Gottheimer, Pascrell Stand Together to Fight New York State Congestion Taxes Targeting New Jersey Commuters

Gottheimer, Pascrell Stand Together to Fight New York State Congestion Taxes Targeting New Jersey Commuters

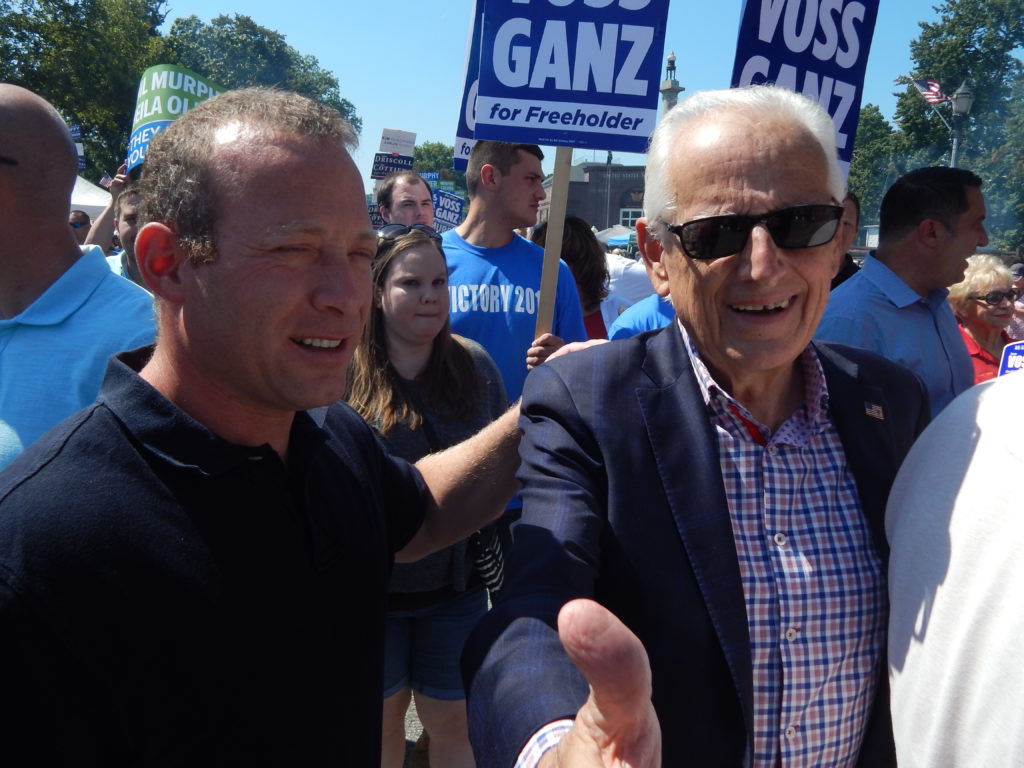

FORT LEE, N.J. — Today, U.S. Congressmen Josh Gottheimer (NJ-05) and Bill Pascrell (NJ-09) announced plans to fight back against the proposed New York congestion taxes targeting hardworking New Jersey families for driving into Manhattan. Even though the full brunt of this tax burden will be placed on New Jersey drivers, they won’t see a nickel.

According to the most recent Census data, nearly 400,000 New Jersey residents not only worked in New York City, but they also filed and paid state taxes in New York. Most of these folks are daily commuters into New York City.

Congressman Josh Gottheimer (NJ-05) announced new bipartisan legislation with Congressman Chris Smith (NJ-4) — the Anti-Congestion Tax Act, also known as the Manhattan Moocher Prevention Act — that takes two concrete actions to encourage New York to reconsider its new, outrageous congestion tax on New Jersey commuters.

1) The Anti-Congestion Tax bill will prohibit the Secretary of Transportation from awarding any new Capital Investment Grants to MTA projects in New York until drivers from all three New Jersey crossings into Manhattan receive exemptions from this new congestion tax.

2) The Anti-Congestion Tax bill will amend the Internal Revenue Code to offer drivers a federal tax credit at the end of the year equal to the amount paid in congestion taxes entering Manhattan from any of the three New Jersey crossings. This will protect Jersey drivers from double taxation.

Pascrell and Gottheimer also sent a letter to New York Governor Andrew Cuomo calling on him to consider the burden proposed congestion pricing would place on already-taxed New Jersey commuters, and call on him to invest revenue gained through imposed congestion pricing with New Jersey Transit, the Port Authority, the Lincoln and Holland Tunnels, the PATH system, and the Port Authority Bus Terminal which desperately needs an upgrade.

