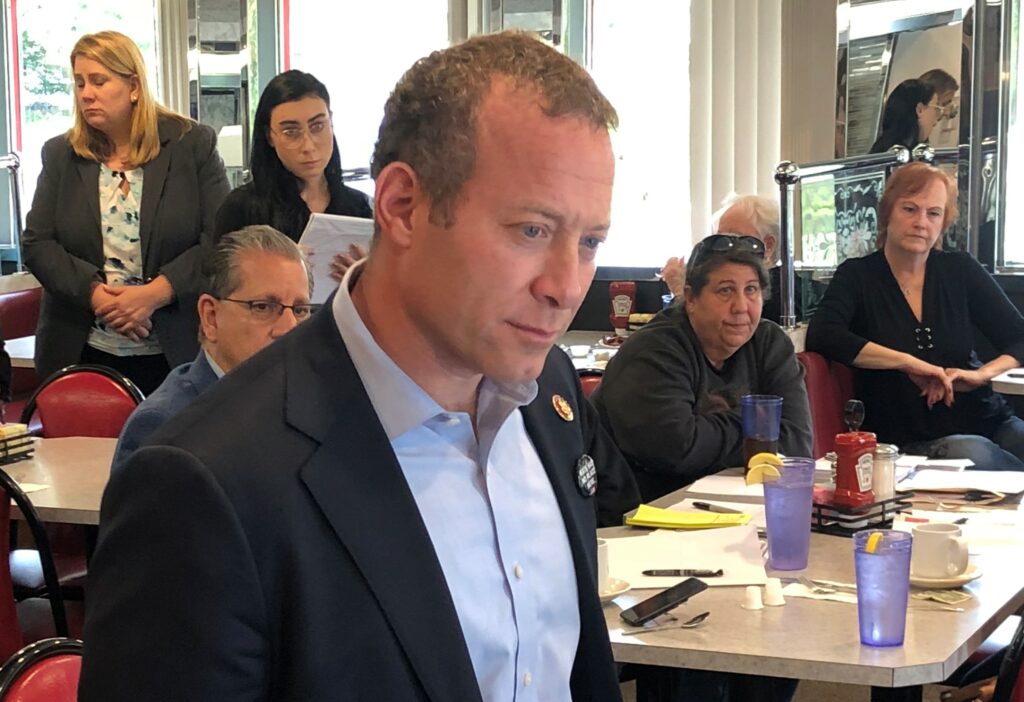

Gottheimer, Mitchell Seek 90-Day Federal Tax Filing Extension to Protect Taxpayers, Tax Preparers, Small Businesses

Gottheimer, Mitchell Seek 90-Day Federal Tax Filing Extension to Protect Taxpayers, Tax Preparers, Small Businesses

WASHINGTON - On Thursday, March 19, 2020, U.S. Representatives Josh Gottheimer (NJ-5) and Paul Mitchell (MI-10) asked the U.S. Department of the Treasury and the Internal Revenue Service (IRS) to extend the filing deadline for individuals and businesses by a minimum of ninety days.

Earlier this week, the Secretary of the Treasury announced that the deadline for Americans to pay their federal taxes would be extended, following Gottheimer and Mitchell’s request. However, Americans still need to file their taxes by the April 15, 2020, deadline.

There are now reports that accounting firms are unable to operate out of public health concerns, at a time when they are normally experiencing the highest demand in their business.

Gottheimer and Mitchell also expressed concern over the conflict between filing and payment deadlines has created confusion among constituents and small businesses.

“We applaud actions taken by the Treasury Department and Internal Revenue Service (IRS) to provide relief to American workers and businesses for the current tax season by delaying the tax payment deadline until July 15, 2020. However, we continue to urge the Treasury and IRS to offer further relief and flexibility for taxpayers by extending the tax filing deadline,” the Members wrote in a letter to Treasury Secretary Steven Mnuchin and IRS Commissioner Charles Rettig today. “We urge the IRS to delay individual and business tax deadlines, including filing, by a minimum of ninety days. This will give Americans more flexibility in deciding when they should file their taxes. We also request that tax deadlines continue to be evaluated, including whether further delays to the tax season for individuals or businesses will be necessary.”

The Members continued, “Americans need relief from filing and to be able to fully focus on the health and safety of themselves, their families, and their community.”

A copy of the letter is available HERE, the text of which is provided below.

March 19, 2020

Honorable Steven T. Mnuchin Honorable Charles P. Rettig

Secretary Commissioner

U.S. Department of the Treasury Internal Revenue Service

1500 Pennsylvania Avenue N.W. 1111 Constitution Avenue N.W.

Washington, D.C. 20220 Washington, D.C. 20220

Dear Secretary Mnuchin & Commissioner Rettig,

We applaud actions taken by the Treasury Department and Internal Revenue Service (IRS) to provide relief to American workers and businesses for the current tax season by delaying the tax payment deadline until July 15, 2020. However, we continue to urge the Treasury and IRS to offer further relief and flexibility for taxpayers by extending the tax filing deadline.

We appreciate and agree with Secretary Mnuchin’s statement that those Americans who are expecting a refund of tax payments should file as soon as they can, and would add only as long as they can do so safely. However, there are reports that accounting firms are unable to operate out of public health concerns, at a time when they are normally experiencing the highest demand in their business. We are also concerned that the conflict between filing and payment deadlines has created confusion among our constituents and small businesses.

As stated in our letter sent to Commissioner Rettig on March 13th, 2020, we urge the IRS to delay individual and business tax deadlines, including filing, by a minimum of ninety days. This will give Americans more flexibility in deciding when they should file their taxes. We also request that tax deadlines continue to be evaluated, including whether further delays to the tax season for individuals or businesses will be necessary. Americans need relief from filing and to be able to fully focus on the health and safety of themselves, their families, and their community.

We look forward to your response on this important matter and urge you to utilize all tools available to assist our communities.

Sincerely,

_______________________ _______________________

Josh Gottheimer Paul Mitchell

MEMBER OF CONGRESS MEMBER OF CONGRESS

###