Gottheimer-backed SALT Bill Gives Massive Cuts on Taxes for Fifth District Families — Gottheimer Releases Model of Tax Cut Benefits at All Income Levels

Gottheimer-backed SALT Bill Gives Massive Cuts on Taxes for Fifth District Families — Gottheimer Releases Model of Tax Cut Benefits at All Income Levels

Bipartisan bill fights back against Moocher States, repeals SALT deduction cap, saving Fifth District families $5.6 billion total each year

New Jersey Chamber of Commerce, New Jersey Realtors backs tax cut legislation, will help businesses, real estate prices

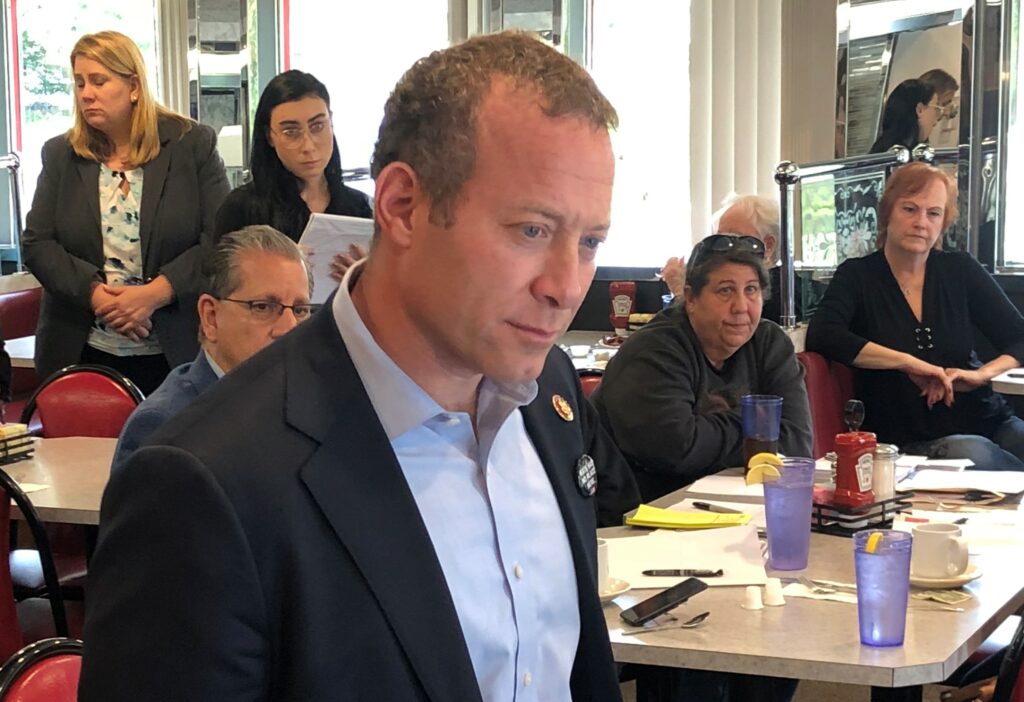

WASHINGTON – Today, Thursday, December 19, 2019, U.S. Congressman Josh Gottheimer released a model for the massive tax cuts Fifth District families will receive from the bipartisan SALT repeal plan, H.R.5377 — Restoring Tax Fairness for States and Localities Act. H.R.5377 will ultimately save Fifth District tax filers $5.6 billion dollars total each year.

“I’m releasing this tax cut model to show the massive tax cut North Jersey families — at every income level — will receive from the bipartisan SALT repeal plan that the House is voting on today,” said Congressman Josh Gottheimer (NJ-5). “Joint filers in tax brackets from $100,000 to $2 million and above will finally get a tax cut from the 2017 Tax Hike Bill that’s slammed our hardworking families with thousands in extra taxes and lower property values. The Tax agile Bill has driven residents and jobs out of the Garden State in droves. Ever since I joined Democrats and Republicans in voting against the 2017 Tax Hike Bill, I’ve been fighting to fully reinstate SALT and finally cut taxes for North Jersey families. This bill delivers on that. It’s time we fought back against the Moocher States. This is a huge win for New Jersey families and businesses.”

“The impact of the SALT deduction has been very harmful to many New Jersey residents, not only increasing tax obligations but reducing real estate values — both have aggravated the affordability of living in New Jersey and prompted a growing number of citizens to look at exit strategies. The proposed SALT repeal bill will begin to rectify our affordability issue and take away the monetary penalty with which New Jersey has been saddled,” said Tom Bracken, the President and CEO of the New Jersey Chamber of Commerce.

“As a real estate broker, I applaud the work that Congressman Gottheimer has done to support the 5th District and New Jersey’s economy. Raising the SALT cap for married couples filing jointly in 2019 and eliminating the SALT deduction cap for 2020 and 2021 will help many of our neighbors realize the dream of homeownership,” said Randy Lyn Ketive, Vice Chair, New Jersey REALTORS Legislative Affairs Committee.

The model below estimates the massive tax cuts this legislation will deliver for New Jersey tax filers at all levels:

| Example Joint Income | SALT Deduction (estimated NJ income tax + property taxes) | Taxes Paid with Current $10k SALT Deduction Cap | Taxes Paid without SALT Deduction Cap

(H.R.5377 in Place) |

Tax Savings

with H.R.5377 in Place |

| $100,000 | $12,000 | $15,750 | $15,300 | $450 |

| $250,000 | $25,000 | $59,100 | $53,943 | $5,157 |

| $500,000 | $55,500 | $146,500 | $130,800 | $15,700 |

| $750,000 | $95,000 | $238,800 | $206,600 | $32,200 |

| $1,000,000 | $110,000 | $331,300 | $305,600 | $25,700 |

| $1,500,000 | $170,000 | $516,300 | $479,840 | $36,460 |

| $2,000,000 | $240,000 | $701,300 | $650,200 | $51,100 |

###