Pascrell Raises Alarms at Kushner Corruption

Pascrell Raises Alarms at Kushner Corruption

Trump family members using program for underprivileged communities to reap millions

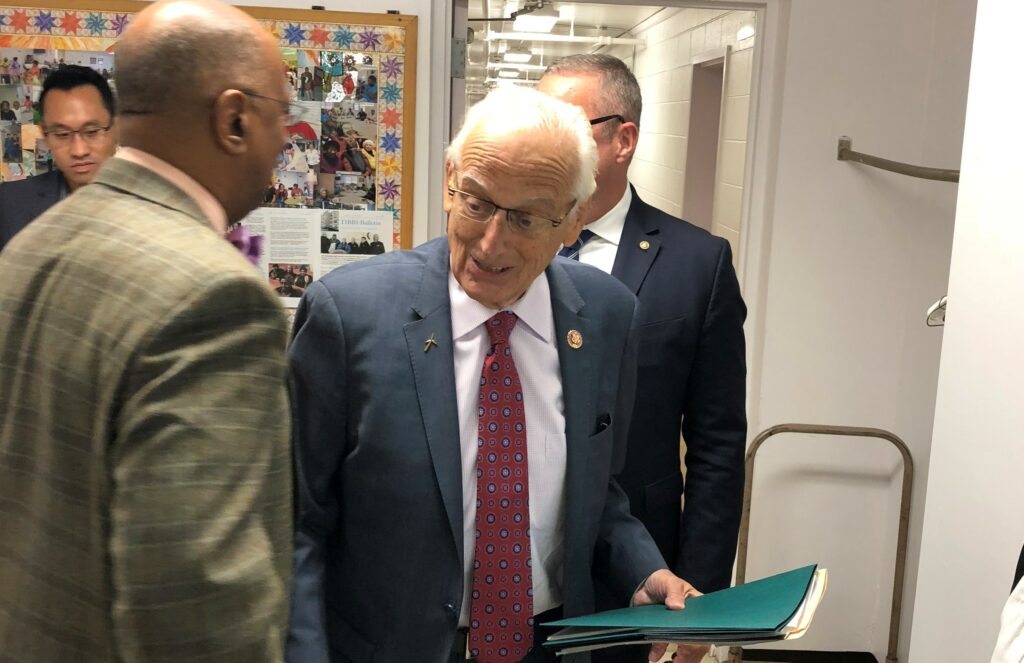

WASHINGTON, DC – U.S. Rep. Bill Pascrell, Jr. (D-NJ-09) today wrote to U.S. Treasury Secretary Steven Mnuchin on a new report that Donald Trump’s White House advisor and son-in-law Jared Kushner won up to a $50 million windfall after investing in a company that enjoyed access to the Qualified Opportunity Zones program designed to benefit impoverished and underprivileged communities.

“I write you today on the latest credible story of rampant corruption and conflicts of interest occurring within a program under your direct control. An article published by the Associated Press on March 3, 2020 reports that Donald Trump’s senior White House advisor Jared Kushner enjoyed a personal windfall ‘worth between $25 million and $50 million’ after investing in a company that had utilized the qualified opportunity zones program, which is designed to help low-income and impoverished Americans,” Rep. Pascrell writes.

Kushner was an investor in Cadre, a “digital platform for smaller investors in commercial properties” which was directly investing in several projects that had qualified for federal tax breaks as opportunity zones, though it is unclear just how much it has done so. The article further notes that Kushner “has stakes in more than a dozen properties in Opportunity Zones owned by his family firm, Kushner Cos.” Kushner himself, as well as his wife Ivanka Trump, were strong advocates for the creation of the opportunity zones tax breaks in the 2017 Republican tax scam legislation signed into law.

On October 29, 2019, Rep. Pascrell wrote Mnuchin demanding answers on a New York Times report alleging that Mnuchin broke his own department’s own guidelines in ordering that a friend of his, disgraced con artist Michael Milken, receive favorable coverage for a qualified opportunity zones tax break.

