NJCPA Responds to Governor Murphy’s Proposed FY 2021 Budget

NJCPA Responds to Governor Murphy’s Proposed FY 2021 Budget

Statement by Ralph Albert Thomas, CPA (DC), CGMA

CEO and Executive Director

New Jersey Society of Certified Public Accountants

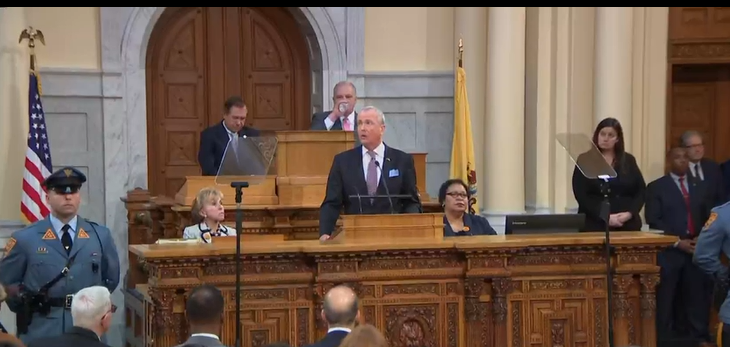

Today, Governor Phil Murphy delivered a budget address with significant consequences for New Jersey’s future. There’s much at stake. New Jersey is facing a fiscal crisis and we are not committing ourselves to the difficult decisions that will put the state on sound financial footing.

The state’s total long-term obligations soared to over $200 billion, according to the Department of Treasury’s most recent accounting. That’s nearly five times the size of the state’s annual budget. According to a New Jersey Business & Industry Association (NJBIA) analysis of state revenues, expenses and debt found in New Jersey’s Comprehensive Annual Financial Reports, state revenues increased 23 percent from 2007 to 2017, while state expenses have increased 45 percent and state debt increased 382 percent during the same period. That’s a big difference.

New Jersey needs a more competitive economy, not just for the businesses operating here and their executives, but for the middle-income employees who depend on these businesses for their livelihood. According to NJBIA’s 2020 Business Climate Analysis, New Jersey has the least-competitive business climate in the region. Compared to the six other states in the region, New Jersey had the highest top income tax rate (10.75 percent), top corporate tax (10.5 percent), state sales tax (6.625 percent) and property taxes paid as a percentage of income (5.05 percent). This is on top of New Jersey’s onerous regulatory climate.

We applaud the Governor for not including in his proposed budget an increase in New Jersey’s sales tax and changes to the state’s overall corporate business taxes, but his proposal to expand the millionaires’ tax will drive high-earning residents and their tax dollars out of the state and hurt small businesses that flow their income taxes through personal returns, while doing nothing to address New Jersey's ballooning pension liability.

The only way to solve the state’s debt problem is through pension and benefit reform, which is why the NJCPA continues to endorse Senate President Sweeney’s “Path to Progress” package of bills that would, among other things, shift from the current defined benefit pension system to a sustainable hybrid system and change benefits for new public workers, which could save the state millions of dollars a year.

The NJCPA has long advocated for policies that will generate economic growth and a fair tax system that enables companies and individuals to thrive. We are concerned that the increased spending and revenue raisers in the Governor’s budget will have far-reaching consequences, affecting New Jersey’s ability to grow and attract business.

NJCPA members serve tens of thousands of businesses and individuals. They are on the front lines of the state’s economy, in the trenches with the people who make the thousands of decisions every day, big and small, that shape New Jersey’s economic climate. Our members are, by and large, practical and realistic. They know that the state can’t tax its way to prosperity.

Our members already hear objections about New Jersey’s high taxes from clients who are looking to leave New Jersey. In a member survey, 75 percent said they have recommended to some clients that they move out of state. In short, the proposed budget plan will be counterproductive.

We need to work together to provide an environment that not only fosters growth but adapts quickly to changing business needs. The NJCPA stands ready to be a resource to the Governor.

# # #

The New Jersey Society of Certified Public Accountants, with more than 14,000 members, represents the interests of the accounting profession and advances the financial well-being of the people of New Jersey. The NJCPA plays a leadership role in supporting the profession by providing members with educational resources, access to shared knowledge and a continuing effort to create and expand professional opportunities.