Booker, Brown Urge Banks to Temporarily Ban Exploitative Overdraft Fees

Booker, Brown Urge Banks to Temporarily Ban Exploitative Overdraft Fees

Letter to 14 bank CEOs follows legislation that would temporarily ban overdraft fees during coronavirus emergency

Average consumer with overdraft coverage pays $260 in fees each year

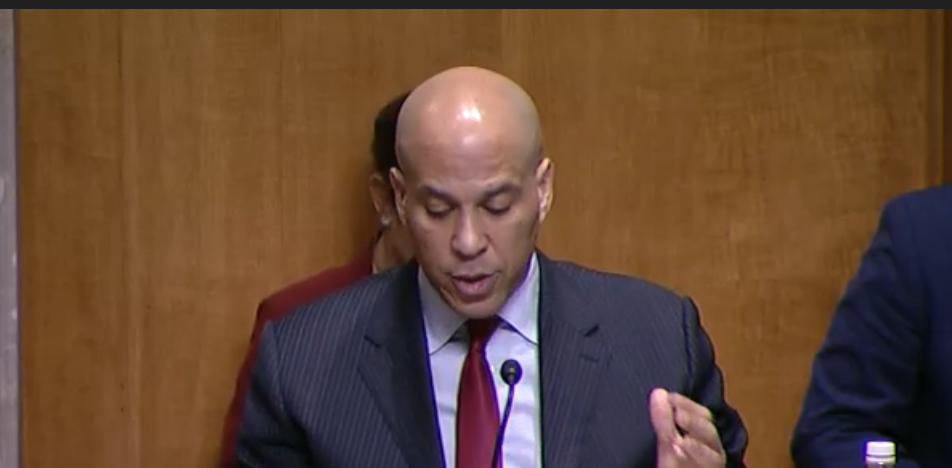

WASHINGTON, D.C. – U.S. Senators Cory Booker (D-NJ) and Sherrod Brown (D-OH) today urged more than a dozen bank CEOs to temporarily ban charging customers exploitative bank overdraft fees during the coronavirus emergency. Banks charge such fees to consumers when they make a purchase or pay a bill but don’t have sufficient funds in their account; typically the charge is $35. Such fees fall disproportionately on those who are least able to afford them.

“We are writing to urge [you] to take steps to relieve consumers from burdensome practices as they face financial constraints related to the COVID-19 pandemic,” the lawmakers wrote in a letter today to 14 bank CEOs. “In particular, we urge you to cease charging overdraft and non-sufficient funds fees during this time. Reasonably priced overdraft lines of credit are a far better and more fair alternative, especially during a time of financial crisis.”

“Overdraft and nonsufficient fund fees are overwhelmingly borne by those already living on the financial brink,” the lawmakers added, citing data showing that nearly 80 percent of overdraft-related fees are borne by only nine percent of account, who tend to carry low balances – averaging less than $350 – and have relatively low monthly deposits.

“Government stimulus funds, passed as part of the CARES Act, are intended to help consumers through this crisis—not to go to banks in the form of overdraft fees,” the lawmakers added.

The letter was sent to the CEOs of U.S. banks leading in overdraft and non-sufficient-fund revenue, as well as banks with over $2 billion in assets that take in the most overdraft and non-sufficient-funds revenue per account.

Today’s letter follows legislation Booker and Brown introduced last month to temporarily ban banks from charging overdraft fees during the coronavirus public health emergency. The pair also have comprehensive legislation to permanently restrict such fees.

Full text of the letter is here. The letter was sent to the following banks:

Ameris

Bank of America

Bank Plus

Truist Bank

Chase Bank

Ocean Bank

PNC Bank

Regions Bank

TD Bank

U.S. Bancorp

Wells Fargo

Woodforest National Bank

Citigroup

HSBC North America Holdings

Senator Booker’s record on overdraft fees:

Booker has been a leader in the Senate on cracking down on exploitative bank overdraft fees. He first introduced comprehensive overdraft legislation in 2018 with Senator Brown. In 2017, he sent a letter to the CEOs of 13 banks – the top ten U.S. banks in overdraft revenue, as well as the U.S. banks with over $2 billion in assets that take in the most overdraft revenue per account – requesting more information on their practices as they relate to overdraft fees.

Based on the responses to that request, as well as relevant data from banks’ publicly available disclosures and quarterly financial filings, Booker’s office released a comprehensive report outlining how banks use overdraft fees in ways that often don’t serve the best interests of consumers.

In 2018, Booker sent a letter, signed by 14 other Senators, to the Consumer Financial Protection Bureau questioning its plan to no longer pursue regulatory action on overdraft fees, after it failed to mention action in its most recent regulatory agenda filing, even though it had been on the Bureau’s agenda for four years.