Pascrell, Porter, DeLauro Call Out Government COVID Favoritism of Private Equity

Pascrell, Porter, DeLauro Call Out Government COVID Favoritism of Private Equity

While community hospitals struggle, Trump administration lavishes interest free loans on billion-dollar Wall Street firms

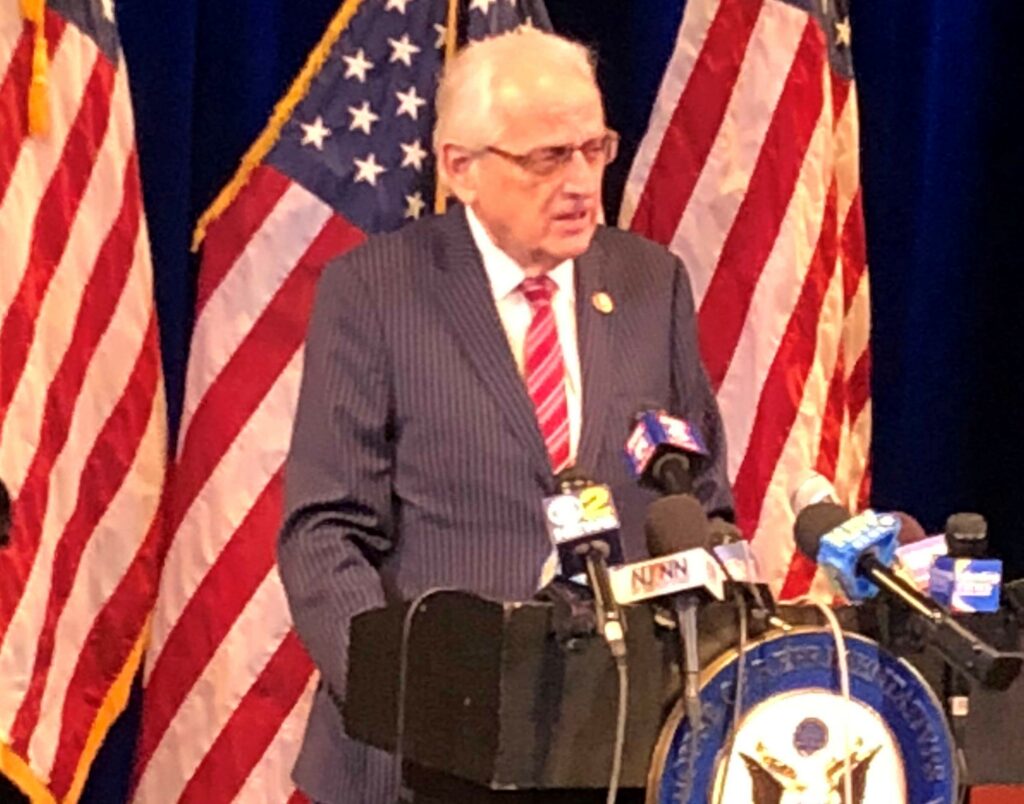

PATERSON, NJ – U.S. Reps. Bill Pascrell, Jr. (D-NJ-09), Katie Porter (D-CA-45), and Rosa DeLauro (D-CT-03) today wrote to U.S. Health and Human Services (HHS) Secretary Alex Azar demanding answers to HHS and the Centers for Medicare and Medicaid Services (CMS) providing at least $1.5 billion interest-free loans to health care companies owned by multi-billion dollar Wall Street private equity firms while community hospitals increasingly falter under enormous losses fighting COVID-19.

“As hospitals across our country desperately clamor for support,” the members write, “we are disturbed that CMS is focusing time and resources approving loans for private equity-backed providers. These private equity firms can provide funding that other hospitals lack. Instead of looking to their for-profit owners for investments, private equity owned hospitals are abandoning their responsibilities to patients and communities. By giving health care companies owned by wealthy private equitable firms interest-free loans, you are enabling these destructive decisions.”

In recent years, private equity funds have acquired hundreds of health care companies, including large hospitals. Private equity firms have a profit-based mission, which is at odds with the goals of community hospitals, whose mission is to save lives. Private equity funds target companies in distress, using their debt to increase the fund’s profits, regardless of the effect it has on the companies. Private equity firms have little incentive to invest federal loans in a manner that benefits the public. In fact, their interests may directly conflict with those of patients and providers in need.

A copy of the members’ letter is available here and the text of the letter is provided below.

