Bucco, DePhillips & DiMaso Introduce Bill to Help Struggling Bars & Restaurants

Bucco, DePhillips & DiMaso Introduce Bill to Help Struggling Bars & Restaurants

Proposal Creates Four-Month Sales Tax Holiday for Food & Beverage Establishments

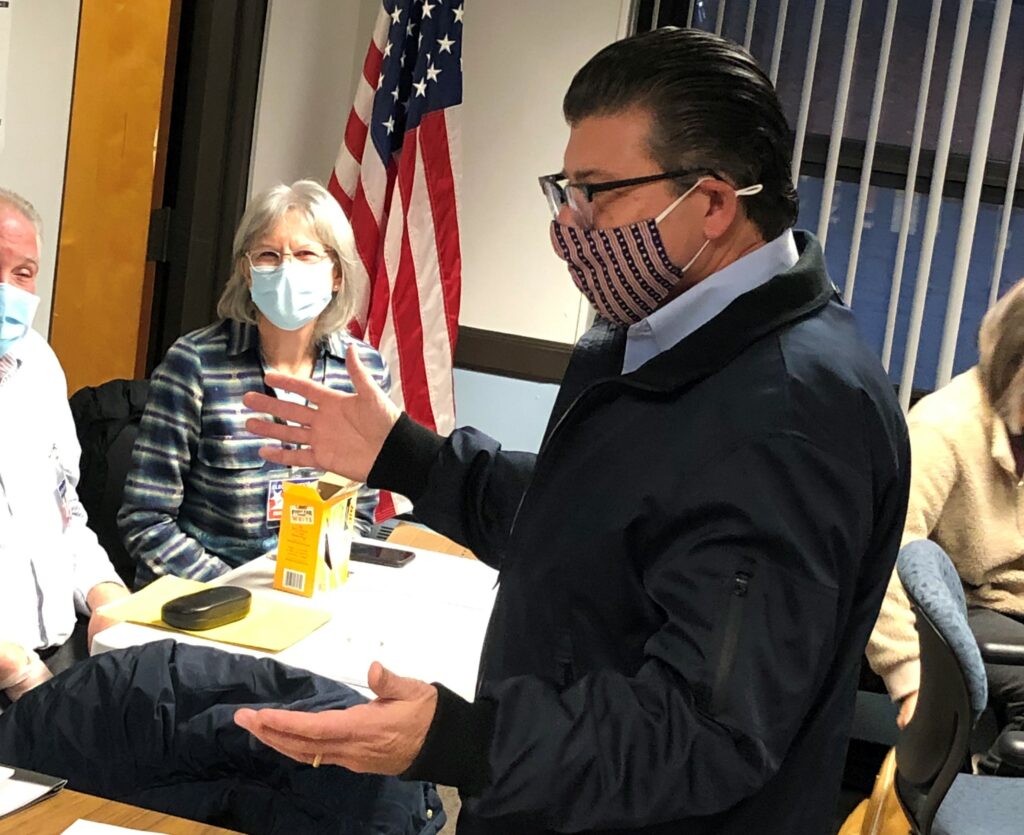

Senator Anthony M. Bucco, Assemblyman Christopher DePhillips, and Assemblywoman Serena DiMaso have introduced legislation to provide tax relief to bars and restaurants struggling to recover from the severe financial impacts of the pandemic.

“Our local bars and restaurants and the hundreds of thousands of workers they employ across New Jersey have suffered enormously due to the restrictions imposed by Governor Murphy during the pandemic,” said Bucco (R-25). “Nearly 40% of our restaurants have closed temporarily or permanently, while many that remain face financial challenges that may be difficult to overcome without assistance. Our proposal to create a sales tax holiday would help this important industry to survive long enough for our state’s reopening to support their full recovery.”

The legislators introduced a bill in both the Senate and General Assembly to create a sales tax holiday for food and beverage establishments.

The bill allows qualifying establishments to keep the sales taxes they collect on up to $70,000 in taxable sales per eligible business location during each month of a four-month relief period.

“New Jersey built a massive budget surplus during the pandemic and we have nearly $6.5 billion in federal aid to help with pandemic relief over the next year,” said DePhillips (R-40). “We have the resources to help the restaurants and workers who have been hurt gravely by the governor’s overbearing executive orders over the past year. A sales tax holiday would provide them critical relief and support the recovery of Main Streets across New Jersey.”

Under the legislation, the following food and beverage establishments would qualify for the deduction: (1) alcoholic beverage establishments, including breweries, wineries, distilleries, and brew pubs; (2) restaurant and food establishments, not including fast-food restaurants, and (3) mobile food service establishments, including food trucks and food stands.

“The restaurant industry is among the biggest employers in New Jersey, and they took the biggest hit during the pandemic,” added DiMaso (R-13). “A sales tax holiday for restaurants could be the fuel that helps New Jersey’s recovery to really take off. Other states are considering similar proposals as an effective way to quickly put state and federal resources to work to recover from the pandemic.”

The proposal is modeled after similar legislation in New Mexico and Colorado. It was recommended for consideration in New Jersey in a recent editorial by Garden State Initiative.