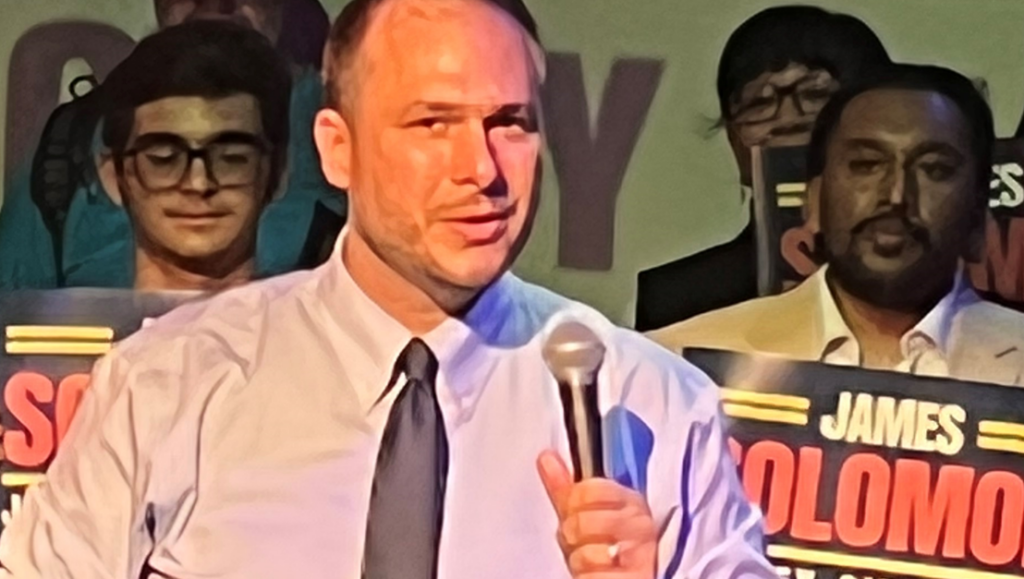

COUNCILMEMBER JAMES SOLOMON’S CRACKDOWN ON DELINQUENT CORPORATIONS SKYROCKETS COLLECTIONS, EARNS OVER $103 MILLION FOR PUBLIC SCHOOLS

COUNCILMEMBER JAMES SOLOMON’S CRACKDOWN ON DELINQUENT CORPORATIONS SKYROCKETS COLLECTIONS, EARNS OVER $103 MILLION FOR PUBLIC SCHOOLS

The total amount raised represents an over 50% increase in payroll tax collections, mainly from corporations that either failed to register for the payroll tax or stopped paying altogether.

JERSEY CITY, NJ — Today, Jersey City Councilmember James Solomon announced that over $103 million was raised through the city’s payroll tax — almost double the $67.7 million collected last year by the tax. No taxes were raised on any business or homeowner; instead, the money was collected by cracking down on large corporate tax evaders. A Jersey City internal audit uncovered multiple large corporations that had either never registered for the payroll tax, as is required by law, or had simply stopped paying.

“Large corporations across the city have an obligation to pay into the city’s payroll tax, which helps fund our city’s public schools,” said Councilmember Solomon. “I am thrilled that our office’s efforts to raise awareness around the tax has netted over $103 million for our public schools, and I am incredibly grateful to City Hall staff and the administration for their help.

“For too long, homeowners and tenants have been forced to shoulder the burden for the city’s budget while some corporations have simply stopped paying what they owe. Our office recognized immediately that this is unfair to Jersey City residents, and we spent the last year working to ensure businesses knew about this tax and were up to date on their payments. This is only the first step; we are also working with the Jersey City Public Schools and our state legislative delegation to give the city the tools we need to truly enforce this tax and go after any deadbeat corporations that still haven’t paid.”

As a result of the Councilmember’s audit and awareness campaign, which included pushing the city to do a mass mailing outreach campaign to unregistered businesses as well as directly sending letters to specific large non-registrants, over 100 new businesses registered for the payroll tax while registered businesses who had stopped paying the tax provided back pay to the city.