Pascrell, Panetta Demand Trump Administration Stop Any Delays to Relief Payments

Pascrell, Panetta Demand Trump Administration Stop Any Delays to Relief Payments

Letter to Treasury Secretary decries potential delays, red tape for seniors

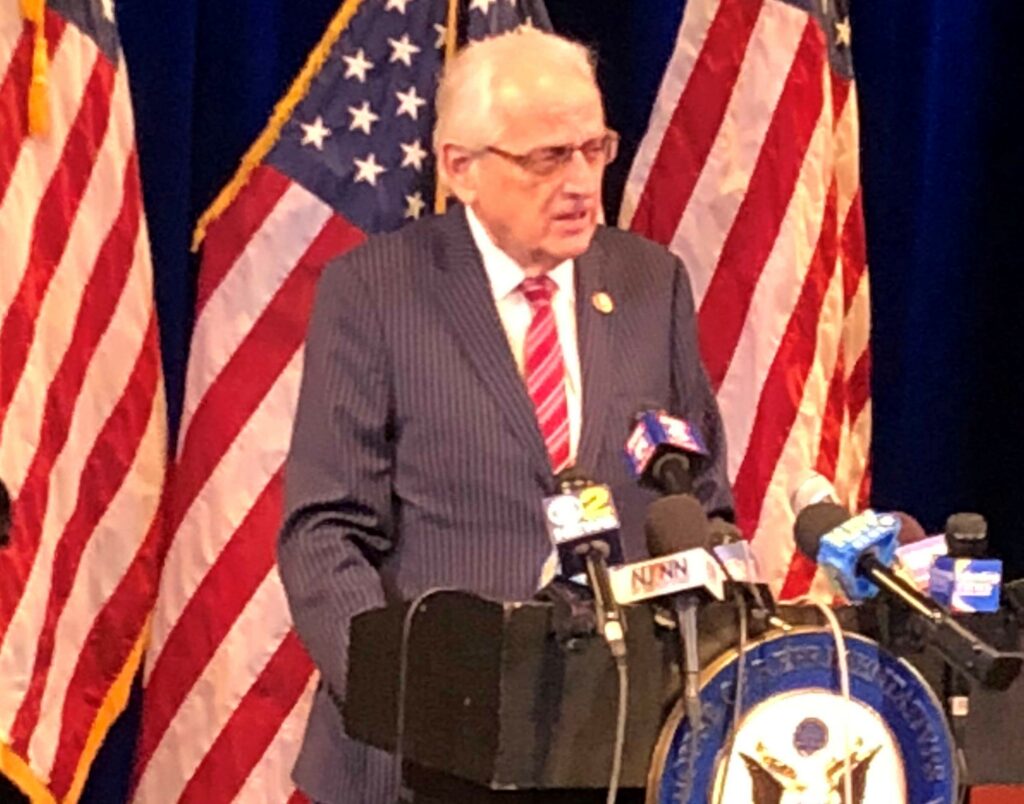

PATERSON, NJ – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09) and Jimmy Panetta (D-CA-20), members of the tax-writing House Ways and Means Committee, wrote to U.S. Treasury Secretary Steven Mnuchin objecting to guidance issued by the Internal Revenue Service on the recently-passed Coronavirus Aid, Relief, and Economic Security (CARES) Act which could result in delaying the disbursement of relief checks to Americans, including senior citizens, Social Security recipients, veterans, and the disabled.

“The immediate delivery of these payments is essential. For taxpayers that have filed 2018 and/or 2019 returns, the IRS can easily verify income levels and issue payments electronically for those that have provided direct deposit information. However, your actions have created delay and confusion for the millions of individuals who do not normally file returns to receive the payment to which they are entitled,” Pascrell and Panetta write.

The CARES Act provides that all individuals below an income threshold of $75,000 for individuals and $150,000 for married couples will receive $1200 and qualifying children will receive $500. The new guidance issued by the IRS will likely force many of these Americans in desperate need of their relief checks to file extra paperwork first – in direct contravention of Congress’s intent and common sense.

“Your failure to do so will likely result in many Americans never receiving the assistance to which they are entitled during this perilous time,” the letter concludes.

A copy of Reps. Pascrell and Panetta’s letter is available here, the text of which is provided below.

March 31, 2020

Dear Mr. Secretary:

The guidance (IR-2020-61) issued yesterday by the Internal Revenue Service on the recovery rebates enacted in the CARES Act (the “Act”) ignores clear congressional intent to swiftly distribute funds. The Act provides that all individuals below an income threshold of $75,000 for individuals and $150,000 for married couples will receive $1200 and qualifying children will receive $500. This includes individuals who do not typically file tax returns, such as low-income individuals and couples, senior citizens, Social Security recipients, some veterans and individuals with disabilities.

The immediate delivery of these payments is essential. For taxpayers that have filed 2018 and/or 2019 returns, the IRS can easily verify income levels and issue payments electronically for those that have provided direct deposit information. However, your actions have created delay and confusion for the millions of individuals who do not normally file returns to receive the payment to which they are entitled. For those individuals who are Social Security benefit recipients, the Social Security Administration (SSA) already has the necessary information to make these payments, which can be shared with the IRS under current law.

Requiring non-filers to file with the IRS is extremely burdensome and confusing for the typical non-filer-senior citizens, low-income Americans, veterans, and the disabled. Moreover, in many cases, as noted above, it is wholly unnecessary as the government already has the information. We understand that there are some individuals that will need to provide information to the IRS because they are not picked up by SSA data collection. But this should be the clear minority of non-filers.

To provide vulnerable and needy Americans with the payments they deserve as quick and painlessly as possible, we call on you to ask the SSA to share this information and utilize the data already at the federal government’s fingertips. Your agency must immediately work to coordinate across the government. Your failure to do so will likely result in many Americans never receiving the assistance to which they are entitled during this perilous time.

Sincerely,

###