Pennacchio to Governor: Slow Down on Film Tax Credits

Pennacchio to Governor: Slow Down on Film Tax Credits

Says Film Tax Credits Unproven, Calls Governor’s Position Inconsistent With His Effort to Limit Other Tax Incentives

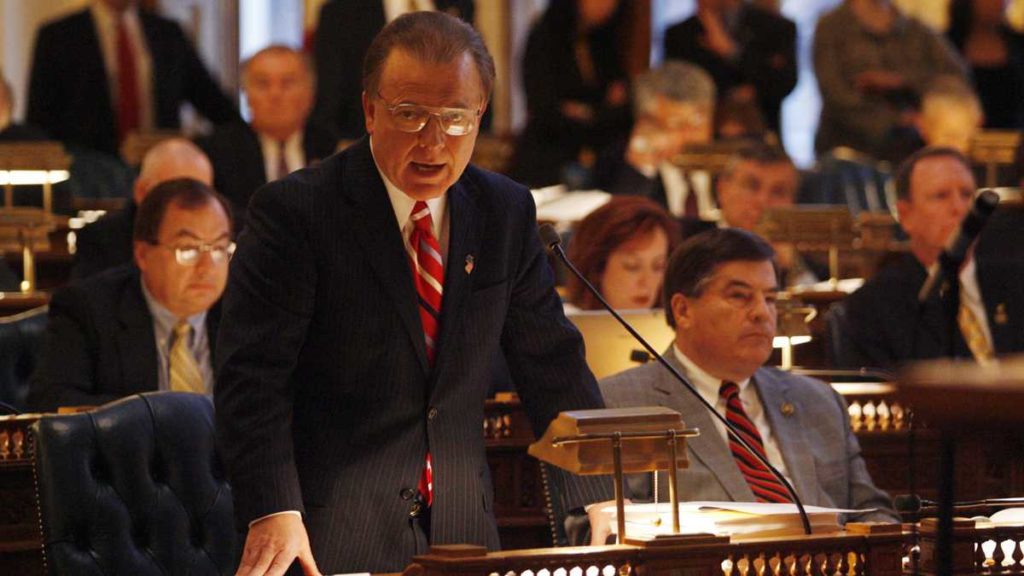

Senator Joe Pennacchio said Governor Phil Murphy shouldn’t rush to expand and extend the state’s $425 million film tax credit program until it’s clear that the incentive program actually works.

“Outside of the Hollywood lobbyists who are pushing for the film tax incentives, we have no evidence that they have helped to boost the New Jersey economy,” said Pennacchio (R-26). “Before he considers raising the $425 million cap on this relatively new program, Governor Murphy should slow down and determine if it’s working as intended.”

Pennacchio sponsors legislation (S-3051) introduced last October which would increase oversight of the State’s various incentive programs by requiring the State Auditor to conduct performance review audits of the NJEDA’s business assistance and incentive programs at least once every two years. That includes any of the NJEDA’s programs or incentives that provide monetary or financial assistance in any form, including grants, loans, loan guarantees, tax credits, tax exemptions, or other monetary benefits or awards.

“How can you say we need to expand tax credits for the entertainment industry without any understanding of the economic benefits generated by the existing program?” Pennacchio asked. “My legislation would provide the data we need to understand the value produced by both our film tax credit and our tax incentive programs more broadly.”

According to the NCSL, film tax credits have produced mixed results across the nation, leading a number of states to scale back or end their incentive programs.

A pair of studies conducted by researchers at the USC Price School of Public Policy determined state tax credits for film making to be “a bad investment.”

Pennacchio, a long-time critic of the film tax credit program, questioned how the Governor could be so supportive of increasing tax incentives for the entertainment industry while being so adamant that other business tax incentive programs should be further restricted.

“Governor Murphy’s inconsistency on the issue of tax credits is problematic,” Pennacchio added. “Why should New Jersey expand unproven film tax credits that other states are abandoning, especially when we’re one of the few states without a functioning broad business tax incentive program? It doesn’t make sense.”