Booker Applauds CFPB's Proposed Rule to Limit Overdraft Fees and Protect Consumers

Booker Applauds CFPB's Proposed Rule to Limit Overdraft Fees and Protect Consumers

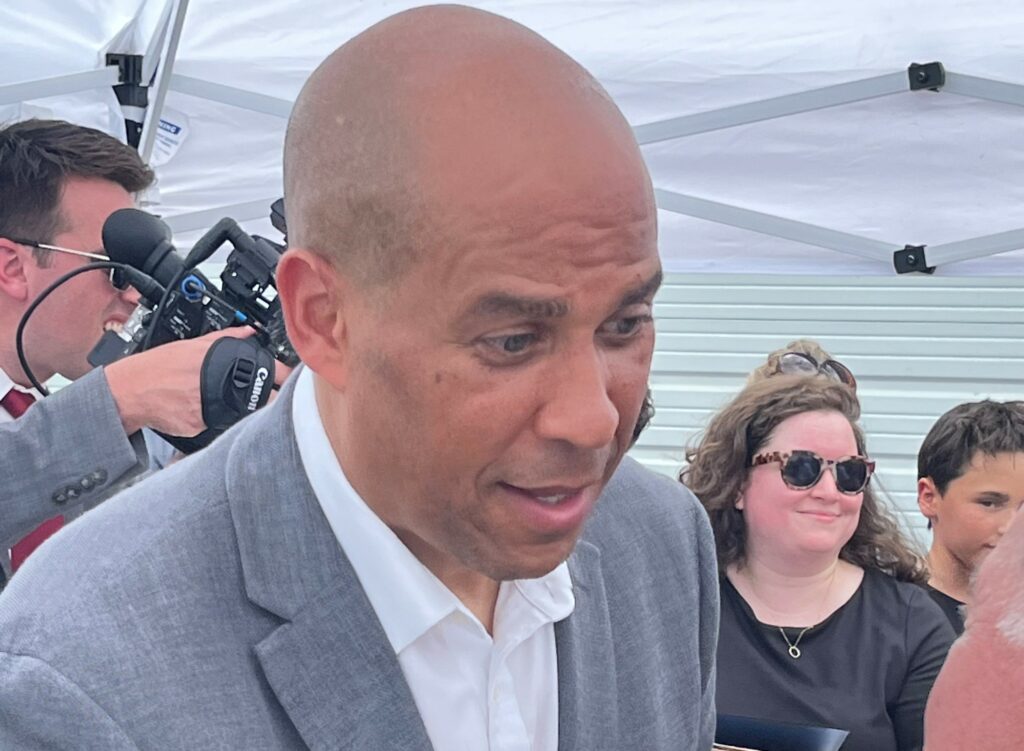

WASHINGTON, D.C. - Today, U.S. Senator Cory Booker (D-NJ) praised the Consumer Financial Protection Bureau’s (CFPB) proposed rulemaking to crack down on exploitative overdraft fees. The newly announced regulations will take aim at financial institutions charging exorbitant overdraft fees which boosts banks’ income while disproportionately burdening those already living on the financial brink.

“I applaud the Biden Administration for taking this significant step forward in addressing exploitative overdraft practices,” said Senator Booker. “These excessive and exploitative fees have allowed banks to reap enormous profits off the backs of struggling individuals and must be permanently banned. The CFPB’s proposed rule is a commonsense approach to closing loopholes in our consumer protection laws. Congress must build on this proposal by passing the Stop Overdraft Profiteering Act, which will ban overdraft fees on debit card transactions and ATM withdrawals and pave the way for a fairer banking system.”

The Stop Overdraft Profiteering Act would ban overdraft fees on debit card transactions and ATM withdrawals, and limit fees placed for checks and recurring payments. It would also mandate that banks post transactions in a manner that minimizes overdraft and nonsufficient fund fees (often times, banks reorder transactions in such a way as to maximize overdraft fees, which can mean, in some cases, that the consumer faces multiple charges).

Booker has targeted overdraft fees charged to consumers by banks for years. This year, Booker sent letters to 10 large banks and federal regulators urging them to pause overdraft fees in the aftermath of U.S. bank failures. Booker introduced the Stop Overdraft Profiteering Act in 2018 and again in 2021, which would ban overdraft fees on debit card transactions and ATM withdrawals and limit fees placed for checks and recurring payments. In 2020, Booker filed legislation that would have placed a moratorium on overdraft fees for the duration of the Coronavirus public health emergency. Also in 2020, Booker sent a letter to more than a dozen bank CEOs urging them to temporarily ban charging customers burdensome bank overdraft fees during the coronavirus emergency. And in 2017, Booker sought to make public more information about banks’ overdraft fee practices.