Pascrell-Gomez-Menendez Bill to Make Student Loan Debt Forgiveness Tax-Free Passes Congress

Pascrell-Gomez-Menendez Bill to Make Student Loan Debt Forgiveness Tax-Free Passes Congress

Major relief for student borrowers included in landmark American Rescue Plan

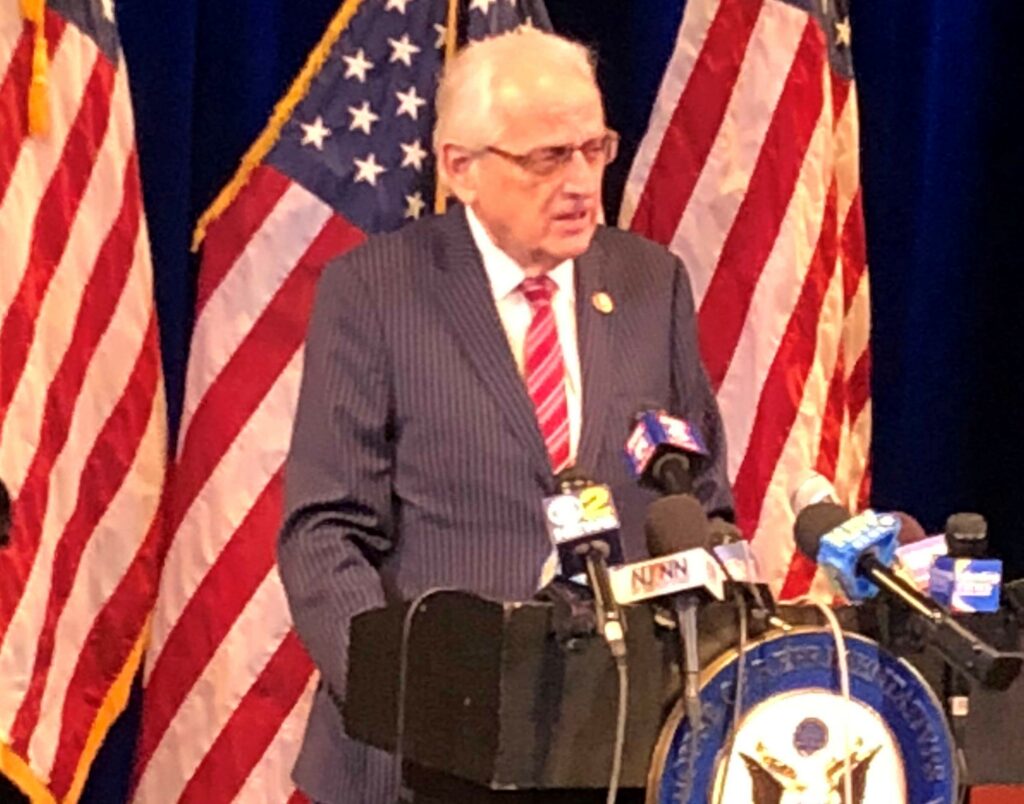

WASHINGTON, DC – Today, legislation introduced by U.S. Reps. Bill Pascrell, Jr. (D-NJ-09), Jimmy Gomez (D-CA-34), and Senator Bob Menendez (D-NJ) to make student loan forgiveness tax-free was approved by the United States Congress and sent to the White House for President Biden’s signature. This milestone relief for student borrowers was included in the American Rescue Plan, comprehensive relief and stimulus legislation passed by Democrats today to confront the dual threats of the continuing pandemic and its economic fallout.

“Government exists to share the burden of daily life and do good in Americans’ lives,” said Rep. Pascrell. “For tens of millions of Americans carrying debts to pay for their educations, the burden can be crippling. By freeing student borrowers from the weight of heavy taxes, we are today giving millions of Americans the opportunity to continue life with a cleaner slate. I thank my colleague Representative Jimmy Gomez for his leadership. So many lives can be changed for the better through our plan to make loan forgiveness tax-free.”

“Student loan debt is a trillion-dollar industry that is crippling graduates of all ages and backgrounds nationwide, especially first-generation students and people of color,” said Rep. Gomez. “This crisis is so severe that it impacts people even decades after graduation, including myself. While my colleagues and I continue to push President Biden to cancel student through executive action, my legislation will be critical in ensuring working Americans aren’t penalized for any potential government relief. With the passage of the American Rescue Plan Act that includes our tax-free student loan forgiveness legislation, we’re one step closer to the reality of broad student loan debt cancellation for millions of Americans.”

“Millions of Americans were already drowning under a mountain of student loan debt before getting hit with the economic impact of COVID-19. And when they’re lucky enough to get some relief, the government shouldn’t then tie a heavy tax anchor around their financial life line,” said Senator Menendez. “We now have a tremendous opportunity to relieve this paralyzing weight and that opportunity should not be jeopardized by an arbitrary tax bill on unrecognized income. I’m hopeful this will pave the way for President Biden to provide real debt relief so many student borrowers need and give a boost to our economy that benefits everyone.”

Under current law, most student loan forgiveness, including forgiveness through federal income-driven repayment plans, is treated as additional taxable income. This often pushes borrowers into higher tax brackets and leaves them saddled with a crippling tax payment on their forgiven loans.

The Pascrell-Gomez-Menendez bill would exclude the full or partial forgiveness of any college loan between December 31, 2020 and January 1, 2026 from a borrower’s income. This relief applies to public, private, and institutional loans. For example, a family of four that earns $100,000 per year and has $50,000 in college loans forgiven could receive more than $10,000 in federal tax savings under this legislation.

###