Pascrell Opening Statement at Oversight Subcommittee Hearing on 2021 Tax Filing Season

Pascrell Opening Statement at Oversight Subcommittee Hearing on 2021 Tax Filing Season

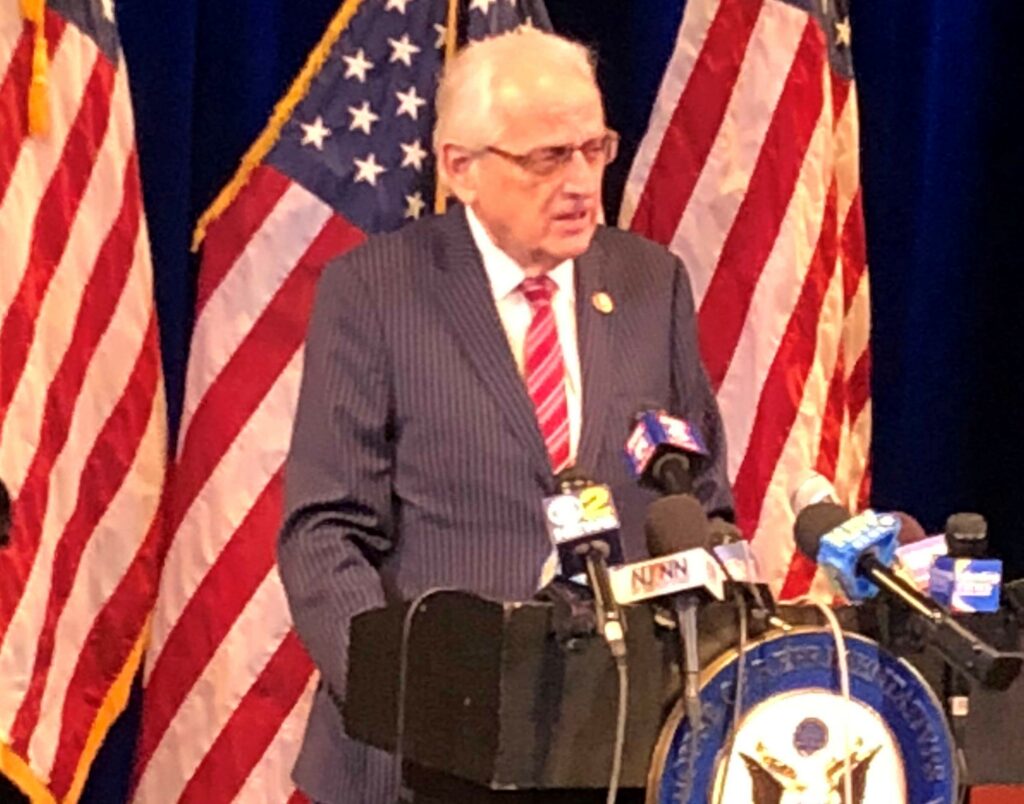

WASHINGTON, DC – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09), the Chairman of the House Ways and Means Subcommittee on Oversight, today issued the following statement at the opening of the panel’s hearing this afternoon on the 2021 Tax Filing Season with IRS Commissioner Charles Rettig.

Chairman Pascrell Opening Statement (as prepared for delivery)

Good afternoon and welcome to our second hearing of the Oversight Subcommittee in the 117th Congress.

Today’s hearing could not be timelier. The Commissioner of the IRS, Charles Rettig, is testifying today on the 2021 filing season.

This is a usual subject of oversight by our panel. But there is nothing normal about this year’s filing season for either taxpayers or the IRS.

The pandemic created chaos for taxpayers trying to prepare their returns. And it has created disorder for the IRS, which is still having a difficult time answering taxpayers’ questions and simply processing their returns.

When the pandemic first struck one year ago, the IRS wisely extended the filing deadline to July 15. This was necessary to aid taxpayers in addressing the unprecedented disruption caused by the pandemic. And it also allowed the IRS to address the additional burdens it faced in disbursing the first round of stimulus checks.

I am pleased that after several letters and other requests from the Oversight Subcommittee and our House colleagues, the Commissioner has agreed with us that the deadline needs to be extended this filing season as well. For now, the IRS has decided to move the deadline to Monday, May 17th.

We will continue to consult with the Commissioner and will monitor IRS activities as the filing season progresses to determine if more time might be necessary. But for now, I appreciate the Commissioner’s willingness to heed our calls for relief for our constituents.

We will also ask the Commissioner why millions of struggling families never received their first two rounds of direct checks from our COVID relief packages. We need to understand why to make sure that this does not happen with the third round just enacted in the American Rescue Plan.

The Commissioner must also update us on the status of the gigantic backlog. This includes 2019 returns filed last year. These returns must be processed now so taxpayers can get the money they are owed. Many of these taxpayers have been receiving erroneous notices saying they haven’t timely filed. We have demanded that these notices must stop but we keep hearing horror stories of the IRS sending confusing, incorrect notices to struggling taxpayers.

And I am also looking forward to resuming my discussion with the Commissioner about the two-tier tax system that has developed at the IRS: one for the wealthy and another one for the average American taxpayer. The IRS audits poor people for spare change while millionaire scofflaws loot the treasury. I am anxious to learn in detail how efforts are proceeding on increasing audits of high-income, high-wealth taxpayers.

Finally, I hope the Commissioner can update us on when the Administration will transmit Donald Trump’s tax returns to this Committee pursuant to the Committee’s request and the clear letter of the law. Our request has languished at the IRS for over 23 months.

Let me turn now to the Ranking Member, Mr. Kelly, for his opening remarks. Mr. Kelly, you are recognized for 5 minutes.