Rep. Sherrill Delivers House Passage of SALT Tax Relief Bill

Rep. Sherrill Delivers House Passage of SALT Tax Relief Bill

Legislation Eliminates the Marriage Penalty, Provides Additional Tax Relief for Teachers and First Responders Nationwide

Follows Sherrill’s 12 Days of SALT Campaign Demanding a Vote on the House Floor

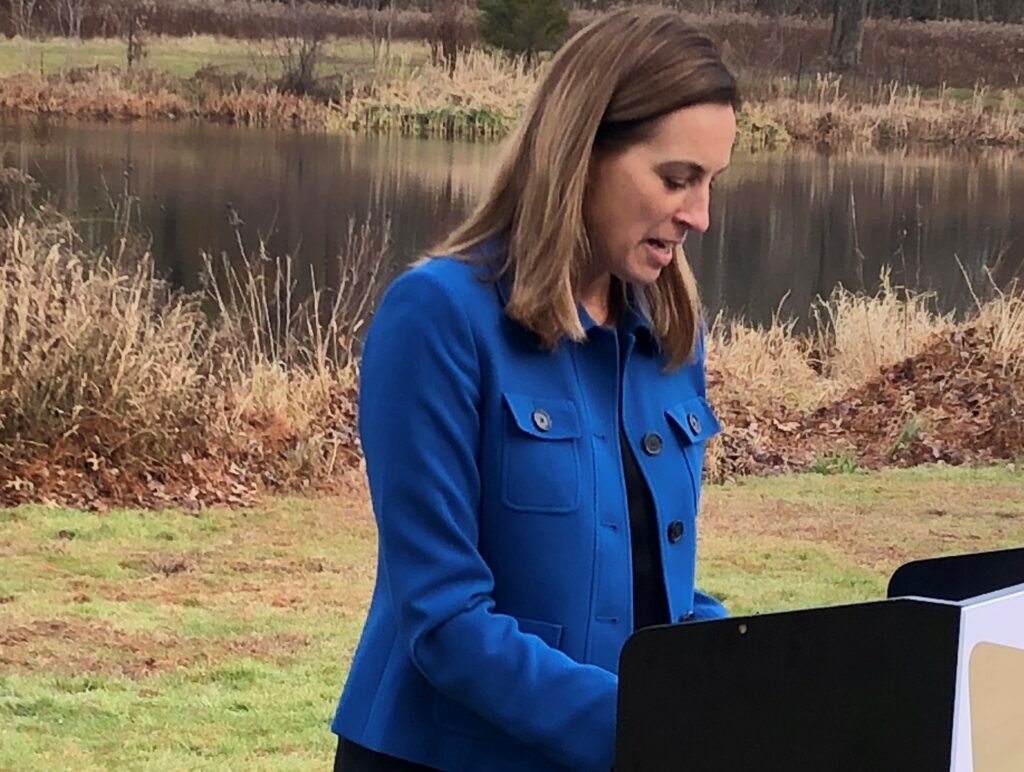

Rep. Sherrill Presides During the Vote on the Restoring Tax Fairness for States and Localities Act

Washington, DC – Representative Mikie Sherrill (NJ-11) fulfilled another key pledge today to residents in New Jersey by delivering House passage of a state and local tax (SALT) deduction bill. The bipartisan Restoring Tax Fairness for States and Localities Act (H.R. 5377) removes the marriage penalty for joint filers and restores the ability for taxpayers to deduct their state and local taxes from federal tax returns after 2020.

The 2017 Tax Cut and Jobs Act imposed a $10,000 cap on the SALT deduction. This policy violates 150 years of precedent in federal tax law, disproportionately harms New Jersey, and unfairly imposes a marriage penalty on couples filing jointly by having the same $10,000 cap as individuals.

Sherrill is a co-sponsor of H.R. 5377 and authored a bill end the marriage penalty, which H.R. 5377 does by making the SALT deduction equal to the standard deduction for the first year.

“I promised residents I would fight for tax relief and lift the SALT deduction cap that attacks New Jersey residents, businesses, and homeowners – and unfairly imposes a marriage penalty on couples filing jointly,” said Representative Sherrill. “It targets New Jersey’s investment in our communities, investments in roads, libraries, schools, first responders, and teachers.”

With 12 days left on the legislative calendar, Representative Mikie Sherrill (NJ-11) launched a “12 Days of SALT” campaign on the House Floor earlier this month to urge the House to lift the federal cap on state and local tax (SALT) deduction before the end of 2019. After Sherrill launched her campaign, colleagues from across the country joined her effort to highlight the nationwide impact of SALT.

“Residents in every corner of the district have shared with me how badly the SALT deduction cap hit them when tax season came around. Families were forced to dip into their retirement accounts, put off home repairs, and worry about how they would pay their bills,” Representative Sherrill continued. “I will continue to work to get this passed through the Senate and so we can put money back in the pockets of New Jersey families and support our teachers and first responders across the country.”

In addition to lifting the SALT deduction cap, the legislation provides additional tax relief to teachers and first responders across the country. It doubles the deduction for educators’ out of pocket expenses from $250 to $500. This will benefit more than 17,000 teachers in New Jersey’s 11th District and 3.5 million teachers nationwide. It also creates a new deduction for first responders. This will allow our police, firefighters, and EMTs to deduct up to $500 in work-related costs like professional development or uniform expenses.

###