Pascrell Votes to Restore SALT Deduction

Pascrell Votes to Restore SALT Deduction

Critical middle-class tax relief passes House 218 to 206

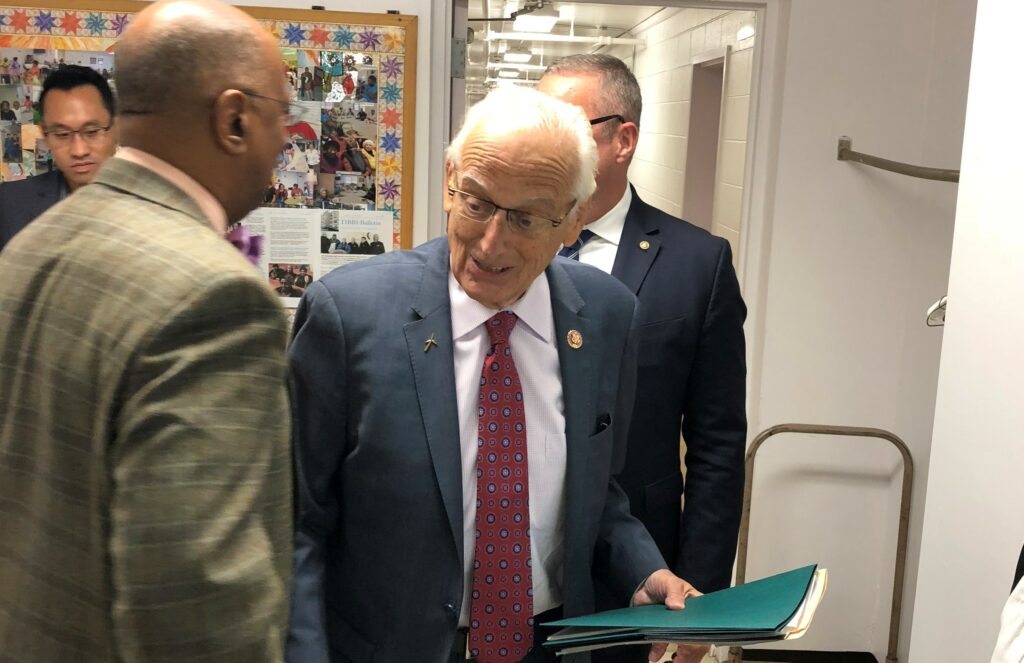

WASHINGTON, D.C. – Today, longstanding efforts led by U.S. Rep. Bill Pascrell, Jr. (D-NJ-09) to provide tax relief to millions of Americans by repealing much of the cap on the state and local tax (SALT) deduction paid off with House approval of H.R. 5377, the Restoring Tax Fairness for States and Localities Act. Today’s bill was modeled after Rep. Pascrell’s legislation, H.R. 1142, to fully repeal the SALT cap and pay for it by raising the top income tax rate back to its pre-2017 level of 39.6 percent.

The SALT deduction, which provided needed relief for middle-class families and funding streams for local services, was egregiously capped at $10,000 as part of the GOP Tax Scam bill of 2017. The $10,000 cap is far below the $18,668 average SALT deduction throughout New Jersey’s Ninth Congressional District, leaving many taxpayers with a form of double taxation.

“Last Congress, the middle-class and states like New Jersey were targeted by the destructive GOP tax scam law of 2017. It remains one of the most destructive bills we’ve ever seen here because it specifically went after vulnerable taxpayers. The principal way it did this was by capping the SALT deduction,” said Rep. Pascrell, New Jersey’s only member of the tax-writing Ways and Means Committee. “The average value of all New Jersey families’ deductions was nearly double the GOP’s $10,000 cap. Imagine that damage spread out over millions of households from coast to coast. Too many hard-working families were seeing their property values decrease while paying through the nose to fund a tax cut for big business and its executives.”

Pascrell continued, “our package today is fully paid for by restoring upper-class tax rates to their pre-2017 levels. It also includes my legislation to provide tax relief for first responders and school teachers. This bill is a carefully crafted and necessary package to provide tax fairness to our middle class, to provide tax relief to our first responders and teachers, and to enable our local communities to fund services. It has my full support and I call on the Senate to quickly take up this critical bipartisan proposal for tax fairness.”