June 17, 2020

The Honorable Alex Azar

Secretary

Department of Health and Human Services

200 Independence Avenue, S.W.

Washington, D.C. 20201

Dear Secretary Azar,

We write today regarding recent reports that the Department of Health and Human Services (HHS) and the Centers for Medicare and Medicaid Services (CMS) provided health care companies owned by multi-billion-dollar private equity firms with interest-free loans.[i] As hospitals across our country desperately clamor for support, as well as relief from the terms and conditions of the Medicare Accelerated and Advanced Payment Programs (AAP), we are disturbed that CMS is focusing time and resources approving loans for private equity-backed providers. These private equity firms can provide funding that other hospitals lack. Instead of looking to their for-profit owners for investments, private equity owned hospitals are abandoning their responsibilities to patients and communities. By giving health care companies owned by wealthy private equitable firms interest-free loans, you are enabling these destructive decisions.

The growing role of private equity firms in our health care system is a distressing trend. In recent years, private equity funds have acquired hundreds of health care companies, including large hospitals, dermatology clinics, and dental practices.[ii] Private equity ownership is often obscured by layers of limited liability corporations, making it very difficult for consumers or regulators to understand ownership. This impedes accountability. Private equity firms have a profit-based mission, which is at odds with the goals of community hospitals, whose mission is to save lives. Private equity funds target companies in distress, using their debt to increase the fund’s profits, regardless of the effect it has on the companies. Congressional intent in establishing these programs was to invest in our health care systems, not private equity firms. Our goal was to help hospitals prepare and respond to future pandemics, not give free taxpayer money to boost the profitability of private equity. Private equity funds have little incentive to invest these federal loans in a manner that benefits the public. In fact, their interests may directly conflict with those of patients and providers in need.

Community hospitals across the country are suffering significant financial losses—they’ve been required to cease routine work, treat unpredictable and costly COVID-19 cases, build temporary medical sites, increase the health care workforce, and acquire much needed resources, such as personal protective equipment (PPE) and testing supplies. This has left community hospitals nationwide in dire financial straits as they continue to be central to the COVID-19 response. The American Hospital Association estimated $202.6 billion in losses for America’s hospitals and health systems between March 1 and June 30, or an average of $50.7 billion per month.[iii] The health care workforce in hospitals nationwide also face a high risk of exposure. These workers are often forced into quarantine and separation from their families. High exposure rates also cause staffing shortages, Nationally, nearly 70,000 health care workers have been infected with COVID-19 and more than 300 have died from the virus.[iv]

As hospitals sought to shore up their finances in order to pay staff and purchase supplies, HHS moved swiftly to approve at least $1.5 billion in loans for health care companies and hospitals owned by private equity firms.[v] Many of these private equity-owned hospitals engage in surprise medical billing practices, like staffing in-network emergency rooms with out-of-network physicians and balance billing patients, which have faced congressional scrutiny. Many of these private equity firm-owned hospitals and health care companies have been behind campaigns to prevent federal action to prohibit their surprise medical billing tactics. The decision of CMS to prioritize loans for such companies when community hospitals so urgently need help is alarming

To support struggling providers, CMS expanded the AAP programs on March 28 and subsequently approved over 21,000 applications totaling $59.6 billion in payments to Medicare Part A providers, which includes hospitals, and 24,000 applications totaling $40.4 billion in payments to Medicare Part B suppliers, including doctors, non-physician practitioners, and durable medical equipment suppliers. Many community hospitals were forced to seek these payments, which come with a 10.25% interest rate and require repayment beginning as early 120 days from the receipt of the first payment. Within one month of the program’s expansion, CMS announced that it would reevaluate funds provided to Part A providers and suspend funds to Part B providers under the AAP program. Considering the concerns raised in this letter and by the reports mentioned above, CMS should include review of these loans provided to private equity-owned hospitals as part of its review moving forward.

Understanding this, we request a full accounting of the funds and loans that have been distributed so that Congress and the public can know if and how much support private equity-backed heath care companies and hospitals received. Further, we ask that:

- If CMS provides funding to private equity-owned hospitals the agency condition that funding on the requirement that no providers face furloughs or pay cuts;

- If CMS provides funding to private equity-owned hospitals, the agency require the involved private-equity owned firms to match any funding via grants or loans;

- Future distributions of funds by CMS account for a hospital’s reserve accounts as well as patients treated during for COVID-19l; and

- CMS increase transparency in the loan program by requiring ownership information and cash reserve information on any application for health care entities seeking loans.

We urge CMS to ensure that only hospitals operating in true service to their communities are provided with the resources necessary to continue operations by preventing private equity backed heath care companies and hospitals from receiving federal funds.

Thank you very much for your attention to our request. We look forward to working with you going forward on this important issue.

Sincerely,

###