“The bottom line: When New York does well, it helps New Jersey. When New Jersey does well, it helps New York. Under the new plan, when commuters go across this bridge and drives into Midtown, they will be whacked, not just with the $15 toll here, which is ridiculous, but now an additional eight to twelve dollars when they drive south of 60th Street. That’s absurd double taxation at its finest. Even more galling, unlike the shared Port Authority resources for from the tolls on this bridge, that help New York and New Jersey, every nickel of that new mid-town congestion tax will go to New York, to their MTA, to help fix their subways. Thousands of Jersey drivers – many from my District and from Bill’s District – who commute every day, will face a new congestion tax of about $3,000 a year. That’s a joke.” said Congressman Josh Gottheimer (NJ-05).

Gottheimer continues, “Proposing a new regressive congestion tax out of the blue on New Jersey commuters who already pay a fortune is no way to make this region stronger. I’m hoping that New York comes to its senses and we can sit down together, cooperatively and constructively, and eliminate this new double tax on Jersey commuters. New York can’t just take an additional 2×4 to our head. That’s why, in the coming days, I’ll be introducing bipartisan legislation with Republican Congressman Chris Smith, to encourage New York to reconsider their new, outrageous congestion tax on New Jersey commuters.”

“The Anti-Congestion Tax Act – or, as I like to also call it, the Manhattan Moocher Prevention Act, takes two concrete actions to stop New York in their tracks.”

“New Jerseyans are used to getting the short end of the stick. It’s part of why we’re so tough. But we pay our fair share – and then some,” said Congressman Bill Pascrell (NJ-09). “What we’re proposing is sensible, as the needs of commuters in the region go beyond what happens in Lower Manhattan. New Jersey and New York are on the same team. We are not in competition. New Jersey’s priorities are New York’ priorities and vice-versa. But we will not back down from a fight to protect New Jersey families either.”

Until New York reconsiders their unreasonable congestion tax proposal, there is no other choice but to dig in and fight back.

A link to the video of the event can be found here.

Congressman Gottheimer’s remarks as prepared for delivery are below:

Thank you, Bill, for your friendship and for always standing up and fighting for New Jersey. Thank you also to Mayor Sokolich for welcoming us to Fort Lee this morning. I also want to thank law enforcement from the New Jersey Port Authority, who are stationed only a stone’s throw from here.

We are standing here today in the shadow of the George Washington Bridge, where, every day, 289,000 people drive in and out of Manhattan from Bergen County and from all over the state.

Many of them work in New York, who are going in to support their families. And some are headed to New York City to spend a day with family and friends in one of the greatest cities in the world.

The relationship between New York and New Jersey is a driving economic force, not only in the country, but in the world. It always has been, and we’ve always stood and worked together. Every day, a massive portion of the global economy travels between the two states – about $100 million a day. This region is the economic nerve center of the world. And, it’s in no small part, thanks to the incredible people from my state — especially here in North Jersey — with an educated and diverse workforce that can compete with any country around the globe.

According to the most recent Census data, nearly 400,000 New Jersey residents not only worked in New York City, but they also filed and paid state taxes in New York. Most of these folks are daily commuters into New York City.

From financial services to life sciences, our deep and historic relationship benefits both states. It’s why we’ve shared and worked cooperatively on everything from transportation and infrastructure projects, through the Port Authority, to environmental cleanup projects to fighting crime and terror. We are working together to strengthen our regional airports and fighting together tirelessly against intractable forces from the Red States to build the Gateway Tunnel and to stop double taxation and reinstate SALT. We’re working together on the Never Forget the Heroes Act to extend the 9/11 Victim Compensation Fund, so we can have the backs of our first responders and others who had our backs in our darkest hour.

The bottom line: When New York does well, it helps New Jersey. When New Jersey does well, it helps New York.

So, you can imagine to my surprise when, last month, out of the blue, our friend and teammate, the New York State legislature announced a budget deal that would include a new congestion tax targeting New Jersey commuters. We didn’t see that coming. As we say here in Jersey, with friends like these, who needs enemies?

Under the new plan, when commuters go across this bridge and drives into Midtown, they will be whacked, not just with the $15 toll here, which is ridiculous, but now an additional eight to twelve dollars when they drive south of 60th Street. That’s absurd double taxation at its finest. Even more galling, unlike the shared Port Authority resources for from the tolls on this bridge, that help New York and New Jersey, every nickel of that new mid-town congestion tax will go to New York, to their MTA, to help fix their subways. Thousands of Jersey drivers — many from my District and from Bill’s District – who commute every day, will face a new congestion tax of about $3,000 a year. That’s a joke.

