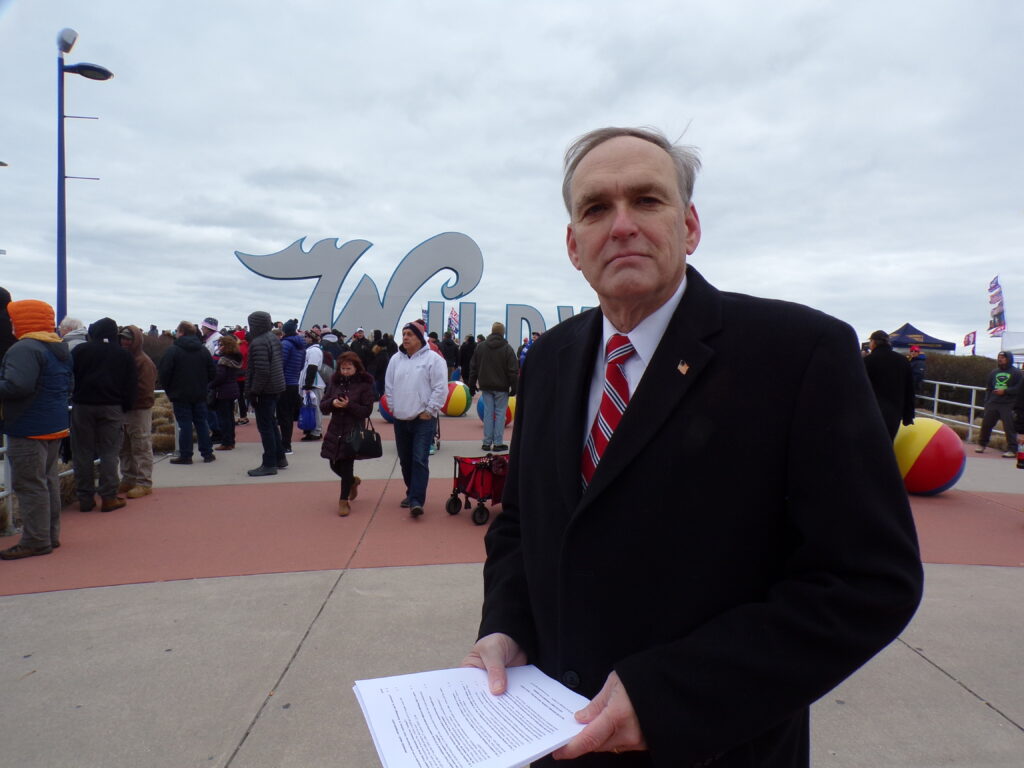

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS FRAMEWORK TO DEAL WITH ADVERSE EFFECTS TO INDIVIDUALS AND SMALL BUSINESSES RESULTING FROM GOVERNMENT RESPONSE TO THE CORONAVIRUS PANDEMIC

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS FRAMEWORK TO DEAL WITH ADVERSE EFFECTS TO INDIVIDUALS AND SMALL BUSINESSES RESULTING FROM GOVERNMENT RESPONSE TO THE CORONAVIRUS PANDEMIC

In response to the coronavirus pandemic, governments at the local, state, and federal levels have imposed or suggested measures designed to limit the spread of the virus among the US population. Virtually all Americans will be affected by these measures, however, the degree to which they will be affected will vary greatly. Some Americans will experience only minor inconvenience, while others will face a substantial loss of job-related income due to a reduction in working hours. Others may become unemployed. Similarly, the effect on small businesses will vary, largely dependent on revenue shortfalls incurred by these companies.

This proposal (while not totally inclusive) attempts to address these adverse effects in several ways: First, it attempts to put cash in the hands of individuals and businesses most impacted by the loss of employment/business income. Second, it attempts to limit the adverse consequences to individuals and businesses resulting from the late payment of expenses.

Actions to be taken by the Federal Government

- Extend the due date for filing and paying Federal Income Taxes for all taxpayers from April 15, 2020, to May 15, 2020. For low-and-moderate income taxpayers who are/become unemployed or who incur loss of substantial job-related income, defer payment of federal income tax liability (without interest penalty) until June 15, 2020. Encourage state governments to take similar actions.

- Suspend collection of federal taxes on motor vehicle fuels during the period of the National Emergency. Encourage state governments to take similar actions.

- Pass a National Emergency Federal Child Care Tax Credit (not deduction) which would allow individuals to recoup costs incurred for child care precipitated by the crisis.

- Make available short-term, Small Business Administration loans to help small businesses meet financial obligations caused by revenue shortfalls.

Actions to be recommended by the Federal Government

- 5. Recommend to hospitals and all health care providers that they allow payment deferral of deductibles and copays for a period of 90 days from the date of service, for individuals who have suffered job loss or substantial loss of job-related income.

- Recommend to lending institutions servicing home mortgage, automobile, and student loans, that they enter into penalty-free, short-term, late payment renegotiation agreements with borrowers who have suffered job loss or substantial loss of job-related income.

- Recommend to public utility providers (home heating, electric, telephone, etc.,) that they waive late payment fees for customers who have suffered job loss or loss of substantial job-related income. Also recommend that utility providers abstain from disconnecting service to impacted customers during the pendency of the National Emergency.

- Recommend to lending institutions servicing business loans, that they enter into penalty-free, short-term, late payment renegotiation agreements with businesses who have suffered revenue shortfalls as a result of the National Emergency.