Menendez, Kim, Pallone Unveil Bill to Help Communities Recovering from Superstorm Sandy, Battling COVID-19

Menendez, Kim, Pallone Unveil Bill to Help Communities Recovering from Superstorm Sandy, Battling COVID-19

Bill provides timely relief for towns, homeowners now struggling with decimated tax revenues, high unemployment due to coronavirus pandemic

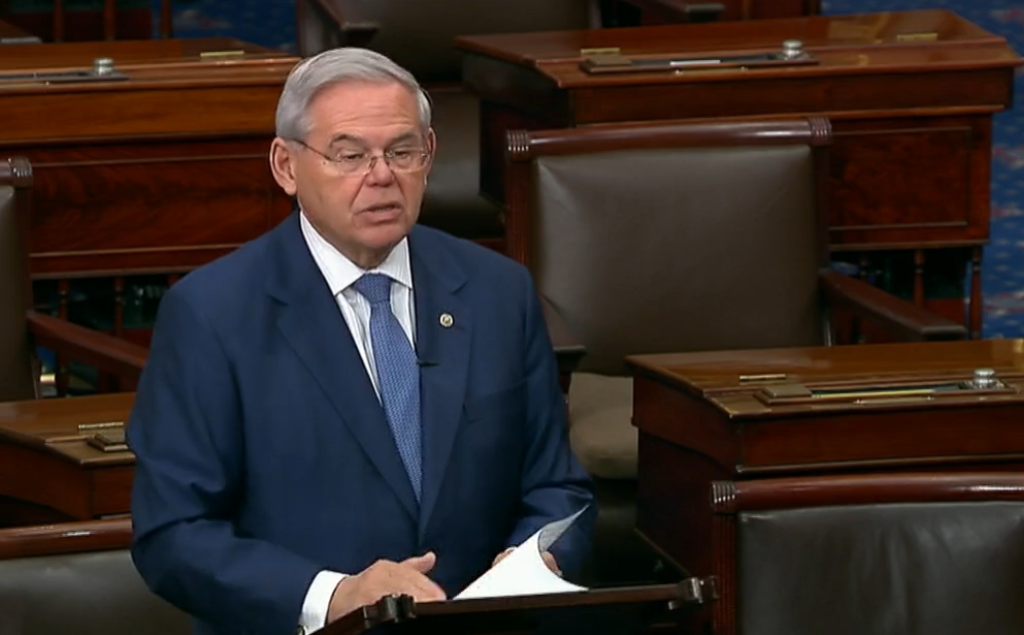

NEWARK, N.J. – U.S. Senator Bob Menendez, chair of the Sandy Task Force, today announced legislation to forgive debt owed to the federal government by municipalities and homeowners recovering from Superstorm Sandy to help provide relief to cash-strapped towns and residents coping with the COVID-19 pandemic. Congressmen Andy Kim (N.J.-03) and Frank Pallone, Jr. (N.J.-06) are introducing companion legislation in the House of Representatives.

“As New Jerseyans and the communities they call home struggle to flatten the curve and fight this pandemic, the last thing they should have to worry about is facing federal government clawbacks from the assistance they needed to recover from a previous natural disaster like Superstorm Sandy,” said Sen. Menendez. “With expenses soaring to combat COVID-19 and revenues drying up due to the necessary emergency shutdown orders, communities need to prioritize their limited resources to keeping their residents safe and maintaining essential services. It’s equally unconscionable for the federal government to claw back millions in aid from Sandy survivors still struggling to rebuild their lives as unemployment skyrockets and the economy falling deeper into recession. The least the federal government can do at this trying time is to alleviate this unnecessary to burden to returning life back to normal.”

“New Jersey is recovering from two crises right now; the impact of COVID-19 on our state and the lingering effects of Superstorm Sandy. It’s time we took action to help our local mayors and homeowners to give them a fighting chance to stay on their feet during these historically tough times,” said Rep. Kim. “I want to thank Chairman Pallone, Senator Menendez and our local officials throughout Ocean County who have all come together to craft this important bill. I know together, we’ll get it passed and give our neighbors the relief they need.”

“Our communities and residents faced extraordinary financial strain as a result of Superstorm Sandy’s devastation. The coronavirus pandemic has only exacerbated the economic outlook for many of our communities that are still working to recover from Sandy’s destruction. The Security After Sandy Act will forgive Community Disaster Loans still owed by towns from Superstorm Sandy and provide relief for families facing ‘clawbacks’ for government aid received during the disaster,” said Rep. Pallone. “This financial relief will go a long way to help hardworking New Jersey families who are still recovering from Sandy and to aid our municipalities who are facing budget shortfalls as they provide critical services to New Jerseyans during the pandemic. I want to thank Congressman Kim and Senator Menendez for their leadership on this critical piece of legislation.”

The Security After Sandy Act provides direct relief to communities by forgiving all Community Disaster Loans (CDLs) from January 1, 2016 to January 1, 2020, which includes all Sandy loans. The CDL program supports local governments with significant tax and other major revenue losses after major disasters. While the program provided critical emergency support for many communities after Sandy, the loan recipients are being asked to pay back those loans at a time when localities are projecting extraordinarily steep revenue declines due to constricted economic activity as a result of COVID-19.

The bill would also help New Jersey homeowners forced to pay back aid that was disbursed in the aftermath of Sandy by stopping any further recoupment efforts for debt owed to the federal government in relation to Sandy and other major declared disasters between 2006 and 2020. These recoupment efforts, also known as “clawbacks”, have blindsided many, because it was under the federal government’s own recommendation that many New Jersey residents applied for loans and benefits offered by various federal programs without clear guidance on repayment terms and contingencies.