Murphy Signs Legislation Temporarily Extending Deadlines for Property Tax Appeals and Decisions

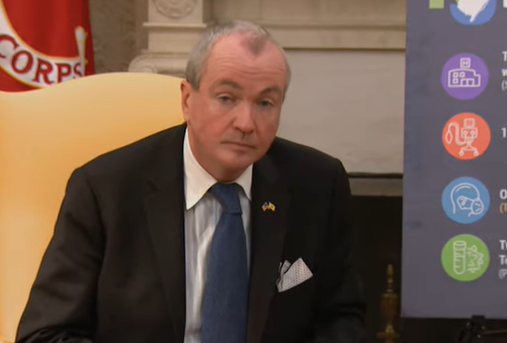

Governor Murphy Signs Legislation Temporarily Extending Deadlines for Property Tax Appeals and Decisions

TRENTON – Governor Phil Murphy today signed legislation (A4157), which temporarily extends the deadline to file a property tax appeal to July 1, 2020, and the deadline for county boards of taxation to render decisions in tax appeal cases to September 30, 2020. The bill takes effect immediately and applies retroactively to April 1, 2020.

“Our current public health crisis has substantially disrupted many of our routine processes, including the ability of New Jersey homeowners to file timely property tax appeals,” said Governor Murphy. “Establishing clear dates for tax appeals and decisions will eliminate the potential for a backlog that would only cause further fiscal uncertainty for taxpayers and municipal governments.”

"The current pandemic has no doubt strained the processes individuals would need to navigate to successfully file an appeal on their property tax assessment,” said Assemblymembers Raj Mukherji and Gordon Johnson in a joint statement. “Giving homeowners and counties time, by extending deadlines, is therefore critical to ensure properties can be fairly assessed and appeals adequately processed. And for families it provides an opportunity to generate savings on tax payments, particularly when many have lost income and become financially vulnerable.”

“The COVID shutdown made it difficult, if not impossible, for many taxpayers to file their appeals by the deadlines which normally fall between April 1 and May 1, a period when many government offices were closed to visitors,” said Senator Paul Sarlo. “This will provide tax payers more time to file appeals and ensures that decisions will be rendered this year so that successful appellants can receive refunds this year. This is a temporary move in response to the crisis we are all experiencing.”

“The extent and duration of the current public health emergency could mean that property tax appeals for the current tax year may not be resolved until 2021, which could create a backlog of appeals that may ultimately delay their resolution,” said Senator Joseph Cryan.“This bill would establish a date certain for filing appeals so that residents and local officials can better manage their finances during these difficult times.”