Pascrell, Kelly Call for Report on Faulty IRS Notices

Pascrell, Kelly Call for Report on Faulty IRS Notices

House Ways and Means oversight heads demand review of millions of new notices being sent amidst tremendous agency backlog

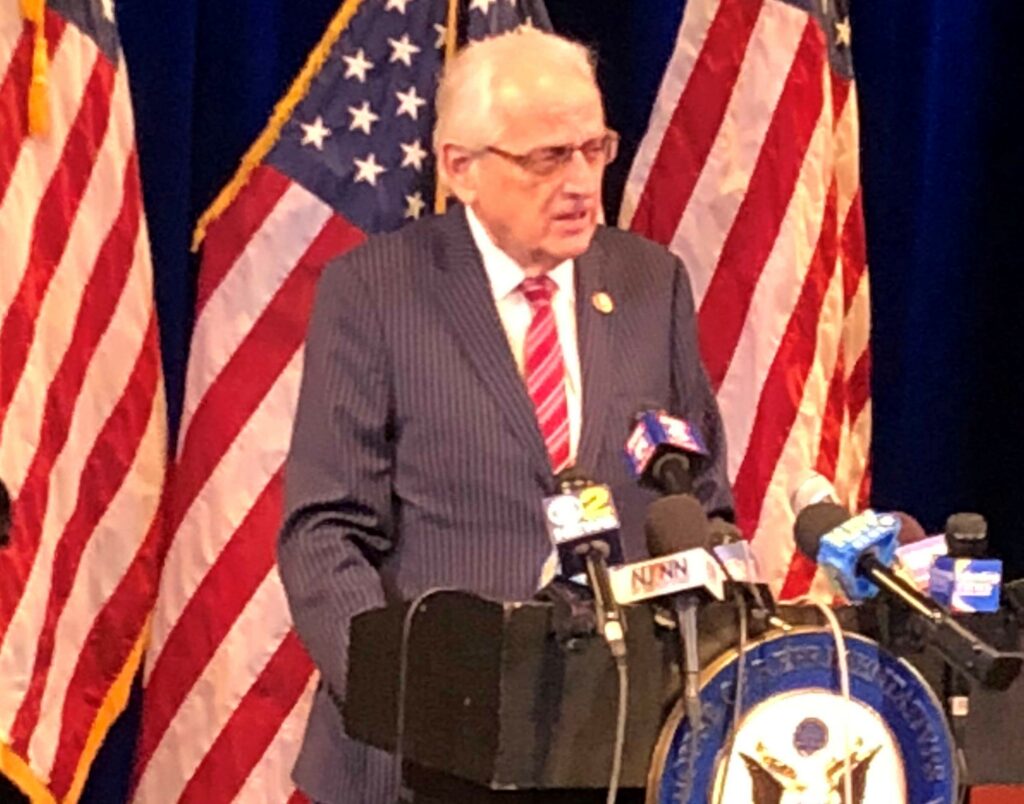

WASHINGTON, DC – U.S. Reps. Bill Pascrell, Jr. (D-NJ-09) and Mike Kelly (R-PA-16), the Chairman and Ranking Member of the House Ways and Means Subcommittee on Oversight, have written to the Treasury Inspector General for Tax Administration (TIGTA) seeking a review of potentially erroneous notices being printed or sent by the Internal Revenue Service (IRS).

“Today, the National Taxpayer Advocate reports that 11 million notices were computer generated in November but not mailed and, while some of these have been discarded by the IRS, approximately 5 million of those notices will be mailed in December and January,” the members write. “[W]e welcome TIGTA’s recommendations for actions that can be taken by IRS to prevent the issuance of untimely or erroneous notices.”

TIGTA responded to a similar letter from full committee Chairman Richard Neal and then-subcommittee Chairman John Lewis on the confusion arising from erroneous IRS notices earlier this year.

Reps. Pascrell and Kelly have been active in pursuing IRS oversight. Last week, the members wrote the IRS Commissioner and TIGTA seeking urgent answers on whether the recent government cyberattack compromised any Americans’ taxpayer information.

The text of the members’ letter is provided below.

December 22, 2020

The Honorable J. Russell George

Inspector General

Treasury Inspector General for Tax Administration

U.S. Department of the Treasury

1401 H Street, NW, Suite 469

Washington, D.C. 20220

Dear Inspector General George,

In June, you reviewed the Internal Revenue Service’s (IRS) issuance of erroneous notices for the Committee on Ways and Means (Committee).

Today, the National Taxpayer Advocate reports that 11 million notices were computer generated in November but not mailed and, while some of these have been discarded by the IRS, approximately 5 million of those notices will be mailed in December and January. These notices include the notice of tax due and demand for payment.[1]

On June 30, 2020, you addressed the issue of IRS’s erroneous notices in a response to the Committee. We respectfully request that the Treasury Inspector General for Tax Administration (TIGTA) provide a similar review of the current notice including: TIGTA’s concerns with respect to the mailing of these notices; the number of notices printed and mailed; and who reviewed and approved these notices. Further, we welcome TIGTA’s recommendations for actions that can be taken by IRS to prevent the issuance of untimely or erroneous notices. A response in early January is requested.

As always and again, your assistance is appreciated.

Sincerely,

###

[1] NTA Blog: IRS Notices Delayed (Again): Look for Insert With Revised Deadlines for Certain Notices - Taxpayer Advocate Service