Kazmark Sends Letter To State Officials Calling For Local Finance Reforms

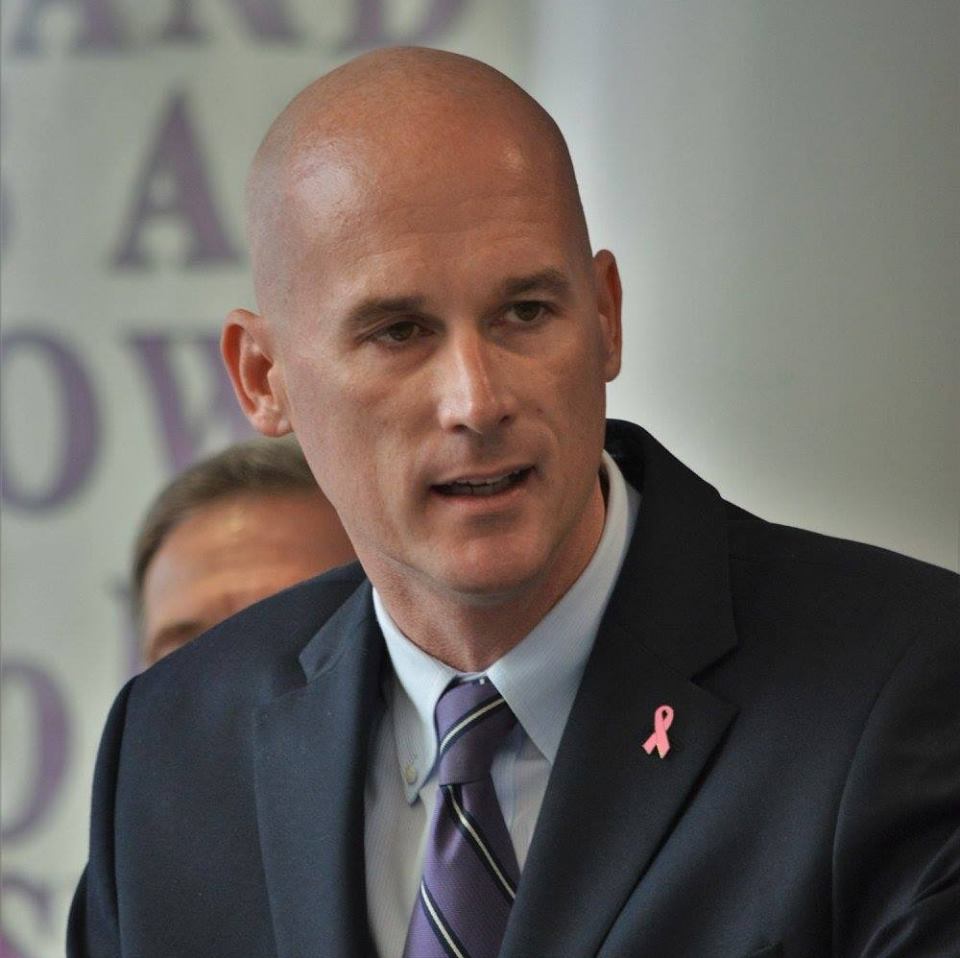

WOODLAND PARK - Woodland Park Mayor Keith Kazmark on April 14 sent a letter to Gov. Murphy and legislative leaders Sen. Kristin Corrado, Senate President Stephen Sweeney, Assemblyman Kevin Rooney, Assemblyman Christopher DePhillips and Assembly Speaker Craig Coughlin asking that they fully support the financial reforms proposed on April 13 by Mayor Matthew Moench of Bridgewater Township to address municipal budget challenges as a result of the COVID-19 outbreak.

“As Mayor Moench stated, these difficulties are felt throughout the State regardless of location,” Kazmark wrote. “The largest concerns obviously are a significant loss of revenue ranging from reduced tax collection, construction fees, permitting and municipal court fines, in addition to unforeseen expenses directly related to COVID-19. As you are aware, taxpayers are already hard hit by the economic fallout of the crisis and the uncertainty of what is to come.”

Mayor Kazmark requested that the recommendations propose by Mayor Moench be acted upon swiftly, as municipalities throughout the State are working to finalize their municipal budgets and will not realize any of the prior year revenues.

Below is the summary of Mayor Moench’s proposals, which Kazmark noted hoped would be considered and adopted by the Legislature and signed by the Governor:

- Authorize municipalities to have the ability to issue a special emergency for COVID-19 expenses and raise those funds over five budget years. The statute is very limited as to what type of emergencies can be issued by a municipality and raised over three or five years. Most emergencies funds must be raised in the following budget year. Relief must be provided through legislative or administrative action for the DCA to authorize COVID-19 related expenses that are issued as emergencies to be raised over five years.

- Create a mechanism whereby municipalities can address the loss of revenue over five budget years. Generally, operating expenses cannot be paid with debt. The law allows municipalities to issue Tax Anticipation Notes, but it is only for 12 months. Municipalities should have an ability to issue debt, preferably with no down payment, to provide funding for lost revenue, allowing municipalities to raise one-fifth of it every year for the next five years and to raise it outside the levy cap.

- School districts and Counties should share in the costs of borrowing if tax income is delayed or reduced. If tax revenue collections are low or delayed and a municipality has to borrow money in order to provide payments to the County and the Board of Education, the burden for paying interest on Tax Anticipation Notes should be shared by the County and the Board of Education.

[pdf-embedder url="https://www.insidernj.com/wp-content/uploads/2020/04/Letter%20to%20NJ%20officials_COVID-19.pdf" title="Kazmark letter"]