconstruction, Rehabilitation, Elevation and Mitigation (RREM) Program. As a result, the married couple allegedly received a total of approximately $134,981 in relief funds to which they were not entitled. It is alleged that the couple falsely claimed in their applications that a home they own on Willard Drive in Manahawkin, N.J., which was damaged by Superstorm Sandy, was their primary residence at the time Sandy struck. It is alleged that, in fact, their primary residence at the time of the storm was in Cream Ridge, and the house in Manahawkin was a long-term rental property. As a result of the alleged fraudulent applications, the Luboscos received $2,270 from FEMA, approximately $122,711 in RREM grant funds, and a $10,000 RSP grant. Each of them is charged with second-degree theft by deception.

· Peter Raia Jr., 51, of Lodi, N.J., allegedly filed fraudulent applications following Superstorm Sandy for FEMA assistance, a low-interest SBA disaster-relief loan, and state grants under the Homeowner Resettlement Program (RSP) and the Sandy Homeowner and Renter Assistance Program (SHRAP). As a result, he allegedly received approximately $37,822 in relief funds to which he was not entitled. Raia allegedly falsely claimed in his applications that a home he owns on Lincoln Avenue in Seaside Heights, N.J., which was damaged by Superstorm Sandy, was his primary residence when Sandy struck. It is alleged that, in fact, at the time of the storm, his primary residence was in Lodi, and the home in Seaside Heights was a weekend property. As a result of the alleged false applications, Raia received $5,640 from FEMA, a $10,000 RSP grant, $14,000 in SBA loan proceeds, and $8,182 in SHRAP funds. Raia is charged with third-degree theft by deception and fourth-degree unsworn falsification.

“Through this historic anti-fraud program, we have held over 100 defendants accountable for allegedly lying about vacation homes and other secondary properties in order to steal relief funds intended for victims whose primary homes were damaged,” said Director Veronica Allende of the Division of Criminal Justice. “We also have charged a number of renters who falsely claimed they were displaced by the storm or lost personal property. This collaborative state and federal initiative will undoubtedly serve as a model for other jurisdictions that face these issues in future disaster relief efforts.”

The new cases were investigated by detectives of the New Jersey Division of Criminal Justice and special agents and inspectors of the U.S. Department of Homeland Security Office of Inspector General, HUD Office of Inspector General, SBA Office of Inspector General, U.S. Department of Health and Human Services Office of Inspector General, and U.S. Postal Inspection Service. The National Insurance Crime Bureau assisted. Deputy Attorneys General Supriya Prasad, Alyssa E. Bloom and Thomas T. Huynh are prosecuting the new defendants under the supervision of Deputy Attorney General Mark Kurzawa, Deputy Chief of the Financial & Computer Crimes Bureau. Lt. David Nolan and Sgt. Fred Weidman conducted and coordinated the investigations for the Division of Criminal Justice, with others, including Special Civil Investigators Ken Crane, Ron Rauer and Scott Naismyth.

Second-degree charges carry a sentence of five to 10 years in state prison and a fine of up to $150,000, while third-degree charges carry a sentence of three to five years in prison and a fine of up to $15,000. Fourth-degree charges carry a sentence of up to 18 months in prison and a fine of up to $10,000. The charges are merely accusations and the defendants are presumed innocent until proven guilty.

On Oct. 29, 2012, Superstorm Sandy hit New Jersey, resulting in an unprecedented level of damage. Almost immediately, the affected areas were declared federal disaster areas, making residents eligible for FEMA relief. FEMA grants are provided to repair damaged homes and replace personal property. In addition, rental assistance grants are available for impacted homeowners. FEMA allocates up to $31,900 per applicant for federal disasters. To qualify for FEMA relief, applicants must affirm that the damaged property was their primary residence at the time of the storm.

In addition to the FEMA relief funds, HUD allocated $16 billion in Community Development Block Grant (CDBG) funds for storm victims on the East Coast. New Jersey received $2.3 billion in CDBG funds for housing-related programs, including $215 million that was allocated for the Homeowner Resettlement Program (RSP) and $1.1 billion that was allocated for the Reconstruction, Rehabilitation, Elevation and Mitigation (RREM) Program. Under RSP, the New Jersey Department of Community Affairs is disbursing grants of $10,000 to encourage homeowners affected by Sandy to remain in the nine counties most seriously impacted by the storm: Atlantic, Bergen, Cape May, Essex, Hudson, Middlesex, Monmouth, Ocean and Union counties. The RREM Program, which is the state’s largest housing recovery program, provides grants to Sandy-impacted homeowners to cover rebuilding costs up to $150,000 that are not funded by insurance, FEMA, SBA loans, or other sources.

The Small Business Administration provides low-interest disaster loans to homeowners, renters, businesses of all sizes, and most private nonprofit organizations. SBA disaster loans can be used to repair or replace real estate, personal property, machinery and equipment, and inventory and business assets damaged or destroyed in a declared disaster. Renters and homeowners may borrow up to $40,000 to repair or replace clothing, furniture, cars or appliances damaged or destroyed in the disaster. Homeowners may apply for a loan of up to $200,000 to replace or repair their primary residence to its pre-disaster condition. Secondary homes or vacation properties are not eligible for these loans, but qualified rental properties may be eligible for assistance under the business loan program.

The Disaster Relief Act provided HHS approximately $760 million in funding for Sandy victims. The Administration for Children and Families (ACF) received approximately $577 million in Sandy funding through three grant programs, including the Social Services Block Grant (SSBG) program, which received nearly $475 million to help five states (New York, New Jersey, Connecticut, Rhode Island, and Maryland). New Jersey received over $226 million for a wide range of social services directly related to the disaster. New Jersey used SSBG funds to develop the Sandy Homeowner/Renter Assistance Program (SHRAP) to assist individuals/families with expenses for housing and other related needs.

Defense Attorneys:

For Jolly: Edward J. Dimon, Esq., Carluccio, Leone, Dimon, Doyle & Sacks, LLC, Toms River, N.J.

For Ralph and Eileen Lubosco: Undetermined.

For Raia: James Harrison Banks, Esq., Fair Lawn, N.J.