“The Trump Tax Scam was a hit job on states like New Jersey that choose to invest in public education, police officers, firefighters, and infrastructure that improves the quality of life for all its residents. As a result, middle-class homeowners in our state are being squeezed and property values are being impacted ,” said U.S. Sen. Bob Menendez, a senior member of the Senate Finance Committee that writes national tax policy. “I’m proud to work with Congressman Pascrell in Washington to fix this injustice and he deserves credit for pushing this repeal bill through the House. It’s now time for the Senate to act to restore the full SALT deduction and provide much-needed relief for homeowners across our state.”

“The passage of H.R. 5377 is an important step toward undoing the damage brought by President Trump’s 2017 tax bill,” said Governor Phil Murphy. “I am proud to work alongside Congressman Pascrell, bill sponsors, and New Jersey’s congressional delegation to continue the fight to restore tax fairness for hardworking New Jersey taxpayers. We know this fight is not yet over, and our Administration will continue to stand with our residents and allies to restore full deductibility.”

Prior to its passage, Rep. Pascrell rallied support for H.R.5377 on the House floor. His full comments can be viewed here and a readout is provided below.

Rep. Pascrell has been a leading a critic in Congress of the Republican tax scam and has repeatedly assailed the capping of the SALT deduction. Pascrell was the lead sponsor of H.R. 1142, the bipartisan Stop the Attack on Local Taxpayers Act of 2019, which sought to remove the cap on federal SALT deduction and also raise the top personal income tax rate to where it was before the 2017 Republican tax scam. Pascrell first authored legislation addressing importance of the state and local tax deduction in 2012. He recently offered several amendments on SALT fairness, including the amendment to eliminate the cap during Ways and Means Committee consideration of the 2017 tax bill.

FLOOR STATEMENT OF THE HONORABLE BILL PASCRELL, JR. ON THE RULE FOR H.R. 5377, THE RESTORING TAX FAIRNESS TO STATES AND LOCALITIES ACT [REMARKS AS PREPARED]

Mr. Speaker, I rise in strong support of the rule reported by the Committee on Rules providing for the consideration of H.R. 5377, the Restoring Tax Fairness for States and Localities Act, of which I am an original cosponsor.

Last Congress, the middle class was targeted by the former House majority. The tax scam law of 2017 remains one of the most destructive bills we’ve ever seen here because it specifically went after the middle class. The principal way it did this was by capping the state and local tax or SALT deduction.

This unfair cap hit New Jersey like an anvil dropped from 5 stories up. The average value of all New Jersey families’ deductions was $19,162 in 2017 – a figure nearly double the $10,000 cap.

But this is not just about my state. The SALT deduction directly benefitted more than 46.5 million households, representing over 100 million Americans, in 2017. Almost 40 percent of taxpayers earning between $50,000 and $75,000 claimed SALT, and over 70 percent of taxpayers making $100,000 to $200,000 used it.

Imagine that hit spread out over millions of households from coast to coast. These are families in New Jersey, Illinois, New York, Minnesota, Kentucky, and Texas – all paying through the nose to fund a tax cut for big business and its executives.

Nor is this just a Blue State issue, like some bad faith critics claim. In 2017, the average SALT deduction exceeded $10,000 in 25 states and the District of Columbia. At least ten are so-called red states where the average deduction exceeded $9,000, including South Carolina, Idaho, Arkansas, and West Virginia.

SALT benefits flow to all communities, like my hometown of Paterson. SALT relief empowers communities to make investments into the broadly-shared services like education, infrastructure, teachers, and water. When the deduction was capped, it forced many cities across America in impossible choices. Restoring this deduction gives our communities the flexibility they deserve.

I want to emphasize that this package is fully paid for. It is modeled after my legislation, H.R. 1142, to fully repeal the SALT cap and pay for it by raising the top income tax rate back to its pre-2017 level of 39.6 percent. Raising the top rate back to 39.6 percent ensures taxpayers getting the most in SALT relief will also pay the pre-tax scam top rate.

I am proud that this legislation includes a bill I introduced to give first responders a $500 deduction for the costs of their uniforms and professional education, as well as the bill introduced by the gentleman from Nevada, Mr. Horsford, to increase the teacher expense deduction from $250 to $500.

This bill is a carefully crafted and balanced package of tax relief. It is the product of months of hard work by the SALT working group. I strongly urge all my colleagues to support this rule so we can consider the important legislation to rectify the injustice perpetrated on our middle-class constituents and the communities in which they live.

###