In Letter to New York Governor Hochul, Gottheimer Voices Opposition to Punitive Manhattan Congestion Tax

In Letter to New York Governor Hochul, Gottheimer Voices Opposition to Punitive Manhattan Congestion Tax

Gottheimer Works to Protect New Jersey Residents, Commuters

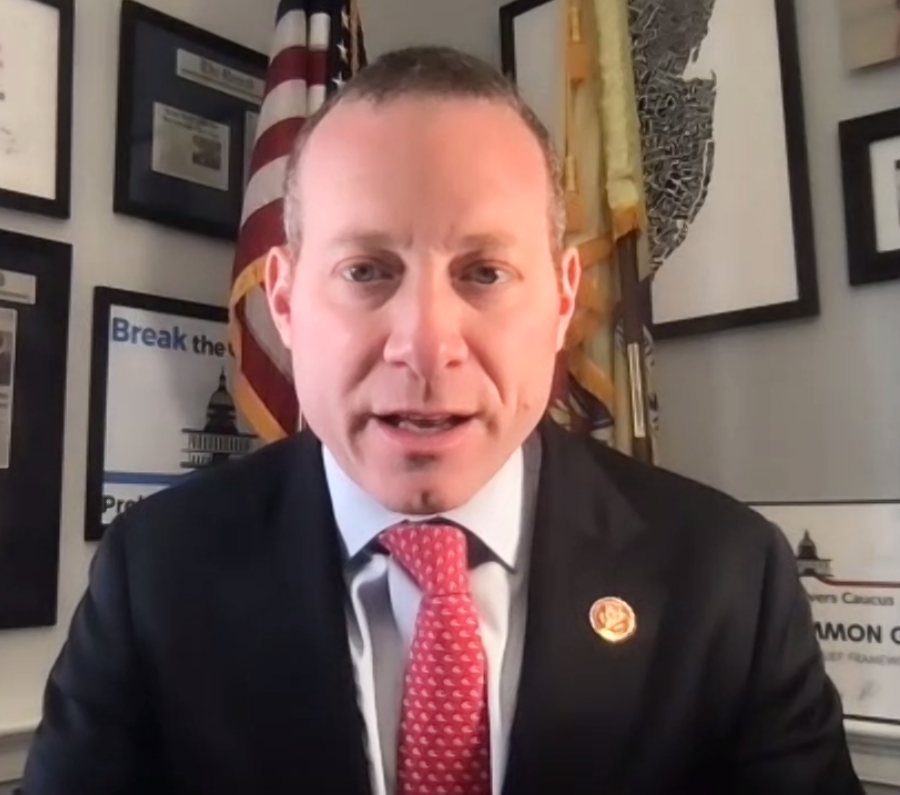

WASHINGTON, D.C. — U.S. Congressman Josh Gottheimer announced that he sent a letter to New York Governor Kathy Hochul, during the Governor’s first week, asking her to oppose the proposed Manhattan congestion tax. If the proposed congestion tax is to proceed, Gottheimer urged Hochul to act to ensure hard-working New Jerseyans do not bear the brunt of the tax’s burden.

The letter comes on the heels of bipartisan federal legislation, the Anti-Congestion Tax Act, that Congressman Gottheimer introduced earlier this month.

The letter highlights how the proposed congestion tax would add an approximately $3,000 per year cost on top of the roughly $4,000 toll that New Jersey commuters already pay to enter New York City via the George Washington Bridge. Despite the significant impact on New Jersey commuters, not a cent of the proceeds generated by the congestion tax would go to helping NJ TRANSIT or New Jersey infrastructure.

“New York City’s proposed congestion tax would endanger the economic recovery of the New York metropolitan region, add further expense to the already sky-high cost of commuting into New York City, and comes at a time when MTA has received billions in federal transit aid,” said Congressman Josh Gottheimer. “For these reasons, I urge you to oppose the proposed tax — or at least work to ensure hard-working New Jerseyans do not bear the brunt of it — to continue our states’ decades-long relationship of cooperation.”

In the letter, Gottheimer posed the following questions.

- In March, the U.S. Department of Transportation determined that an Environmental Assessment (EA) was the appropriate next step for the proposed congestion tax. As part of that March announcement, the Department stated that the EA process was “designed to ensure involvement of stakeholders from throughout New York, New Jersey, and Connecticut…” To date, however, no public hearings or meetings with New Jersey officials or residents have occurred. What is the MTA’s plan to involve New Jersey residents in the EA process?

- Legislation passed by the New York Legislature in 2019 established a “Traffic Mobility Review Board,” to be comprised of a chair and five members, to make various recommendations regarding the congestion tax. What is the status of the formation of this Board? When will members be appointed, and when will the Board begin to make its recommendations?

- The Traffic Mobility Review Board is tasked with recommending a plan for “credits, discounts, and/or exemptions” from the congestion tax. However, there have been reports that agreements have been reached regarding exemptions from or credits toward the congestion tax, including for commuters using certain crossings into Manhattan. Have decisions been made or agreements reached regarding congestion tax exemptions or credits? If so, what are the components of those decisions and/or agreements?

Congressman Gottheimer is looking forward to discussing this important issue with Governor Hochul as they work together in the coming months to fight for the shared interests of the region.

