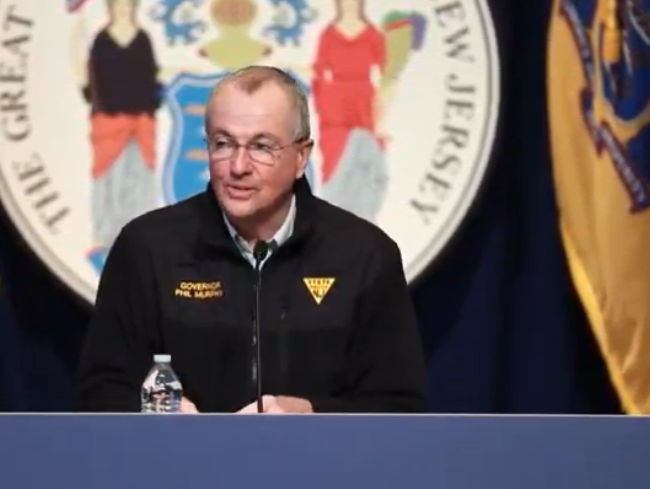

Governor Signs Bare Bones State Spending Plan into Law for Extended Fiscal Year to Help Weather Continued Fallout from COVID-19

Governor Signs Bare Bones State Spending Plan into Law for Extended Fiscal Year to Help Weather Continued Fallout from COVID-19

TRENTON – Governor Phil Murphy signed a three-month spending plan into law on Tuesday that includes a series of deep cuts and spending deferrals to help the state meet its most basic obligations through the extended fiscal year (FY 2020), which ends September 30.

New Jersey extended its fiscal year beyond the traditional closing date of June 30 in light of the extreme uncertainty caused by the global pandemic and the subsequent decision to extend state and federal tax filing deadlines to July 15 to help taxpayers weather the COVID-19 crisis.

“The fiscal impacts of the COVID-19 pandemic are as unprecedented as this public health emergency itself,” said Governor Murphy. “As we move forward toward the nine-month Fiscal 2021 budget, our choices will have an even bigger impact. But, make no mistake, we cannot just cut our way forward. We must have the flexibility to borrow essential funds to secure the core services we will rely upon as we emerge from this pandemic, and we need direct assistance from the federal government. Absent those, the tough decisions we have made now will pale in comparison to those which lay just around the corner.”

The $7.632 billion spending plan signed by the Governor is relatively unchanged from the proposal the Administration put forth in its May 22 budget update to the Legislature. It authorizes the deappropriation of nearly $1.2 billion in funds enacted in the FY 2020 Appropriations Act, does not include nearly $850 million in new spending proposed in the Governor’s February budget message, defers a number of significant payments (described below), and does not include any new revenue raisers.

“We have been working around the clock since this crisis hit to get a handle on the state’s continuously evolving finances,” said State Treasurer Elizabeth Maher Muoio. “The one certainty forecasters can agree on at this point is that uncertainty lies ahead and we must prepare for that. Unfortunately, this means we must brace ourselves for more painful decisions on the road ahead.”

As a result, the supplemental appropriations bill includes a 5 percent across-the-board reduction in funding for non-salary operating costs and a 10 percent reduction in discretionary grants. It also includes savings from delaying cost-of-living adjustments as part of the agreement negotiated in good faith with the Communications Workers of America.

The three-month spending plan provides sufficient funds to support the projected need for social services programs through the end of September and 25 percent of the annual need for operating costs that were not otherwise reduced. State Aid, grants, and other mandatory payments are generally recommended to be appropriated during the three-month extended fiscal year based on the normal timing of disbursements or as projected to cover actual services rendered.

More specifically, the supplemental appropriations bill includes the following key provisions across various state departments:

- Community Affairs: Delays September payments for Consolidated Municipal Property Tax Relief Aid (CMPTRA) and Energy Tax Receipts (ETR) until October.

- Education: Continues to implement the school funding formula designed in partnership with the Legislature without any additional funding over FY 2020; delays the September 22nd school aid payment into October; and defers the September school choice payments.

- Health: Provides the same overall funding for hospitals as the first quarter of FY 2020 (Charity Care, Graduate Medical Education); however the distribution may vary because funding will be allocated based on FY 2021 data.

- Labor and Workforce Development: Includes $3.875 million to modernize unemployment processing.

- Higher Education: Maintains tuition assistance programs for post-secondary students—including Tuition Aid Grants, the Educational Opportunity Fund, and Community College Opportunity Grants—at their FY 2020 funding levels. Also includes $52 million in operating aid for senior public higher education institutions and almost $14 million in operating aid for community colleges.

- Transportation: Does not include any state subsidy for NJ TRANSIT due to $1.4 billion in federal CARES Act funding being provided to the agency.

- Treasury: Does not include Senior Freeze or Homestead Benefit payments and delays the September pension payment into October.

The three-month spending plan is supported by $8.625 billion in total resources, and ends with a surplus of $956 million through September 30. The revised surplus – which includes the transfer of the entire $421 million Surplus Revenue Fund (also known as the Rainy Day Fund) to the General Fund – is up $462 million from the May 22 budget update.

The improved revenue forecast is primarily due to Sales and Use Tax revenue exceeding expectations as a result of the incremental re-opening of New Jersey’s economy. However, the state must still contend with a historic decline in overall projected revenue and the uncertainty over whether taxpayers will request extensions beyond the already extended July 15 deadline for personal income tax filings or claim refunds for overpayment of Corporation Business Tax obligations.

The Administration and the Legislature must now work on crafting a nine-month budget for Fiscal Year 2021, which will run from October 1, 2020 through June 30, 2021 under the legislation that previously authorized the extension of the current fiscal year.