Pascrell, Suozzi to Advance SALT Cap Repeal

Pascrell, Suozzi to Advance SALT Cap Repeal

Bill to reverse damage of GOP tax scam on middle-class Americans to be marked up in Ways and Means Committee

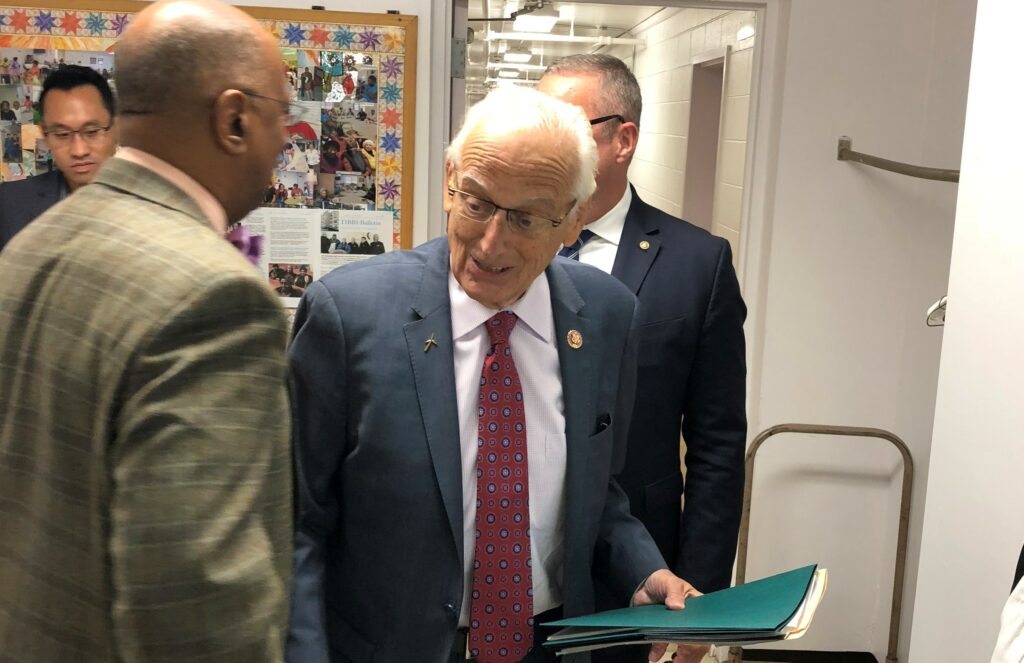

WASHINGTON, D.C. – U.S. Reps. Bill Pascrell, Jr. (D-NJ-09) and Tom Suozzi (D-NY-03) today introduced the Restoring Tax Fairness for States and Localities Act, legislation repealing the GOP imposed cap on the State and Local Tax Deduction and reacted positively to the announcement that the tax-writing House Ways and Means Committee will hold a markup of the legislation on Wednesday, December 11.

“Millions of Americans are crying out for state and local tax relief after being pummeled by the GOP tax scam,” said Rep. Pascrell, the leading member of the House demanding reversal of Republicans’ 2017 SALT cap. “The House is moving swiftly to provide that relief. As the chief sponsor of legislation to restore the full SALT deduction, I am gratified that the bedrock elements of my bill have been included in the legislation the committee will consider. New Jersey and other states are footing the bill for the 2017 big business tax cut. By reversing the destructive SALT cap we can return some of that money it to where it belongs: with middle class taxpayers. Thank you to Chairman Neal for scheduling committee action, and I appreciate the leadership of my friends Congressman Suozzi and Chairman Thompson for spearheading this effort with me.”

“Simply put, our bipartisan legislation is about restoring tax fairness in America,” said Rep. Suozzi. “The SALT cap was a punch in the gut to local communities across the country creating double taxation for homeowners whose local taxes fund essential services such as schools, police and fire departments. I am proud join in this effort with Chairman Thompson and Rep. Pascrell, who has been a leader in Congress on this issue since day one.”

The legislation would (1) eliminate the cap’s marriage penalty for 2019, enabling married taxpayers filing jointly to claim up to $20,000; (2) repeal the cap entirely for 2020 and 2021; and (3) pay for the tax relief by restoring the top income tax rate of 39.6 percent that was in effect prior to the 2017 tax scam.

Rep. Pascrell has been a leading a critic in Congress of the Republican tax scam and has repeatedly assailed the capping of the SALT deduction. Pascrell is the lead sponsor of H.R. 1142, the bipartisan Stop the Attack on Local Taxpayers Act of 2019, which would remove the cap on federal SALT deduction and also raise the top personal income tax rate to where it was before the 2017 Republican tax scam. The bill is currently cosponsored by 47 House members. Companion Senate legislation, S. 437, is sponsored by Sen. Robert Menendez (D-NJ) and currently cosponsored by 13 senators. Pascrell first authored legislation addressing importance of the state and local tax deduction in 2012. He recently offered several amendments on SALT fairness, including the amendment to eliminate the cap during Ways and Means Committee consideration of the 2017 tax bill.

###