In addition to the letter to Governor Hochul and the introduction of the Anti-Congestion Tax Act, Gottheimer has also joined Congressman Bill Pascrell, Jr. (NJ-9) to request that U.S. Secretary of Transportation Pete Buttigieg require a comprehensive review of the congestion tax’s burden on Jersey commuters, as well as public hearings in Northern New Jersey. Gottheimer is also helping lead bipartisan legislation with Congresswoman Nicole Malliotakis, H.R.2476, the Economic Impact of Tolling Act, to ban implementation of a congestion tax until there is more information on the economic impact on our constituents and states.

Full letter text can be found below:

August 24, 2021

The Honorable Kathy Hochul

Governor of New York State

NYS State Capitol Building

Albany, NY 12224

Dear Governor Hochul:

Congratulations on your swearing-in as the 57th Governor of New York State. As a member of the New Jersey Congressional delegation, I look forward to working with you in the coming months to advance the priorities of our region and to deepen the decades-long relationship of cooperation between New Jersey and New York. As a part of that ongoing relationship, I would like to express my concern — and to request updated information — regarding New York’s proposed congestion tax in Manhattan. For the reasons explained here, I urge you to oppose the congestion tax. In the alternative, if the proposed tax is to move forward, I urge you to act to ensure hard-working New Jerseyans do not bear the brunt of the tax’s burden.

The proposed congestion tax would add an approximately $3,000 per year cost on top of the roughly $4,000 toll that New Jersey commuters already pay to enter New York City via the George Washington Bridge. The New York City area suffered the worst pandemic-related job losses among surveyed metropolitan areas, according to Moody’s Analytics, and the full return of New York City’s economy is not guaranteed. Implementing the proposed congestion tax in New York City, therefore, would work against efforts to encourage those working remotely due to the COVID-19 pandemic to return to in-person work in Manhattan. This uncertainty weighs against the imposition of a congestion tax that would place an additional burden on New Jerseyans seeking to return to in-person work in New York City.

Even aside from the proposed congestion tax, the cost of commuting into New York City has become unsustainable in recent years. Indeed, toll rates on the George Washington Bridge have doubled over the last decade, threatening the ability of many in North Jersey to enter New York City. Because of limited public transportation options, many of my hard-working, middle-class constituents rely on driving to get to work. It is wrong to hit these individuals with a regressive congestion tax as they seek to make a living in the City for their families back home in New Jersey.

Proponents of the proposed congestion tax have argued that the tax is needed to generate revenue for the MTA — but it is not clear at present that the MTA is in need of that additional revenue. At the MTA’s monthly board meeting on June 23, Chief Financial Officer Robert Foran stated that the agency was “not in a position now to really be needing...the congestion pricing proceeds” for the MTA’s capital program. That viewpoint is consistent with the fact that over the course of three federal COVID-19 relief packages, Congress has provided nearly $20 billion in transit aid to the New York metropolitan area. And unlike revenue generated by tolls on existing Port Authority bridges and tunnels, revenue from the congestion tax would go entirely to New York. None of the MTA improvements funded by the congestion tax would benefit New Jersey commuters, despite their paying a significant portion of the tax collected. In short, the proposed congestion tax directly contradicts the longstanding relationship of cooperation between New York and New Jersey.

Given these factors — and ongoing uncertainty regarding the status and timeline of the congestion tax’s implementation — I respectfully request the following information from your Administration by September 24, 2021:

- In March, the U.S. Department of Transportation determined that an Environmental Assessment (EA) was the appropriate next step for the proposed congestion tax. As part of that March announcement, the Department stated that the EA process was “designed to ensure involvement of stakeholders from throughout New York, New Jersey, and Connecticut…” To date, however, no public hearings or meetings with New Jersey officials or residents have occurred. What is the MTA’s plan to involve New Jersey residents in the EA process?

- Legislation passed by the New York Legislature in 2019 established a “Traffic Mobility Review Board,” to be comprised of a chair and five members, to make various recommendations regarding the congestion tax. What is the status of the formation of this Board? When will members be appointed, and when will the Board begin to make its recommendations?

- The Traffic Mobility Review Board is tasked with recommending a plan for “credits, discounts, and/or exemptions” from the congestion tax. However, there have been reports that agreements have been reached regarding exemptions from or credits toward the congestion tax, including for commuters using certain crossings into Manhattan. Have decisions been made or agreements reached regarding congestion tax exemptions or credits? If so, what are the components of those decisions and/or agreements?

These questions demonstrate significant uncertainty regarding the implementation of the proposed congestion tax, its impact on New Jersey residents, and whether and to what extent exemptions from the tax will be offered. Due to this uncertainty, I recently reintroduced my Anti-Congestion Tax Act, bipartisan legislation that would prohibit the U.S. Secretary of Transportation from awarding any new Capital Investment Grants to MTA projects in New York until drivers from the New Jersey crossings into Manhattan receive exemptions from this new congestion tax, among other provisions.

New York City’s proposed congestion tax would endanger the economic recovery of the New York metropolitan region, add further expense to the already sky-high cost of commuting into New York City, and comes at a time when MTA has received billions in federal transit aid. For these reasons, I urge you to oppose the proposed tax — or at least work to ensure hard-working New Jerseyans do not bear the brunt of it — to continue our states’ decades-long relationship of cooperation.

Sincerely,

Josh Gottheimer

Member of Congress

###