Proposing a new regressive congestion tax out of the blue on New Jersey commuters who already pay a fortune is no way to make this region stronger.

I’m hoping that New York comes to its senses and we can sit down together, cooperatively and constructively, and eliminate this new double tax on Jersey commuters. I understand New York’s desire to increase funding for their subway system. I get that. There’s plenty of roads I’d like to fix near here. But, in New Jersey, our taxpayers already contribute to the billions in federal transportation dollars that their subway gets every year, not to mention, as I said, what we pay in New York income taxes and what we spend in their restaurants, stores, and shows. New York can’t just take an additional 2×4 to our head.

That’s why, in the coming days, I’ll be introducing bipartisan legislation with Republican Congressman Chris Smith, to encourage New York to reconsider their new, outrageous congestion tax on New Jersey commuters.

The Anti-Congestion Tax Act – or, as I like to also call it, the Manhattan Moocher Prevention Act, takes two concrete actions.

First, the Anti-Congestion Tax Act will prohibit the Secretary of Transportation from awarding any new Capital Investment Grants to MTA projects in New York until drivers from all three New Jersey crossings into Manhattan receive exemptions from this new congestion tax.

Second, the Anti-Congestion Tax Act will amend the Internal Revenue Code to offer drivers a federal tax credit at the end of the year equal to the amount paid in congestion taxes entering Manhattan from any of the three New Jersey crossings. This will protect Jersey drivers from double taxation.

Here’s the good news: This legislative approach is not without precedent. In 1985, Congressman Guy Molinari from Staten Island used the same idea to push New York to change its tolling practices on the Verrazano-Narrows Bridge. He thought those tolls were hosing people from Staten Island and he wasn’t going to let New York get away with it.

So, in the 1986 U.S. Department of Transportation Appropriations Act, Congressman Molinari inserted a provision that would have docked the State of New York of some of its federal funding from DOT, unless it removed two-way tolling on the bridge, and instituted a one-way toll only going into Staten Island. He got it done.

So, we’ve got a clear precedent for Congressional action when it comes to regressive tolls that tax one group of Americans just to fix another group’s problems. We can’t let New York off the hook for trying to pull one over on New Jersey.

Last point, it would be one thing if our suburban commuters had a ton of other transit options to get into New York City. Unfortunately, they don’t. If you’re in Franklin Lakes, or Newton, or Knowlton, or Ringwood, your options are limited – too few bus lines and too many failing trains.

Finally, one extra point: there’s just no consistency in New York’s congestion tax plan.

While their new congestion tax plan exempts drivers using certain crossings into Manhattan — like the Holland and Lincoln Tunnels — it excludes the George Washington Bridge, the most heavily trafficked bridge on the planet. In other words, if you take the Lincoln or Midtown Tunnels, you won’t face the congestion tax. They claim it’s because the GWB doesn’t go into midtown. But here’s the rub, in what seems like blatant hypocrisy: commuters on the Henry Hudson Bridge won’t get hit with the congestion tax, even though it’s further north from midtown than the GWB. Hmm. It seems to me like they’re going after Jersey.

And, as I said earlier, they’re try to rob us blind even though New Jersey residents are already some of the leading contributors to New York’s state income revenue. In fact, the income taxes paid by New Jersey commuters equaled the total income tax owed by 1.3 million people in the Western New York region, including places like Buffalo and Rochester.

With none of these congestion taxes going to support PATH or NJ Transit — there is no way around it — New Jersey is guaranteed to get hosed. That’s why I am also proud to join my colleague Rep. Pascrell in writing to the Governor asking him to do the right thing. Back off doubly taxing New Jersey commuters. But if they go ahead with their congestion tax, they should at least share the funds not just with the MTA, but with PATH and NJ Transit as well — two crucial modes of public transportation that thousands of us here in New York and New Jersey use every day.

My office, and I’m sure Bill’s office, have received countless calls and messages from constituents who are rightly outraged by the announcement of yet another tax hike.

Our taxes are too high as it is for our commuters to be doubly taxed.

When we work together, New Jersey and New York are a tough combination to beat, especially here in the greatest country in the world. But, as Lincoln said, “A house divided against itself cannot stand.” New York can easily pull back on this proposal and work with us toward a better solution for all of us. But right now, for my District, we have no other choice but to dig in and fight back, Jersey style, and that’s what we plan to do. Thank you again and may God bless you and may God continue to bless the United State of America.

###