Pascrell Calls on Federal Reserve to Aid States

Pascrell Calls on Federal Reserve to Aid States

Buying up municipal debt would help localities meet crushing Covid costs

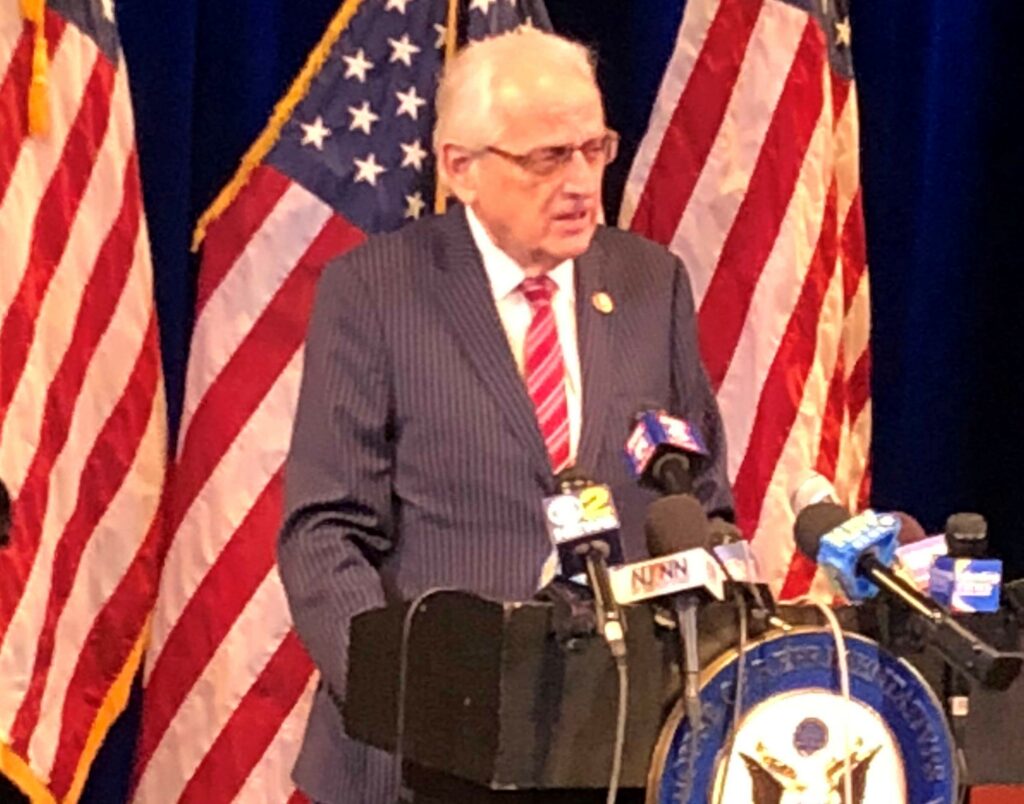

PATERSON, NJ – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09) today wrote to Federal Reserve Chairman Jerome Powell calling on the Fed to begin buying up municipal debt to give state and local governments flexibility to defeat the COVID-19 pandemic.

“The burdens weathered by our state, city, and local governments will be astronomical. Many are already now contemplating significant budgetary cuts, many of which will likely impact essential services including education, social service programs, mass transit, and access to health care. Such cuts will place even greater weight on the shoulders of our neighbors and render any future recessions more severe. We must use every tool in our toolbox to help our communities,” Rep. Pascrell writes Chairman Powell.

Section 4000(b)(4) of the just-passed Coronavirus Aid, Relief, and Economic Security (CARES) Act directs the Fed to buy municipal debt, but that instruction is not mandatory. Additionally, the authority to take this action is codified by Section 14(b)(2) of the Federal Reserve Charter.

A copy of Rep. Pascrell’s letter is available here, the text of which is provided below.

April 6, 2020

Jerome Powell, Chairman

Federal Reserve

20th Street and Constitution Ave NW

Washington, D.C. 20551

Dear Chairman Powell:

In their fight to defeat the COVID-19 pandemic on the frontlines, our cities and states are facing crushing financial costs.[i] The Coronavirus Aid, Relief, and Economic Security (CARES) Act just signed into law includes a provision which instructs the Federal Reserve to buy municipal debt,[ii] a power which the Fed already holds. I write to you today to urge you to use your power to exercise that authority to save our communities from possible calamity.

The burdens weathered by our state, city, and local governments will be astronomical. Many are already now contemplating significant budgetary cuts, many of which will likely impact essential services including education, social service programs, mass transit, and access to health care. Such cuts will place even greater weight on the shoulders of our neighbors and render any future recessions more severe. We must use every tool in our toolbox to help our communities.

Under Section 14(2)(b) of the Federal Reserve charter, the Fed has the power to buy up municipal debt issued by governments at the state and local levels.[iii] Importantly, the Fed’s authority to do this is limited to that state debt that is short-term with maturities of six months or less. But nothing would prevent the Fed from purchasing all existing municipal debt while states and localities periodically rolled over their bonds with the Fed every six months.[iv] Doing this would better allow state and local governments to focus on the fight against COVID while giving them enormous flexibility to avoid making savage reductions to essential services that Americans rely on in their daily lives.[v]

The Fed’s aversion to involving itself in state and local borrowing is well-known and longstanding. But extraordinary times demand extraordinary measures – and bold leadership to effectuate them. It is my firm belief that the negative impacts of the Great Recession begun in 2008 were exacerbated by the Fed’s failure to take complete action on behalf of everyday Americans and its refusal to invoke Section 14(2)(b) as suggested here. The accompanying years-long recovery forced unbearable cuts[vi] on our states that may well be matched or exceeded following this current crisis.[vii] I hope you can pursue this course and help our states in a time of dire need.

We are all in this together. Thank you for your prompt attention to this matter.

Sincerely,

Bill Pascrell, Jr.

Member of Congress

###

[i] See https://www.politico.com/news/2020/03/19/coronavirus-governors-state-budgets-136190; https://dailygazette.com/article/2020/03/26/cuomo-proposes-rolling-budget-cuts-to-absorb-impact-of-covid-19

[ii] S. 3550, section 4003(b)(4) (Public Law No: 116-136)

[iii] https://www.federalreserve.gov/aboutthefed/section14.htm

[iv] See https://rooseveltinstitute.org/wp-content/uploads/2017/11/Monetary-Policy-Toolkit-Report-1.pdf

[v] https://medium.com/@skanda_97974/the-fed-can-and-should-support-state-government-efforts-to-respond-to-covid-19-right-now-5e5ecf7b7ed8

[vi] https://www.epi.org/blog/years-austerity-counting/

[vii] https://www.bloombergquint.com/onweb/muni-bond-liquidity-crisis-hits-governments-with-rates-up-to-11