The opportunity zones program was created as part of the GOP tax scam law of 2017 to “spur economic development and job creation in distressed communities” throughout the United States. The October 26, 2019 report follows a similar exposé by the paper which found that the Trump administration was perverting the opportunity zones program to benefit millionaire real estate developers and friends and family of Donald Trump.

“Given this report, and a panoply of others detailing debasement and manipulation of the opportunity zones program by wealthy developers, politically-connected insiders, and friends and family members of Donald Trump, I despair that this important program created for good purposes has been badly warped. Therefore, please provide answers to my questions immediately,” Pascrell’s letter concludes.

A copy of Rep. Pascrell’s latest letter to Mnuchin is available here, the text of which is provided below.

March 6, 2020

The Honorable Steven Mnuchin

Secretary

United States Department of the Treasury

1500 Pennsylvania Avenue SW

Washington, D.C. 20220

Dear Mr. Secretary:

I write you today on the latest credible story of rampant corruption and conflicts of interest occurring within a program under your direct control.[i] An article published by the Associated Press on March 3, 2020 reports that Donald Trump’s senior White House advisor Jared Kushner enjoyed a personal windfall “worth between $25 million and $50 million” after investing in a company that had utilized the qualified opportunity zones program, which is designed to help low-income and impoverished Americans.[ii]

The $1.9 trillion in tax cuts that mainly went to the top 1% of Americans jammed into law by congressional Republicans in 2017 is one of the worst pieces of legislation passed by Congress in the last generation.[iii] However, its creation of qualified opportunity zones to “spur economic development and job creation in distressed communities” throughout the United States represents a noble goal which, if pursued, could be of significant benefit to millions of needy Americans.[iv] Unfortunately, those goals are not being fully realized.

The Associated Press article asserts that Mr. Kushner was an investor in Cadre, a “digital platform for smaller investors in commercial properties.” Cadre was directly investing in several projects that could benefit from federal tax breaks as qualified opportunity zones, though it is unclear just how much the company has benefited. The article further notes that Mr. Kushner “has stakes in more than a dozen properties in Opportunity Zones owned by his family firm, Kushner Cos.” We know about this because of filings released by the Office of Government Ethics on March 3, 2020. Mr. Kushner himself, as well as his wife Ivanka Trump, were strong advocates for the creation of the qualified opportunity zones tax breaks in the 2017 tax scam legislation.[v]

- Please explain if you or any employees of the Treasury Department have had discussions or consultations with Jared Kushner, Ivanka Trump, or their representatives on the qualified opportunity zones program. If so, please detail the names of those individuals and when the discussions occurred.

- Has Jared Kushner, Ivanka Trump, individuals representing them, representatives of Cadre, or other members of the Trump family directly requested your assistance or the assistance of the Treasury Department to receive a favorable designation under the qualified opportunity zones program? If so, please detail when these discussions occurred.

- Please detail what, if any, measures are taken by your department to eliminate conflicts of interest in the qualified opportunity zones program. Explain why those measures are insufficient.

- Is it appropriate for family members of the President of the United States to reap personal profits of $25 to $50 million dollars through a program created to assist Americans in impoverished and lower income areas?

- Is the qualified opportunity zones program working as was intended? If so, please explain why.

Given this recent report, and a panoply of others detailing debasement and manipulation of the opportunity zones program by wealthy developers, politically-connected insiders, and friends and family members of Donald Trump, I despair that this important program created for good purposes has been badly perverted. Therefore, please provide answers to my questions immediately.

Sincerely,

Bill Pascrell, Jr.

Member of Congress

c.c. Emory A. Rounds III, Director of the United States Office of Government Ethics

###

[i] https://pascrell.house.gov/uploadedfiles/pascrell_mnuchin_letter.pdf

[ii] https://www.syracuse.com/us-news/2020/03/jared-kushner-sells-stake-in-firm-that-benefited-from-trump-tax-breaks.html

[iii] https://pascrell.house.gov/news/documentsingle.aspx?DocumentID=2404

[iv] https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

[v] https://www.vox.com/policy-and-politics/2018/12/12/18137834/jared-kushner-ivanka-trump-opportunity-zone