Gottheimer-backed Health Care Tax Cuts Signed into Law

Gottheimer-backed Health Care Tax Cuts Signed into Law

President signs 2020 investment priorities for NJ-5

Repeal of Cadillac Tax, Health Insurance Tax, Medical Device Tax helps North Jersey families

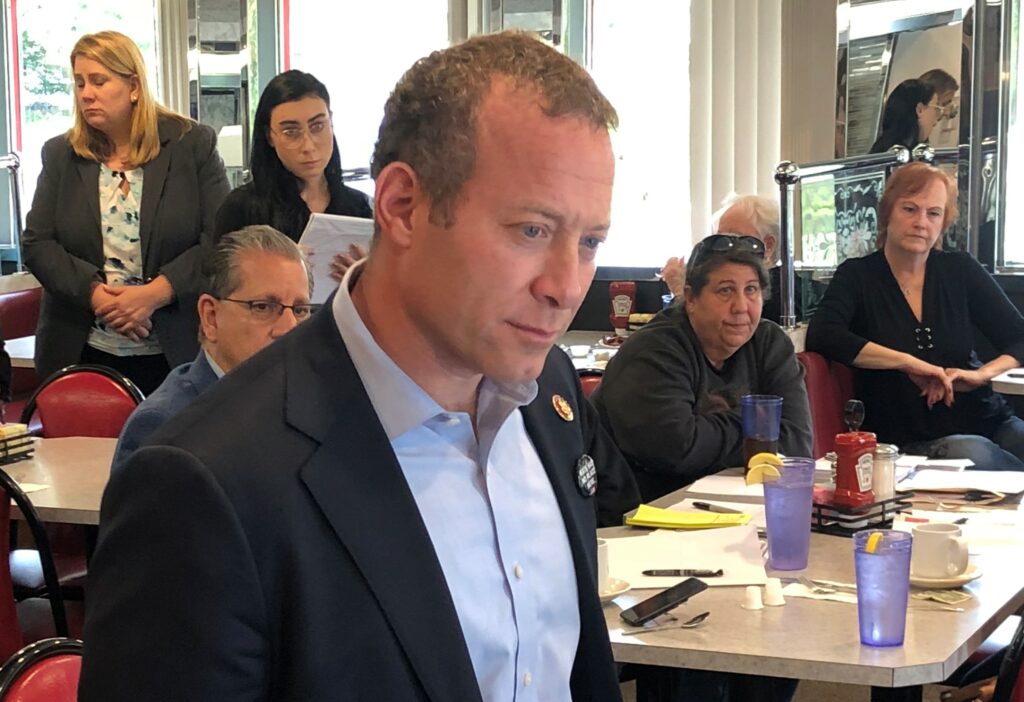

WASHINGTON – Today, Monday, December 23, 2019, U.S. Congressman Josh Gottheimer announced that bipartisan measures he co-sponsored and backed to keep health care costs down for North Jersey families have been signed into law. After passing both the House and Senate and with the President’s signature, with Gottheimer’s strong backing, the “Cadillac” Tax, the Medical Device Tax, and the Health Insurance Tax have now been repealed. Gottheimer has been sponsoring legislation and fighting for the repeal of both, and for lower healthcare costs for constituents, since his first day in office.

“New Jersey’s Fifth District is counting on tax cuts to keep jobs in North Jersey and bring much-needed health care savings to local families and businesses. I’ve been fighting to repeal these harmful taxes on our health care, so that we can continue boosting the quality of care in North Jersey, increase innovation, keep costs down, and continue to grow our local economy,” said Congressman Josh Gottheimer (NJ-5). “Democrats and Republicans have come together to repeal these taxes that would have hurt our medical community and our patients. Finally having the repeal of the Cadillac tax, Health Insurance Tax, and Medical Device Tax signed into law is a huge win for families all across the Fifth District.”

The bipartisan federal investment bill that has now been signed into law:

- Repeals the Medical Device Tax, a 2.3 percent excise tax on the price of taxable medical devices sold in the U.S., including X-ray machines, hospital beds, and MRI machines;

- Repeals the excessive health care “Cadillac Tax” surcharge, a 40 percent tax levied on employer health insurance plans above certain thresholds set to go into effect in 2022, which would cause health care costs to increase for one in five Americans;

- Repeals the Health Insurance Tax, which is a tax on health insurance plans that would whack New Jersey families and small businesses with increased premiums.

###