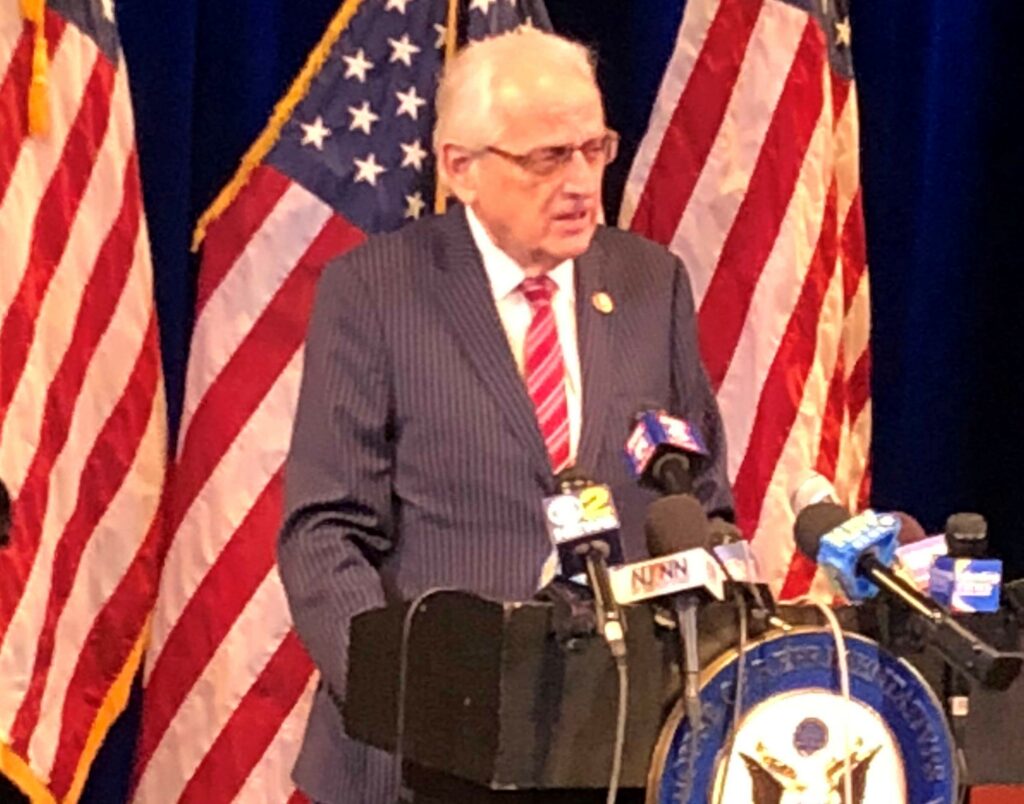

Pascrell, Arrington Introduce FAIR TARIFF Act

Pascrell, Arrington Introduce FAIR TARIFF Act

Bipartisan legislation would provide relief to American importers who have suffered under unfair tariff policies

WASHINGTON, D.C. – U.S. Reps. Bill Pascrell, Jr. (D-NJ-09) and Jodey Arrington (R-TX-19) today introduced the For Accurate Import Relief To Aid Retailers and Importers of Foreign Freights (FAIR TARIFF) Act. The bipartisan bill would alleviate some of the costs American importers incur from the unfair process through which foreign tariffs were imposed, helping to shift the financial burden from American importers back to European producers.

“It is wrong that American importers, rather than European producers, pay a pricey penalty for goods in transit when those goods had already been purchased before the tariff went into effect. Dead wrong,” said Rep. Pascrell, New Jersey’s only member of the House Ways and Means Subcommittee on Trade. “The World Trade Organization ruled in favor of our importers and yet, because some goods take weeks to arrive in port, American firms have not yet received their due and have continued to bear a heavy financial burden. Our plan will remedy an oversight and provide a key refund to American importers who have been suffering through this trade policy chaos.”

“I commend this Administration’s continued fight to protect our nation’s interests in global trade at the World Trade Organization,” said Rep. Arrington. “However, despite the WTO’s favorable ruling that allowed the U.S. to take countermeasures against the European Union, American importers were left to bear unfair penalties on goods already in transit. By rightfully shifting the burden of these retaliatory tariffs back to European producers as intended, this America-first legislation will ensure that the cost of tariffs doesn’t fall on the backs of faultless American businesses or consumers.”

The United States and the European Union (EU) have long claimed that the other either directly or indirectly subsidizes their domestic civil aircraft industries, specifically Boeing (U.S.) and Airbus (EU). Following intense negotiations, in 1992 both government sides concluded a deal placing limits on government subsidies affecting the aircraft industry. Citing dissatisfaction with EU compliance, in 2004 the United States resorted to the WTO dispute settlement system and withdrew from the agreement. In 2018, the WTO Appellate Body issued a final decision in favor of the United States, which upheld a 2016 ruling that the EU and several of its member States improperly subsidized Airbus.

On October 2, 2019, the World Trade Organization (WTO) concluded that the United States could impose $7.5 billion annual countermeasures. In response to this report, the United States Trade Representative (USTR) imposed additional duties on products from certain EU countries on October 9, 2019, including wine, spirits, olive oil, seafood, and coffee, and consumer and industrial products.

However, many of these same American companies had goods already in transit to the United States that were due to arrive after October 18 when the tariffs went into effect. Nearly every product impacted by these tariffs is imported to the United States from Europe by sea, which takes about 40 days to the Port of Seattle, 30 days to the Port of Los Angeles, and 25 days to the Port of Houston.

To reverse the burden of the tariffs on these goods in transit, Pascrell’s FAIR TARIFF Act provides a limited refund to American importers to ensure European producers rightfully bear the entire burden of the WTO approved countermeasures. Current co-sponsors of the legislation include: Brian Higgins (D-NY-26), Jackie Walorski (R-IN-02), Terri Sewell (D-AL-07), Brad Wenstrup (R-OH-02), Jimmy Panetta (D-CA-20), Steve Chabot (R-OH-01), Paul Tonko (D-NY-20), Francis Rooney (R-FL-19) Peter A. DeFazio (D-OR-04), Janice D. Schakowsky (D-IL-09), Reps. Chellie Pingree (D-ME-01), Jackie Speier (D-CA-14), Jose E. Serrano (D-NY-15), Joe Cunningham (D-SC-01), Anthony Brindisi (D-NY-22), Mark Amodei (R-NV-02), and Jenniffer González-Colón (R-PR).

Supporters of the legislation include the American Distilled Spirits Association, Association of Food Industries, Retail Industry Leaders Association, National Association of Beverage Importers, National Grocers Association, National Restaurant Association, National Retail Federation, North American Olive Oil Association, Specialty Food Association, and Wine and Spirits Wholesalers.

From his position on the powerful House Ways and Means Committee, Rep. Pascrell has led the defense of American firms and importers in Congress. Most recently, he and Rep. Arrington urged U.S. Trade Representative Robert Lighthizer to prevent additional duties on olive oil imports. The U.S. is the largest importer of olive oil, about 70 percent of which comes from the EU.

###