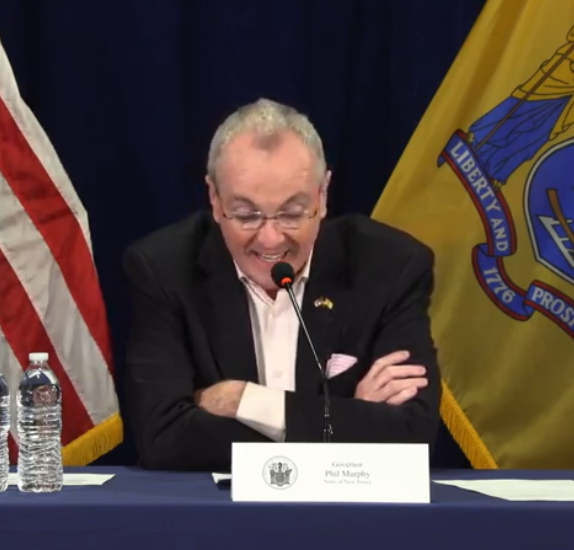

Governor Murphy Enacts Moratorium on Removals of Individuals Due to Evictions or Foreclosures

Governor Murphy Enacts Moratorium on Removals of Individuals Due to Evictions or Foreclosures

Today the Governor signed A-3859 into law, which explicitly provides authority to the Governor to issue an executive order declaring a moratorium on removing individuals from their homes pursuant to an eviction or foreclosure proceeding. The Governor then immediately signed Executive Order No. 106, which imposes such a moratorium. This move will ensure that no renter or homeowner is removed from their residence while this Order is in effect. These actions come a day after the U.S. Department of Housing and Urban Development, Fannie Mae, and Freddie Mac would be suspending all foreclosures and evictions for at least 60 days.

“This outbreak affects all of us and we are all in this together,” said Governor Murphy. “The steps I am outlining today will help those who are suffering financial harm through no fault of their own continue to stay afloat as we work our way through this. They will also bolster public health by ensuring that residents facing eviction or foreclosure can stay in their homes, protecting them against increased risk of contracting and spreading COVID-19.”

Assembly Bill No. 3859 was sponsored by Assemblymembers Angela McKnight, Holly Schepisi, and Benjie Wimberly, and Senators Joseph Cryan and Nellie Pou. The Administrative Office of the Courts also provided helpful guidance on the legislation.

“It is unsettling to think a family could be evicted or asked to leave their home due to foreclosure proceedings at this time,” said Assembly Sponsors Angela McKnight and Benjie Wimberly. We must do everything we can to keep families safe and in a home until we get to the other side of this public health crisis. We will get through this New Jersey.”

“This pandemic could have a serious impact on how many of our residents are able to make a living,” said Assemblywoman Holly Schepisi. “Losing income because you are recovering from this illness or staying home because your child’s school is closed should not cost you your home. Together, we will get through this public health crisis.”

“I applaud the Governor’s swift action in signing this bill into law in the midst of the expanding coronavirus crisis,” said Senator Joseph Cryan. “This is a public health emergency that confronts all of us with challenges, especially those who live paycheck to paycheck to support themselves and their families. It would be cruel to allow people to be forced out of their homes due to circumstances beyond anyone’s control, such as the pandemic. This is a time to care for our neighbors and fellow citizens.”

“As people work anxiously to keep themselves and their loved ones safe in the face of this pandemic, they should not also have to live in the fear of going homeless,” said Senator Nellie Pou. “The coronavirus has turned life upside down, shuttered businesses, and left particularly low-income workers wondering how they will make ends meet. I am glad the Governor sees the necessity of this legislation and the relief that this law will give to thousands of scared New Jersey families at this uncertain moment.”

The Governor also is asking any financial institution holding residential or commercial mortgages, equity loans, lines of credit or business loans, to implement a process to work with the mortgagors or loan holders to avoid foreclosure or default arising out financial hardship caused by the COVID-19 pandemic, or by any local, state, or federal government response to COVID-19.

The New Jersey Economic Development Authority will continue to lead coordination between the SBA and businesses in our State. NJEDA is currently in the process of scaling up local technical assistance programs to help New Jersey businesses apply for SBA assistance. To start, NJEDA has posted additional information about the SBA program on the State’s COVID-19 business portal: https://cv.business.nj.gov

For those businesses with an immediate financial need, the U.S. Small Business Administration has approved Gov. Phil Murphy’s request for a disaster designation, opening up access to the SBA’s Economic Injury Disaster Loan program to New Jersey businesses hit hard by the COVID-19 pandemic.

SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance for small businesses and private non-profits. These loans provide vital economic support to help overcome the loss of revenue caused by COVID-19.

Loans may be used to pay fixed debts, payroll, accounts payable, and other bills that can’t be paid because of the disaster’s impact. The interest rate is up to 3.75% for small businesses without credit available elsewhere. The interest rate for non-profits is up to 2.75%.

Loan terms are up to a maximum of 30 years. SBA will determine an appropriate payment based on the financial condition of the borrower, which also will determine the loan term.

Details regarding the SBA loan program can be found online at: https://faq.business.nj.gov/en/articles/3789809

More information on SBA disaster loans can also be found at https://disasterloan.sba.gov/ela/

To further aid both homeowners and renters facing hardship, the New Jersey Housing and Mortgage Finance Agency is expanding its Foreclosure Mediation Assistance Program (FMAP) to include renter and pre-foreclosure counseling utilizing a network of participating housing counselors in each county. The counseling is available now and can be provided remotely. Counseling is free of charge.

Counselors will provide upfront assistance to help homeowners avoid potential foreclosure. At the same time, the counseling made available to renters will guide them on how to approach discussions with their landlords on dealing with their rent situation.

For a list of housing counselors participating in FMAP, visit: https://njhousing.gov/foreclosure

At the Department of Community Affairs, rental assistance programs continue to operate and fulfill all core business functions, including paying rents to landlords and processing recertifications, income redeterminations, and other core functions. While DCA field offices are closed to the public to observe social distancing protocols, DCA encourages current participants to utilize the online portal at assistancecheck.com to submit documents, or to submit documents through the mail. Current program participants may email or call the field offices or the customer service line at 609-292-4080 or email: customer.service@dca.nj.gov to leave messages with questions. Messages are checked frequently and will be returned as promptly as possible.

“Governor Murphy and I understand that this is an extremely stressful time, especially for our most vulnerable residents who are experiencing homelessness or facing eviction,” said Lt. Governor Sheila Oliver, who serves as DCA Commissioner. “We are working diligently at DCA to maintain quality services for the homeless, our tenants, and landlords as we respond to the threat of COVID-19.”

DCA has taken a number of actions to meet the ongoing needs of its clients and to curb evictions and homelessness during the state of emergency. It has:

- Suspended terminations for non-essential reasons (those not involving violence and/or threats to others) in the Section 8 Housing Choice Voucher (HCV) and State Rental Assistance Program (SRAP);

- Extended the housing search period for all current voucher holders to the full 120 days allowed by the U.S. Department of Housing and Urban Development (HUD) for those without disabilities or who are not elderly for the housing search period. Voucher holders needing more than 120 days to identify housing may request extensions through the online portal, via phone call, or mail as needed;

- Prepared to accept from its clients interim income re-certifications due to decreased income from the public and private responses to COVID-19. Income re-certifications may be submitted through DCA’s online portal and through mail. DCA is providing remote access, if necessary, to key employees to process requests as quickly as possible

- Continued to offer language access services to clients who need them.

- In an effort to help keep non-profit service providers viable and operating during this emergency, begun working to provide advances on existing contracts to providers addressing emergent needs.

DCA reminds residents who are in need of emergency housing assistance, please call 2-1-1 .For residents who do not have emergent needs, but would like to find out if they are eligible to apply for any of DCA’s assistance programs, they should visit DCA’s online anonymous screening tool: www.nj.gov/dca/dcaid. Residents may also visit (new webpage link) to learn more about our housing assistance programs.

Finally, in related efforts to help with the financial cost of COVID-19, the governor announced today the New Jersey Higher Education Student Assistance Authority (HESAA) will offer assistance to those who need help making regular payments to NJCLASS student loans due to a diminished income.

Those directly impacted by COVID-19 can apply for NJCLASS loan relief for temporary disability or unemployment. Applications for these relief options are available at

https://www.hesaa.org/Documents/Relief%20Options/Unemployment.pdf and https://www.hesaa.org/Documents/NJCLASSTempDisabilityForm.pdf

In addition, NJCLASS borrowers can apply for financial hardship relief. To assist individuals financially impacted by COVID-19 mitigation measures, who are not eligible to receive unemployment or temporary disability assistance, HESAA is requesting borrowers supplement their financial hardship application with a statement explaining how the impact of the COVID-19 virus response has caused their financial hardship. HESSA will review these applications with greater flexibility considering the impact of COVID-19.

The NJCLASS loan application for financial hardship relief is available at

https://www.hesaa.org/Documents/Relief%20Options/Financial%20hardship.pdf